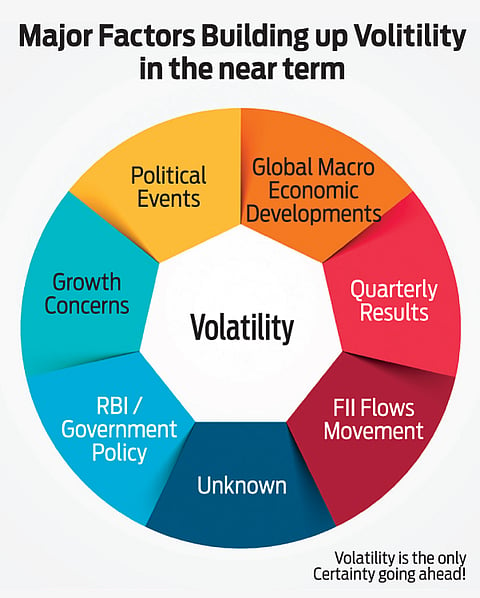

Since the last 24 months, equity was rising and valuations remained costly. There was an inherent fear among investors that markets might crash.

Smart Surfing In A Turbulent Market

Balance advantage funds ride on popularity and investor’s confidence

The fund managers advised everyone to stay invested.

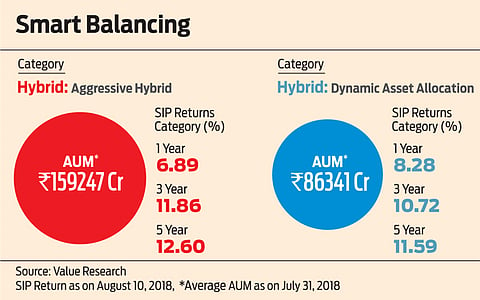

So when the balanced funds started performing well, they witnessed a rise in price to earnings and price to book parameters. Balanced Advantage Funds (BAF) are dynamic asset allocation funds which switch between equity and debt based on quantitative parameters, thus containing the volatility.

During that period, fund managers converted that money into debt. So if they were investing 85 per cent earlier to generate alpha in the equities, the new trend was to reduce the exposure by 10–15 per cent and manage it with 65 per cent in equity and 35 per cent in debt.

This was a good strategy, since the interest rates were falling.

When the interest rates fall, the price of the bonds go up, this results in an investor making capital gains. This was the reason for attractiveness for BAF, which suddenly saw its popularity going up.

“The fund with its auto rebalancing mechanism alleviates need for regular portfolio shifts based on changing market conditions. Hence, the fund can be included as a part of core investment portfolio of any investor. We believe the product is well suited for investors with a moderate risk appetite and medium to long-term investment horizon,” says Manish Gunwani, CIO-Equity Investments, Reliance Nippon Asset Management.

This way the investor does not need to constantly track the fund or take calls on rebalancing between equity and debt, based on the market movement.

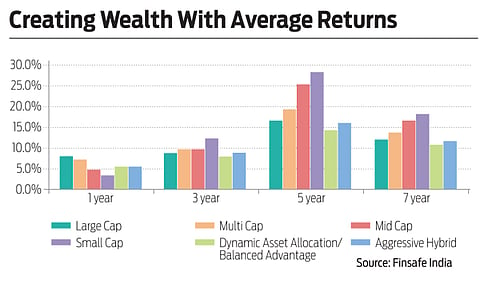

“For investors who can take up moderate risk, BAF are a good bet as they have lower risk compared to the balanced hybrid category and at the same time provide wealth creation (with a minor compromise on returns) over long term (see graphics),” says Mrin Agarwal, director, Finsafe India and co-founder of Womantra. In such an environment investors saw the smart strategy in dynamic asset allocation. It simply means, if the price to earnings or price to book increases, because of the market moving up, it allows the investors to plan or re-plan their portfolio.

“We feel there are ample pockets of opportunities currently and investors with a long-term investment horizon can exploit the same,” says Siddharth Bothra, senior VP and fund manager, Motilal Oswal Asset Management Company.

Traditionally, in such a scenario fund managers and investors prefer to bring down their exposure in equity and shift to debt.

“Also with Dynamic Asset Allocation Funds, the fund would automatically change the allocations based on qualitative parameters and hence investors do not need to take any action. Since the rebalancing is done by the fund and not the investor, the investor saves on transaction costs and tax”, points Bothra.

But, investors want to be in the ‘careful’ sentiments period from a balanced portfolio. Why? This is because with rising equities, interest rates are also going up. Analysts feel this should have triggered the yields to rise. By dynamically changing asset allocation in the fund, most BAFs aim to buy equities when they are cheaper and sell equities as they become expensive. “Regular rebalancing mechanism is the reason why BAFs can be favoured over a pure equity fund as it manages volatility to deliver better risk adjusted returns,” says Gunwani.

However, the yields have gone down, because the demand for the paper, especially the 10 year paper has been extremely high.

This is the reason investors are looking for avenues of safety in a volatile market. “For most investors, buy low and sell high is a nice mantra to talk about, but very difficult to execute, as they are constantly pulled towards two extreme emotions of greed and fear. BAFs tend to overcome these emotional biases and thus provide a tool for asset allocation,” says Harish Krishnan, fund manager, Equity, Kotak Mutual Fund.

Analysts also point that if the funds fail to make money in mutual funds, the investors begin to look at other avenues of investment. As a result, the fund firms begun to sell products with the the ‘advantage’ tags attached or were customised to protect the investment portfolio in a volatile market.

This is the reason firms like ICICI Prudential, Kotak and others came up with balanced funds. ICICI Prudential is the pioneer in this category.

“We had launched ICICI Prudential Balanced Advantage Fund—a product which is counter cyclical in nature. The fund moves between equity and debt asset classes, based on a predefined valuation model”, says S Naren, ED and CIO, ICICI Prudential AMC.

He explains that such a product will ensure that exposure to equity is reduced when markets are expensive and vice versa, thereby reducing risk. As a result, the investor gets the opportunity to participate in the market upside while in times of a market correction, the debt component ensures that the downside is protected.

“The key benefits of BAFs for long-term investors are, first, it has a relatively lower to moderate risk profile, second, it provides flexibility to maintain exposure across equity and debt simultaneously and third, it effectively helps avoid unintended skewness towards any one asset class, due to sustained outperformance or underperformance of any asset class over long period of time”, says Bothra.

The share of BAFs is rising and experts say that in a volatile market investors should go in for such funds. BAFs performance stood reasonably well in comparison to large-cap and multi-cap equity funds during the last 10 years. The BAFs have become popular in the last 24 months. The average return offered by these is in the range of 12–16 per cent, which is much higher than debt funds and bank deposits. The subset schemes of BAFs is largely equity-oriented and are putting on a strong show.

These funds can take the equity proportion to as high as 80–85 per cent and bring down to 20 per cent. Plain balanced funds, on the other hand, stick to a fixed allocation to different asset classes and do not change it.

“Most BAFs vary their net equity allocation (Kotak BAF varies from 20 to 80 per cent), thus the average allocation over a cycle is in the range of 50–60 per cent, thus significantly reducing the volatility of the product, while attempting to give similar long-term compounding characteristics of equities,” says Krishnan.

The thumb rule for investors in BAFs is, they should not be perturbed by the volatility in the markets. It is well proven that one of the best ways to manage volatility is by remaining invested. It should be supported by long-term investment horizon, investment in quality companies and have prudent asset allocation.

rajendran@outlookindia.com