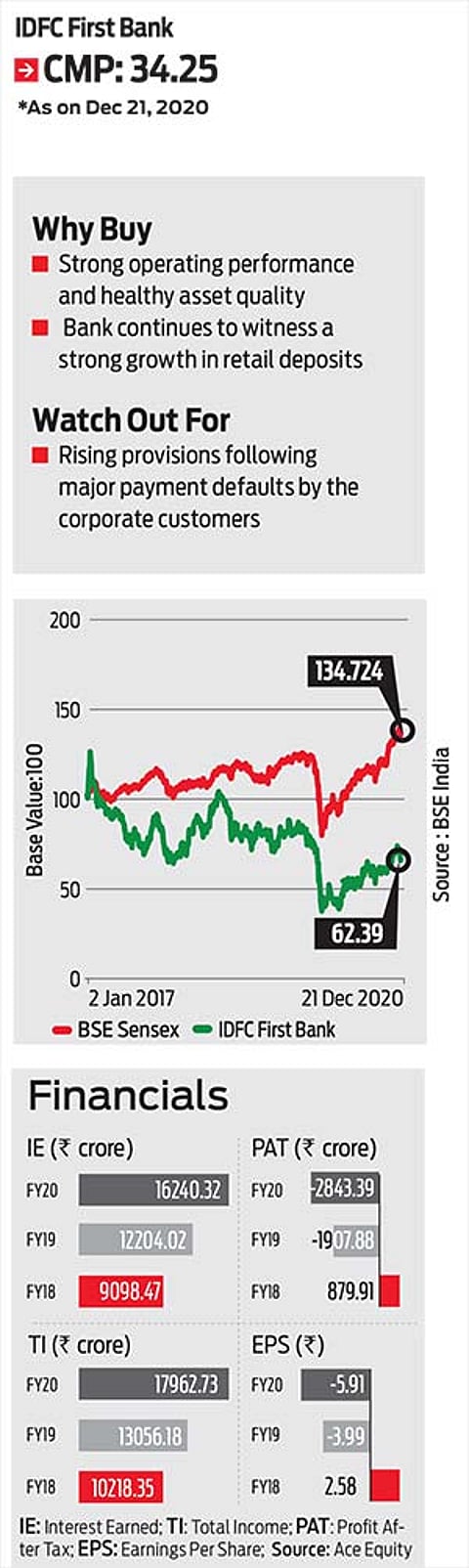

IDFC First Bank is on a firm footing with improved operating performance posted in the second quarter of 2020-21. The net interest income (difference between income earned by bank through lending and interest paid to depositors) rose 22 per cent Year-on-Year (Y-o-Y) in Q2 FY2021 as compared to Q2 FY2020. Similarly, the bank’s Net Interest Margin (NIM) improved to 4.7 per cent during the same quarter Y-o-Y. It aspires to take NIM to 5-5.5 per cent in the next five years.

Promising Asset Quality

Long-term objective of shifting loan mix, higher realisation of liability to help

The net Non-Performing Asset (NPA) in retail segment stood at 0.17 per cent in Q2 FY2021 compared to 1.08 per cent in Q2 FY2020. Moratorium extended to eligible customers till August 31, 2020 has led to improved asset quality.

Says an analyst with Geojit Global Financial Services, “Advance growth to pick up pace from Q3FY21 onwards, given the management remains optimistic about increase in retail assets. The bank seems well capitalised to absorb near-term asset quality shocks. However, we have factored in a gross NPA of 2.2 per cent in FY21 and 2 per cent in FY22 estimates.”

Along with `811 crore provision, the bank has also made additional provision of `1,400 crore towards COVID-19. The provision coverage ratio stood at 73.69 per cent as of Q2 FY2021 against 56.12 per cent in Q2 FY2020.

Its Current Account and Savings Account (CASA) deposits witnessed a massive growth of 142 per cent Y-o-Y in the second quarter of

2019-20. Whereas its retail loan book increased 25 per cent Y-o-Y as on September 30, 2020. It plans to grow retail loan assets to over `1,00,000 crore in the next five years.

As on Sept 30, 2020, the bank had 523 branches and 509 ATMs across the country. To grow retail deposits and CASA, the bank plans to set up 600 to 700 more branches in the next five years.

“Total deposits increased 9 per cent Y-o-Y to `75,800 crore. It continues to focus on increasing contribution from retail and, thus, adding granularity. As a result, retail deposit showed strong growth of 119 per cent Y-o-Y and 24 per cent Quarter-on-Quarter to `4,9610 crore,” explains an analyst at ICICI Direct.

The bank is well on track for achieving its long-term objectives of shifting loan mix to retail and higher realisation from liability franchisees.

“With a prudent approach on the provisioning front, moving away from risky sectors and improving funding profile, we believe return ratios are set to improve meaningfully in the medium to long term with return on assets set to reach 1 per cent,” says an analyst at ICICI Direct. Its stock has recovered by 104 per cent as on December 18, from March 2020 lows. Most of the brokerages continue to remain positive on the future perspective for the long-term horizon.

himali@outlookindia.com