What’s the first thing that comes to mind when you think of calculating tax liability? Add up your total income, from salary, business or profession, and look at the income tax slab it fits in. But calculating your tax liability is not that simple. There are some components of income that are tax-free, then there is income from other sources such as capital gains or from moonlighting or a side gig that you may be doing for an income kicker, and so on. Some of these may be taxed at a different rate and not at your slab rates.

Tax Calculation Made Easy: Worksheets To Help You Arrive At Your Tax Liability

Here is how to calculate your tax liability under different tax regimes. We have created worksheets, which you can use to fill your own numbers and arrive at a broad number

Post that, tax deduction benefits, where applicable, come into play and income tax slabs get applied only later. Your final tax liability is arrived at after considering various factors at different stages of calculation under the Income tax Act, 1961.

If you don’t want to get unpleasantly surprised and pay extra at the time of filing your income tax returns, calculate your liability in advance, at least broadly.

Here’s a step-by-step guide on how to compute your income tax liability. We have created worksheets for you to fill in at various stages, as you keep reading and figuring out the steps.

Though we have broken up the components as much as possible, you may not be able to figure out certain aspects on your own or end up making mistakes due to incorrect or inadequate collection of relevant information. For instance, figuring out how much you have earned under each income head involves a clutch of processes. Treat this only as a broad guide and consult an expert for more details if you think you can’t see it through on your own.

Why Is Calculating Tax Liability Important?

Your tax planning journey won’t start before you decide which tax regime you will opt for.

Says Sudhakar Sethuraman, partner, Deloitte India, a consultancy firm: “The slab rates under the new tax regime are prima facie lower than those under the old tax regime. However, the new tax regime, does not permit claiming exemption/deductions while computing the total income which is available under the old tax regime. Therefore, it is advisable to work out the tax liability under both the regimes and then

exercise the option,”

December is also the time when organisations, typically, ask for proof of investments. Once you have clarity on whether you need to make taxsaving investments or not, filling up that form will be a breeze (read Proof Of The Pie).

Before you commence calculating your tax liability, remember that an individual is taxed in India based on the residential status, irrespective of the nationality. Residential status is determined every year based on the physical presence of an individual in India during the tax year and in the earlier years.

Adds Sethuraman: “An individual could be considered a non-resident (NR), not ordinarily resident (NOR) and ordinarily resident (OR). NRs and NORs are liable to pay tax on income sourced or received in India. For example, salary from employment in India is taxable even if received overseas. NORs or NRs receiving rental income on, say, a property in Switzerland are not required to pay tax in India on that income. But an OR’s global income is taxable.”

Calculate Tax Liability Under Old Tax Regime

Step 1. Add your income from various sources. The Income-tax Act, 1961, specifies five income heads—income from salary, income from house property, income from profits from business and profession, income from capital gains, and income from other sources. Says Naveen Wadhwa, deputy general manager, Taxmann, a Delhi-based book publishing company: “Certain incomes are taxable under the head income from other sources, inter-alia, dividend, winning from lotteries, gifts, interest on enhanced compensation, and others.”

The income under each head has a subcalculation. For example, income from salary is arrived at after deducting Rs 50,000 standard deduction, tax-free allowances and exemption benefits on house rent allowance (HRA).

To arrive at gross income, deduct any set-off or carry-forward of loss. You need to check specific provisions for the set-off rules.

Says Sethuraman: “Inter-source adjustment provides for setting off the loss with the income under the same source. For instance, loss from stationery business can be adjusted against the profits from furniture business. In some cases, loss can be adjusted against another source of income. For example, loss from business can be set off against income from other sources, under interhead adjustment.”

Note that the nature of income or loss will have an effect on inter-head adjustment. Long-term capital loss can be set off only against long-term capital gains (LTCG), whereas short-term capital loss is allowed to be set off against both LTCG and STCG.

“Losses that can’t be adjusted during the tax year with other income can be carried forward for set off in future. For example, unabsorbed short-term capital loss can be carried forward for eight years for set-off with LTCG or STCG. Long-term capital loss can also be carried forward for eight years for set-off , but only with LTCG,” says Sethuraman.

Step 2. The second step is to arrive at the net total income liable to tax. To arrive at this, you will need to subtract the deductions you avail under various sections from the gross total income, which you calculated in the first step.

Deductions up to Rs 1.5 lakh under Section 80C are most availed of, for a range of instruments are covered in this basket. These include contribution to Employees’ Provident Fund (EPF), principal repayment of home loan, investment in equity linked savings schemes (ELSS), Public Provident Fund (PPF), National Pension System (NPS) and others. An additional deduction of Rs 50,000 is allowed under Section 80CCD(1B) on NPS.

Step 3. Once you have the net income liable to tax, you can start calculating your total tax liability.

