Saving is not an optional extra but an obvious choice, which yields its fruit in season. We often tend to succumb to our temptation and spend our income, after deduction, on things that delight our eyes. However, we can never become rich unless we are also setting a part of our income aside as savings.

To Save And Prosper

How savings in mutual funds can help you stay ahead

Amit Kumar Singh, 31, understood the prospect of saving money very early. He has been depositing Rs5,000 every month since 2016 in one of the five-year term recurring deposit schemes, offered by the post office in Darjeeling. He says the post office has promised him around 7.2 per cent added returns per annum on his savings at the time when the security reaches maturity.

In the case of recurring deposits, the compounding happens on a quarterly basis. This means, compounded quarterly sum of Singh’s recurring deposit will grow to Rs3,61,568 when the tenure ends in five years. As Singh mentions he has already invested 42 installments (as on December 2019). The value of his recurring deposit till date is around Rs2,39,261.

On being asked why he did not invest in other investment instruments like mutual funds, he replies, “Honestly, I do not understand the math behind mutual funds, and I have heard that there is a risk involved.”

Savings with banks and post office — either in a bank account, fixed deposit or recurring deposit — has a fixed guaranteed rate of return or is quite safe. Hence, recurring deposit has been an ideal investment tool for Singh to earn some profit, while saving money for the future.

Like many individuals, Singh is careful not to jump on to the bandwagon of investing in mutual funds without understanding risks and prospects associated with the investment instrument.

Mukesh Kalra, CEO, ETMoney, says, “People who are new to mutual funds often believe that all funds carry the same amount of risk, which is not true. Therefore, new investors should be aware that they need not take high risk to get returns all the time.”

“Had Singh invested in large cap funds like Axis Bluechip Fund, through Systematic Investment Plan (SIP) over the same period, his investment corpus would have grown to Rs2.75 lakh (as on December 2019),” says,Sahil Arora, Director and Group Head (Investments) of Paisabazaar.

Typically, Indian families invest in gold, property, government bonds and equity. Arora states, “Equity as an asset class outperforms inflation as well as other asset classes such as fixed income, gold and other instruments over the long term by a wide margin. When adjusted with inflation rates, many fixed income instruments barely generate positive returns. Hence, investors with long-term investment horizon should invest in equity mutual funds to generate higher inflation- adjusted returns.”

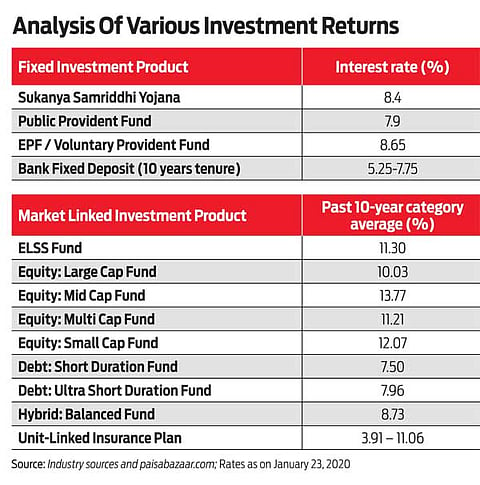

A comparative analysis of the return on various types of investment instruments, as on January 23, 2020 is given below.

However, before making regular investments for a longer period, an investor needs a proper financial planning based on his risk appetite and investment horizon to get a clear idea about the quantum of investment required to achieve financial goals.

There are primarily three types of mutual funds - equity MFs that invest in stock markets; debt MFs that invest in bonds; and hybrid MFs, that invests in a combination of stocks and bonds. Here are some essential financial planning and risks to consider before investing in mutual funds, as told by Ankur Choudhary, Co-founder and Chief Information Officer of Goalwise.

i) Have the right expectations about the risk and returns:

Mutual funds are not a ‘get-rich-quick-scheme’ nor are they risk-free. The returns of equity MFs depend upon the stock market returns and no one can predict what the stock market will do in a given year. One-third of the times, the stock markets give negative annual returns. On the other hand, debt MFs are safer but will give you returns like fixed deposit. There is no such thing as low risk, high returns.

ii) Understand your risk tolerance:

Figure out what degree of losses you are willing to tolerate before you start second guessing your investments — is it zero per cent, 10 per cent, 20 per cent or 40 per cent. Then invest accordingly. The lower the risk appetite, the lower should be your allocation to equity MFs and higher to debt MFs.

iii) Invest according to your goals:

Most people invest without any planning or purpose. The outcome is that they redeem their investments at the first sign of trouble. If you are investing for your retirement, it does not matter whether your investments are down 20 per cent today. So, figure out what your short-term, medium-term and long-term financial goals are and invest accordingly.

