Real Estate Investment Trust (REIT) could be a viable alternative to traditional investment, with falling interest rates, diminishing debt returns from asset-backed investment instruments, coupled with threat of inflation and drop in income.

REITs As An Attractive Asset

This derivative instrument with underlying assets in realty offers stable rent-yielding cash flows

REITs are derivatives that own or finance real estate assets in a range of properties and earn a return of 12-15 per cent. Of these, 6-7.5 per cent is fixed (based on rental income) and the balance is through market escalations.

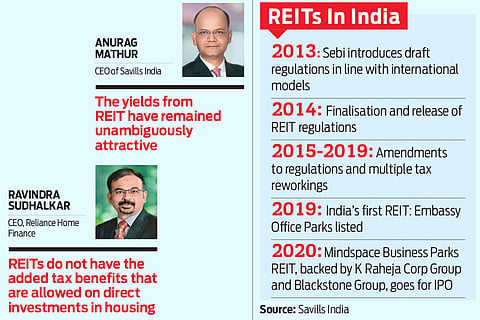

While REITs have existed for the past 60 years, and are now a $2 trillion asset class globally, India saw its first REIT in April 2019 when Embassy Office Parks REIT IPO got listed on the stock exchange and paved the way for retail investors to participate in commercial real estate. More recently, Mindspace Business Parks REIT IPO got listed on the exchange early August, only the second REIT to be listed in India.

According to a study by Savills India, a premier professional property consulting ?rm, ever since the IPO and listing in 2019, Embassy Office Parks REIT had shown an appreciation of 8 per cent (at the end of Q1FY21), reaching a maximum appreciation of around 50 per cent in the pre-COVID phase. On the other hand, Mindspace IPO got oversubscribed by 13 times and got listed at an 11 per cent premium.

“It is just the beginning for REITs in India and with increasing clarity in regulations, significant improvements in Ease of Doing Business rankings, and strong rental performance in commercial real estate, the REIT journey would only accelerate further,” says the “India REIT: A Potential Investment Window” report by Savills India. It adds that despite the COVID bump, REITs have a lot of potential in the Indian market owing to its saturation in foreign shores.

Experts feel listing of REITs makes investment in commercial real estate liquid and accessible to investors even at a small ticket size worth `50,000. Also tax exemption on dividend distributions by REITs also makes them very attractive.

According to Sanjay Dutt, Joint Chairman, FICCI Real Estate Committee, and MD and CEO of Tata Realty and Infrastructure, India’s first REIT outperformed equity markets by around 2000 basis points in the last five quarters since launch, as opposed to the All REIT Index in the US which outperformed S&P 500 by around 440 basis points over 20 years.

“India has approximately 650 million square feet of Grade A office space of which, 310-320 million square feet is REIT-able stock. India’s office stock would touch one billion square feet in the next six to eight years. And in next two years, nearly 100 million square feet is expected to be listed on Indian stock exchange. Therefore, the asset class presents itself with tremendous opportunity and growth to all class of investors,” Dutt says.

Investors earn in two ways from REITs. First, they get returns through stable rent-yielding cash flows, with 90 per cent of the earnings distributed to unit-holders. Second, they also benefit from the capital appreciation as the market price of the underling assets rise.

While COVID has impacted the commercial real estate sector, Dutt however believes that as India continues to be top global IT outsourcing destination, commercial real estate will continue to be a resilient, low risk and high return asset class.

Anurag Mathur, CEO of Savills India, says Indians have had a generally positive experience from the only REIT (before Mindspace IPO) during the last one year, including the difficult phase of 2020. Agreeably, just one REIT doesn’t make the complete story, but it certainly provides a glimpse into this real estate-based derivative.

Mathur believes that Embassy REIT has created some favourable ground for REITs in the near future. “Despite global and domestic economic upheavals of 2018-19, India posted its highest-ever office space absorption for two consecutive years, clearly underlining a very strong occupier demand for its office buildings. The yields from the singular REIT on the market have remained unambiguously attractive, even through the lockdown phase,” he explains.

From an investor’s perspective, the two factors that should determine his decision to invest in REITs or in direct real estate properties are the purpose of the investments and the understanding of the associated risk-return interplay, feels Ravindra Sudhalkar, CEO, Reliance Home Finance.

He says that for someone with real need to own a house, direct investment would make sense as the gratification of “ownership” of a property instils a sense of security in the buyer and satisfies the aspirational aspects of making the investment. On the other hand, if investment is the sole purpose of putting money in real estate, then REITs is a better option as it is a highly liquid instrument.

“However, since REITs essentially behave like mutual funds investments, it requires a certain level of sophistication for understanding the complexities of market-related instruments. The best returns can be accrued only if the investment horizon is for the long term of three to five years. Investment in REITs also doesn’t have the added tax benefits (under Sections 24, 80C and 80EE) that are allowed by the government on direct investments in housing,” Sudhalkar concludes. Most experts feel retail investors can consider investing up to 10 per cent of their portfolio in REITs and diversify, restricting their exposure to 5 per cent in a single REIT. A higher return always has a higher risk attached to it.

While India is a safe destination for REITs, thanks to the really small number of options against global average, a fall in realty price can affect the returns.