At this stage, you will need to look at your income in two parts. The first part will be subject to taxation in accordance with the applicable income tax slab. Income from salary, business and profession, and house property will be part of this.

The second part, which will include income from capital gains, income from lottery winnings and others, will be taxed at the specified rates for these heads. For example, LTCG from equities, exceeding Rs 1 lakh, are taxed at 10 per cent, without indexation, while short-term capital gains attract 15 per cent.

Add these two parts to arrive at your total tax liability.

In the aftermath of Covid, more people are now buying health insurance, and there is an incentive for that too. A deduction up to Rs 1 lakh is available under Section 80D for the amount paid for the health insurance, preventive health check-up, expenditure on medical treatment, and others.

Do note that deduction under Section 80D can be maximised only in the case of senior citizens.

Theree are other benefits for senior citizens too. Under Section 80TTA, senior citizens are eligible for a deduction of Rs 50,000 on interest on bank deposits, which is limited to Rs 10,000 for individuals under 60 years of age.

Step 4&5. Follow these steps to calculate your gross and net tax liability, respectively.

To calculate your gross tax liability, you will need to consider the rebate available under Section 87A to those whose net taxable income after deductions and exemptions is below Rs 5 lakh. For them, the income tax liability reduces to zero. Income between Rs 2.5 lakh and Rs 5 lakh is taxable at the slab rate of 5 per cent, which comes to Rs 12,500, which is the maximum rebate available under Section 87A. Income below Rs 2.5 lakh does not attract tax.

For those in the higher tax brackets, surcharge and cess will get added. Some of those in the highest tax brackets may be eligible for marginal relief.

“Where income exceeds the threshold for surcharge by a small extent, then it is possible that the surcharge is higher than the increase in income. In such instances, a marginal relief is provided to the taxpayer, such that the incremental tax, including the surcharge does not exceed the incremental income over the threshold. In other words, the marginal relief will be the difference between the excess tax payable (including the surcharge) and the income exceeding the threshold,” says Sethuraman.

Further, net tax liability will be calculated after subtracting relief under Section 89A on income, such as advance salary or gratuity, and foreign tax credit, if any. This refers to any tax paid to a foreign authority by a resident Indian on a part of the income that is being offered to tax in India, subject to certain conditions.

“Individual taxpayers, except senior citizens, with taxes exceeding Rs 10,000 a year are required to pay off their tax liability during the course of the year. It’s like pay as you earn,” says Sethuraman.

Delays can attract penalty or interest under diff erent provisions.

Section 234A provides for payment of interest at 1 per cent per month on the outstanding tax, if the tax return is not filed within the prescribed due date. Section 234B provides for 1 per cent interest per month if the aggregate of prepaid taxes (advance tax and withholding tax) is less than 90 per cent of the total tax dues.

If there is shortfall in the payment of advance tax instalments, then interest should be paid at the rate of 1 per cent per month, starting April.

Adds Wadhwa: “ ese charges are added to an assessee’s net tax liability after adding surcharge, deducting rebate under Section 87A, and obtaining relief under Section 89, foreign tax credit and others.”

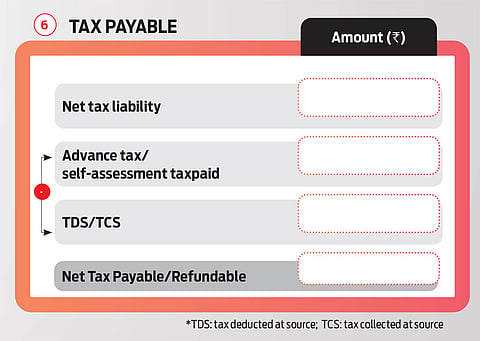

Step 6. This is the last and final step where you will get to know how much tax you are supposed to pay, or whether you have paid more than what was due.

To calculate the final amount, subtract any advance tax, tax deducted at source (TDS) or tax collected at source (TCS) that you may have already paid from the net tax liability.

Calculate Liability Under New Tax Regime

The steps to file your taxes under the new tax regime are pretty much the same, except that to arrive at the net taxable salary, you won’t have to subtract any deductions or exemptions.

The new tax regime does not allow certain deductions, including standard deduction and those available under Section 80C.

Adds Sethuraman: “It is to be noted that only if the tax return is filed within the due date, the taxpayer has the option to choose the new tax regime. If the tax return is filed after the due date (belated tax return), then the taxpayer needs to follow the old tax regime.”

Calculating your tax liability will ensure you don’t have extra taxes to pay at the time of filing returns and will also save you from paying any penalties or fees. Besides, it will also help you choose between the new and old tax regimes.

So, approach your tax-planning exercise in an organised manner this time.

With Inputs From Neelanjit Das