The FM referred to income tax reforms such as the new simplified tax regime, filing of updated tax returns, introduction of Form 26AS, prefilling of tax returns, and more

Status Quo: Govt’s 10-Year Report

The FM referred to income tax reforms such as the new simplified tax regime, filing of updated tax returns, introduction of Form 26AS, prefilling of tax returns, and more

As Union Minister of Finance Nirmala Sitharaman unveiled the Interim Budget for fiscal year (FY) 2024-25, taxpayers eagerly anticipated some relief on the personal tax front. However, the budget being a “vote on account”, did not propose any changes for both direct and indirect tax. Though this was expected, taxpayers had a sliver of hope for tax rate reduction or increase in deductions.

Sitharaman provided a brief report on the reforms, on both personal and corporate tax fronts. She highlighted the increase in direct tax collections and the number of income tax returns filed which grew more than 3 times and 2.4 times, respectively, over the last 10 years.

She referred to the reforms such as new simplified tax regime, filing of updated tax returns, increase in threshold of presumptive taxation for retail business and professionals, introduction of Form 26AS, and prefilling of tax returns, among others. She also highlighted the transition to faceless assessment and appeals as part of her 10 years’ report card, that were introduced for more transparency and accountability.Keeping this objective in mind, she proposed to extend the timeline for issuance of faceless schemes before the Income Tax Appellate Tribunal (ITAT), Dispute Resolution Panel (DRP) and Transfer Pricing, by one year to March 31, 2025.

She said that the government has been committed to improve taxpayer services for long and proposed the withdrawal of outstanding income tax demands of up to Rs 25,000 till FY2009-10 and up to Rs 10,000 from FY2010-11 to FY2014-15. According to her estimates, there will be close to 10 million taxpayers benefitting from this move.

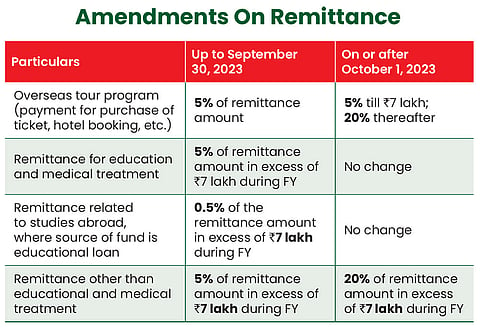

She also mentioned certain amendments that have been proposed in the tax collected at source (TCS) provisions under the Liberalised Remittance Scheme (LRS) and purchase of overseas tour program to align with the circular issued in June 2023, effective from October 1, 2023. (see Amendments On Remittance)

Taxpayers now hope for more benefits from the full-fledged Budget after the general elections.

Divya Baweja, Partner, Deloitte India