With the promise that their dynamic asset allocation will help tide over the current market volatility, balanced advantage funds (BAFs) have shot to fame recently. As on December 2021, BAF has taken over all other mutual fund categories in terms of size, with assets under management (AUM) of Rs 1,69,739.59 crore, according to data from the Association of Mutual Funds in India (Amfi). In 2021 alone, five BAFs were launched and garnered Rs 21,652 crore.

To Create The Perfect Mix

Are balanced advantage funds a pinky promise of dynamic asset allocation or just a pompous claim?

These funds promise to be the one-pot biryani meal, combining equity and debt into one and taking care of asset allocation on behalf of the investors, who would neither need to constantly keep an eye on the changing market dynamics nor worry about the tax hit a switch between equity and debt entails.

But are these funds truly dynamic? Do they deliver all that they promise? Does it make sense to dive into these when individual equity and debt mutual fund categories may serve the purpose instead? Let’s understand the reasons behind the rising popularity of BAFs and whether it makes sense to invest in them.

The Buzz Around BAFs

BAF as a concept has been around for quite some time now in the Indian markets, but has caught the fancy of investors in the last one year.

The BAF category saw continuous outflow from March till December in calendar year 2020. After the 2020 correction, while the markets started moving up, memories of the March 2020 fall were still fresh in investors’ minds, and expecting volatility, they started putting money in BAFs. This category saw inflows in each month of 2021.

“The focus on generating risk-adjusted returns has found favour with Indian investors. Advisors and investors have used this for their asset allocation requirement to a great extent, thereby gaining a measure of control when investing in a volatile asset class such as equity,” says Aniruddha Naha, head-equities, PGIM India Mutual Fund.

Of the five BAFs launched in 2021, SBI Mutual Fund created history, when the new fund offering (NFO), SBI Balanced Advantage Fund, collected Rs 14,551 crore in August 2021. In just a few months, the scheme’s AUM has grown to Rs 23,064 crore.

Other funds in this category have also grown exponentially in size. For example, PGIM Balanced Advantage Fund, which was launched in February 2021 and collected Rs 369 crore in its NFO, has grown almost four times in size to Rs 1,360 crore.

This category officially came into existence in October 2017, when the capital markets regulator, the Securities and Exchange Board of India (Sebi), created a new sub-category of ‘Dynamic Asset Allocation’ or ‘Balanced Advantage’ within the hybrid schemes category. Sebi asked fund houses to keep only one scheme per category. So, fund houses merged many of their schemes that were similar in nature into one scheme. For instance, HDFC Mutual Fund had two hybrid schemes, HDFC Prudence and HDFC Balanced, in the hybrid category. HDFC Prudence was merged with another equity fund, HDFC Growth, and the scheme was renamed as HDFC Balanced Advantage Fund, which is now the largest BAF in the industry with an asset size of Rs 41,282 crore.

Other fund houses also did the same or launched a new scheme if they did not have one in this category. Since December 2017, 13 BAFs have

been launched.

What Differentiates BAFs?

The main benefit of BAFs and the risk-return framework that the category provides is that investors need not try and time the market, which is in any case a very difficult task. BAF brings in some objectivity to the asset allocation process on a dynamic basis. Fund managers do the asset allocation on your behalf as per the market conditions and the investment objective of the scheme. This way, your downside is limited and there is an opportunity of growth as well.

“BAFs are an ideal investment option for those seeking to enhance their gains and limit the downside. When you do asset allocation on your own, every switch-over or exit triggers tax lability, either short term or long term. (In a BAF) you put your money for the long term and somebody takes care of it within the fund; so, there is no tax liability. Also, in BAF you are not risking your money completely, but at the same time, you are taking advantage of the market,” says D.P. Singh, chief business officer, SBI Mutual Fund.

BAFs as a category also provide a solution for first-time investors or investors who hitherto were under-allocating to equities, says Naha of PGIM Mutual Fund. “Combining it with solutions like SWP (systematic withdrawal plan) for customised cash flow generation, taxation efficiency, model-based approach, discipline, and more, are some of the desired features that make BAFs a winner,” he adds.

During periods of heavy drawdowns, such as the market fall in March 2020 at the onset of Covid, BAFs helped in protecting downside. Participation in the upside that came after, was also satisfactory. Thus, investor experience has been good overall.

Are BAFs Truly Dynamic?

Typically, BAFs invest based on their proprietary models, which work on various parameters such as price to earnings (P-E) ratio and price to book (P-B) value, and use various other parameters for their asset allocation in equity and debt.

“We decide equity allocation based on long-term trailing price to earnings, book value, dollar and commodity pricing,” says Ashutosh Bhargava, fund manager and head-equity research, Nippon India Mutual Fund. He explains that asset allocation is based on an in-house proprietary model, which takes into consideration fundamental, technical as well as macro parameters.

