Touted as one of the biggest economic reforms since independence, the Goods and Services Tax (GST) was supposed to replace the complex indirect tax system prevalent in the country with a more simplified, uniform regime. As it entered its third year in July 2019, what India has successfully achieved is the monumental restructuring of what former Finance Minister Arun Jaitley labelled as, “one of the world’s clumsiest indirect tax systems.”

The Highs And The Lows Of GST

India’s most talked-about tax completes two years of its implementation

Looking back at two years of its successful implementation, it can be argued that while India has come a long way from a complicated taxation system with over a dozen different taxes and many more cesses, GST is still far away from an ideal taxation regime.

One of the biggest criticisms of GST, as we know it today, is the number of tax rates it has. In what was supposed to be a simple taxation system, one can now count as many as eight different GST rates with five standard tax slabs–zero, five, 12, 18 and 28 per cent —and specific rates of 0.25 per cent for rough diamonds, three per cent for gold and now one per cent for under-construction affordable houses. While many economists would argue that an ideal GST structure should have a universal coverage and a single tax rate, most would also agree that it was not practical for a country like India with vast economic disparities. This is a stand that the government has also maintained, often giving the example that “a BMW car and a Hawai chappal (flip-flops) cannot be taxed at the same rate.”

However, having eight different rates makes India’s GST one of the most complex in the world, something, which has even been acknowledged by the World Bank in its bi-annual India Development Update report last year. And mind you, at that time, the one per cent tax rate for affordable housing was not even introduced.

To make things worse, applicability of GST is not universal as petroleum products, alcohol and electricity have been kept outside its ambit.

And even as the government repeatedly reiterated its intention to reduce the number of tax slabs by merging them as we go along, it is baffling that the GST Council has chosen to introduce new tax rates. It even allowed Kerala to impose a one per cent disaster relief cess after the devastating floods last year, which effectively made the tax incidence higher by one per cent in Kerala, deviating from the principle of ‘one nation one tax.’

“Albeit propagated as a simple tax regime, GST has significantly increased the compliance burden with challenges, inter-alia, issuance of regular notices by the tax department for minor mismatches,” said Sohrab Bararia, Associate Partner (Indirect Tax), BDO India. He says the entire eco-system of compliances under GST needs to be simplified and made user-friendly, especially for small and medium sector enterprises.

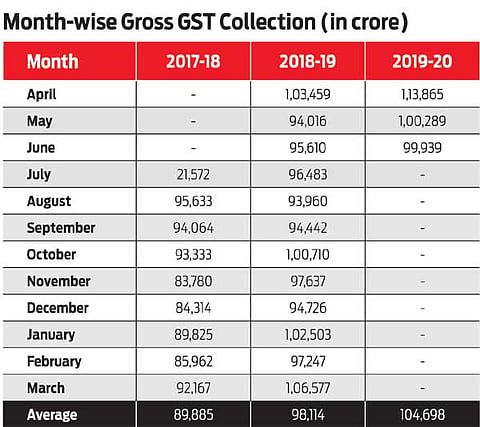

Another area of concern has been the revenue collections, which despite showing signs of improvement, have fallen short of the estimates. Last year, GST collections fell short by around `78,000 crore of the government’s target and even this year, the collections have been underwhelming with June collections falling even below the `1 lakh crore mark, for the first time since February.

However, credit where it is due, the implementation of GST in India has been smoother compared to most other countries in the world barring some teething troubles initially. This is an even bigger achievement considering the size and diversity of India’s economy. Not only did GST consolidate multiple taxes and cesses, it also eliminated inter-state barriers in the country making seamless transport of goods a reality.

Prior to its implementation, both the Centre and the states imposed indirect tax on goods with states having multiple laws, which entitled them to impose taxation at different points. The GST merged all those 17 different laws and created, a single taxation. And to convince the states to get onboard the GST regime, it promised them 14 per cent annual increase from the tax base of 2015-16 for a period of five years.

And despite the shortfall in revenue compared to targets, collections have shown improvement with average monthly revenue of Rs89,700 crore (2017-18) rising to Rs97,100 crore next year. It is expected to improve even further in 2019-20.

According to Bararia, GST has brought about uniformity in taxation of goods and services across the country thereby removing the trade barriers such as check-posts, octroi and entry tax, which has reduced lead time and logistics costs, leaving a positive impact on the supply chain, from procurement and imports till ultimate delivery to end-consumer.

“Another positive step was pruning tax rates by bracketing most commodities within 12 per cent to 18 per cent, to usher market confidence and lower prices of commodities. The GST Council, with adequate representation of state and Union governments, has been at the forefront in addressing the concerns of the industry and provides regular updates and clarifications. Very recently the GST Council debated on bringing the petroleum sector into the GST net, thereby steering fresh confidence,” he said.

Romesh Tiwari, Head of Research, CapitalAim, said it was a herculean task to bring all 29 states and seven Union Territories, with their own local sales and other taxes, under one umbrella of GST. However, he added, India is far from finished. “The government and officials have shown the commitment and determination needed for such a huge task. A lot has been done to achieve the objective of one nation, one tax but still, the procedures and system are unfair towards small stakeholders and businesses, who are disproportionately burdened with complications and technological glitches,” he said.

The journey of the GST has not been smooth, however, with glitches and teething problems experienced from day one. While many of those glitches were addressed by a proactive government, some still remain to be resolved including simplification of return filing, invoice matching and further rationalisation of tax rates. Soon after the new indirect tax system was rolled out, Bibek Debroy, who was then a NITI Aayog Member and later became the Chairman of the Prime Minister’s Economic Advisory Council, had said, “India is a long way off from the ideal GST structure.” Favouring a maximum of three GST rates with all items covered, Debroy had said that starting with seven rates had put India in a situation where it may not get to the ideal GST.

Fast forward to the present. The economy is still grappling with the rather high multiplicity of tax rates while also debating bringing petroleum products, electricity and other items into the GST net with little clarity in the picture.

While there has been expression of intent by the government to merge some of the tax slabs, there has been one-step-forward, two-steps-back approach on that front so far.

Right from the first day of its roll-out on July 1, 2017, there were technical glitches appearing on the GST Network portal causing a lot of hardship to taxpayers in registering on the network. There were often instances of the portal not being able to take the load of last-minute rush to file returns, forcing the government to postpone the filing deadlines several times. The glitches also led to export refunds piling up, resulting in a grave situation of cash crunch for exporters, whose working capital was getting blocked. However, to address this, the government initiated several drives to process pending refunds and cleared most of the backlog. To address the GST network issues, the GST Council set up a five-member ministerial panel headed by Bihar Deputy Chief Minister Sushil Modi to oversee its functioning and smoothen the process. The system has largely stabilised since then.

Tiwari said that technological improvement is badly needed as it is common to see the server crash on the last dates of returns and this is where mobile and web apps can prove to be a great help.

“Going forward, I expect GST rates to become stable and a simplified procedure for registration, returns, input credit and refunds. Tax rate slabs should be limited to less than five as against at present more than 10 rates on different products and services. Electricity and petroleum products should be brought under GST to avoid the cascading effect of taxes as these are used as input by the majority of manufacturers and service providers,” he said.

While the GST Council has already announced a new simplified return filing process in coming months, the government has also indicated a march towards rationalisation of tax rates with merging of the 12 and 18 per cent GST slabs as revenue increases.

“Although the operational readiness to roll-out this important reformative step appeared insufficient and tardy, a strong foundation has been laid thereby creating a room to accommodate changes and propagate the government’s agenda of ‘ease of doing business’,” concluded Bararia.

vishav@outlookindia.com