“Equity MFs also outscore fixed income investments like fixed deposits and debt funds on the taxation front, especially for those belonging to higher tax slabs. Gains from equity funds booked within one year of investment are taxed at 15 per cent, while gains exceeding `1 lakh in a financial year booked after one year are taxed at 10 per cent. “Interest earned from fixed deposit are taxed as per the income tax slab of the investor. In case of debt mutual funds, gains booked within three years of investment are taxed as per the tax slab of the investor whereas those booked after three years are taxed at 20 per cent with indexation benefits,” Arora says.

Rishabh Dave, 28, an investor, has his financial goals set — become a millionaire at 35, and retire early. He is utilising the prospects of long-term regular investments to achieve his goals. He currently invests more than Rs1,25,000 every month, of which majority of the sum goes into mutual funds and the remaining sum in government’s Sovereign Gold Bond (SGB).

He started investing in equity mutual funds since mid-2015 with a monthly installment of Rs20,000. However, to meet his financial goals, the savvy investor now invests between Rs20,000 and Rs25,000 on a weekly basis — mostly 50 per cent in the large cap and 50 per cent on diversified equity funds. He says he owns Rs28-29 lakh in his portfolio.

Dave has signed up with an investment plan, called ‘My First Crore’ being offered by a wealth management fintech platform Scripbox. He says, “This plan tells me if I am on-the-track or off-the-track to achieve my goal of becoming a millionaire. So far, my investment has not hit the negative bar, and as long as that happens, I am not worried about what interest rate I am currently getting on my investments.”

According to data provided by Scripbox, investors have mainly been able to grow their wealth through long-term investments, maintaining that investing regularly is the key to creating wealth. More than 2,255 investors using the platform have become millionaires, of which 49.5 per cent are millennials.

Contrary to popular belief, millennials emerge as responsible and aware of demographics when it comes to financial planning. Of the 2,800 individuals who have accumulated 1x + to 2x+ of their salary, 72.5 per cent are millennials. The data further reveals that millennials invest more in the emergency fund to save tax.

50 per cent of the millennials are investing in tax planning versus 28 per cent of non-millennials

33 per cent of the millennials are ready to deal with an emergency situation as they have invested in an emergency fund versus 28 per cent of non-millennials

On the other hand, women are also clearly taking control of their financial lives, says Scripbox’s data. Out of 2,800 individuals on the platform, who have accumulated more than 1x to 2x of their salary, 36 per cent are women. Till September 2019, new customers signing up with Scripbox comprised up of 29 per cent of women investors.

One of the biggest changes in the financial space among Indians is that millennials have now become more aware of their finances and owe up their decisions about their money. This new segment is changing the way the traditional things looked like by taking independent decisions of owning a car, a house or even investing in mutual funds. Because of this change in mindset of the new generation helped by the advent of technology, a lot of transparency is coming in the way people invest in mutual funds.

Kalra adds, “People have become more aware of the possibility of earning better returns by saving agent’s commission, and investing in direct funds is coming out as a huge trend. Further, a lot of investors are adopting SIPs as a habit of saving a set amount of money every month. Not only does SIP help in keeping aside some money each month, but by investing in mutual funds, people are building a corpus for varied life goals like retirement, owning a house or their child’s education.”

Meanwhile, the volatility in the market has been impacting the overall economy. In the last one year, the number of new SIPs getting registered has grown.

Kalra says this is because of other asset classes like FDs or real estate being more subdued or negatively impacted by the slowing economy. He is hopeful India is going to grow at a rapid pace in the long term.

According to Omkeshwar Singh, Head (Rank MF), Samco Securities, many mutual funds schemes offer very high quality of portfolios, relatively at moderate to high margin of safety, which will continue to perform better irrespective of the present phase of business or market cycle.

“Remember a simple principle: investments in great companies at fair or great prices deliver great returns, and investments in poor companies or at poor prices deliver poor returns. This is true for both equity and debt instruments of companies,” adds Singh.