“Our model uses one-year forward P-E. We also take into consideration the trend momentum, which is a unique parameter that aids in maximising the upside potential and limiting the downside. A strong dollar, typically, coincides with weaker phases of equity prices, while a weaker dollar coincides with strong equity performance. Commodity prices, such as for copper and nickel, act as a strong indicator of global economy and markets,” adds Bhargava.

Similarly, other funds have their own investment strategies. PGIM BAF relies on a traditional, fundamentals-based valuation metric, the P-E ratio of Nifty 50, to decide the equity allocation. “What we do differently in this model is that we consider not only the absolute current level of the P-E ratio, but (also) look at it in a historical context by checking the last 15 years’ rolling history,” says Naha who manages this fund.

The equity allocation is scaled up whenever markets undergo a correction and are undervalued compared to when markets are rising, says Naha. “We gradually move out of equities. In a panic, we have generally seen that sell-off happens much faster and recovery takes comparatively much longer. We believe this methodology is simple for investors to understand, is transparent, and stays relevant in the long term over market cycles. It is widely used by participants as a sentiment indicator as well,” he adds.

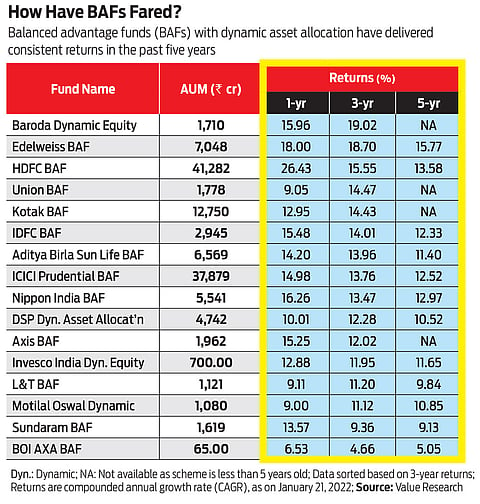

How Have BAFs Performed?

When we dug deeper into the performance of BAFs, we found that the ones that have stayed true to their promise of dynamic asset allocation, delivered better returns and protected the downside. For instance, ICICI Prudential BAF, one of the oldest and the second-largest fund in this category by AUM, has been dynamic with its asset allocation and delivered consistent returns. As the market is near an all-time high at present, the fund has reduced its equity allocation to 30.5 per cent, according to the company. This is the lowest in the past few months. Similarly, Kotak BAF’s equity allocation is 38 per cent.

“Our Equity Valuation Index highlights that valuations are not cheap,” says S. Naren, executive director and chief investment officer, ICICI Prudential Mutual Fund. He says investors who are likely to make money over the next year will be those who are focused on asset allocation, invest in profitable companies and invest across all asset classes with liquidity after considering risk.

“The business cycle in India has turned favourable, which is a major positive at this point of time. Corporate earnings growth, too, has revived in a sustainable manner since the later part of the last fiscal year. The quantum and pace of the US Fed rate hike, trajectory of the US 10-year Treasury yields and impact and severity of new Covid variants are the major triggers to watch out for,” adds Naren.

According to Value Research data, the average equity allocation in top 10 BAFs (based on 3-year returns) stands at 46.44 per cent. However, some funds, such as HDFC BAF and Edelweiss BAF still have high equity allocation with 67.60 per cent and 67.20 per cent, respectively. The HDFC scheme has consistently kept higher equity allocation in the last three years. Some funds, despite being dynamic, prefer to remain static in terms of equity allocation. They may deliver better returns during good equity runs, but may disappoint when markets fall.

Should You Invest?

“BAFs offer investors an opportunity to take graded equity exposure. Given the rapid run-up in the markets, many investors, especially who are new, are looking to invest in BAF to reduce volatility,” says Kaustubh Belapurkar, director, fund research, Morningstar Investment Adviser India. He adds that investors can use BAFs as a part of their portfolio, but this category shouldn’t be the entirety of the portfolio.

You need to carefully choose as all BAFs are not the same.

Each is different. Some experts compare BAF as a category with biryani. In terms of nomenclature, they are all biryani; be it Hyderabadi biryani or Kashmiri biryani. However, their ingredients are different. Similarly, every scheme within the BAF category has different strategies based on which it decides the broad asset allocation on a dynamic basis.

From a regulatory point of view, they are free to decide on their asset allocation and investment strategy. This technically means that BAFs can take exposure to equity and debt from 0-100 per cent in either asset class. However, to take advantage of equity taxation, they need to have 65 per cent gross allocation in equity. Gross allocation can be tricky because it gives the fund manager the flexibility to invest in arbitrage opportunities and hedge the portfolio through derivatives. This helps the BAF fund manager maintain 65 per cent equity allocation despite the net equity allocation being much lower. “In a BAF, the allocation to equity can broadly range between 30 per cent and 80 per cent, hence giving enough cushion to the fund manager to manage volatility and offer superior risk-adjusted returns over a longer horizon,” says Prashant Joshi, co-founder and partner, Fintrust Advisors.

There are many varieties of biryani, and you choose the one that suits your taste buds. Similarly, choose the BAF that fits your risk appetite.

kundan@outlookindia.com