When it comes to financial security, traditional savings instruments like Public Provident Fund (PPF) and Employees’ Provident Fund (EPF) are popular tax-saving retirement plans. Despite falling rates of interest, these two schemes have been around for more than six decades. Both are long-drawn, but secure investment choices. But how many invest in the other government fund - Voluntary Provident Fund (VPF)?

Picking The Right Fund

While PPF and EPF are secure funds,VPF is ahead in the race for the top slot

For many years, Prunita Thingujam, who works with navigation map company Mapmyindia in New Delhi, has been investing in EPF. By investing in EPF, the 28-year-old saves 12 per cent of her basic and dearness allowance every month, to which her employer makes a matching contribution of 12 per cent. “EPF is the easiest and best option,” she says.

But as interest rates in EPF are falling, Thingujam is now looking for a better alternative. “I am planning to switch to VPF or Unit Linked Insurance Plan (ULIP) insurance plan. I want to start a small investment where I can get average to high returns,” she says. EPF interest rates have fallen from 8.8 per cent in 2015-16 to 8.65 per cent in 2016-17.

Not many people have heard or know how Voluntary Provident Fund works. According to Naveen Wadhwa, Deputy General Manager, Taxmann, investors are looking for alternative saving options. Funds like EPF are losing favour among salaried individuals because employers are behind schedule in making their part of contribution on time. “Many employees have started to look at other tax-free investment options and we see people moving towards VPF,” says Wadhwa.

According to Raj Birbal, a senior Supreme Court advocate, a recent court order in an EPF case, stated that “Companies can restrict contribution of 12 per cent EPF on an amount Rs15,000, if the salary of an employee is running beyond the statutory prescribed limit.”

VPF/PPF Benefits

Wadhwa explains why VPF is a better option than EPF. If an individual’s annual cost to the company (CTC) is Rs12 lakh and he invests in PPF, the person would get a CTC of Rs10 lakh annually after standard tax deduction. Of this, if the person invests Rs1.5 lakh in savings, the CTC will be Rs8.5 lakh. But with the same CTC of Rs12 lakh, if a person invests Rs72,000 in VPF, the tax is calculated on the remaining amount of Rs11.28 lakh. Wadhwa says that instead of investing the taxable amount in PPF, a person made the investment before calculating the tax on it.

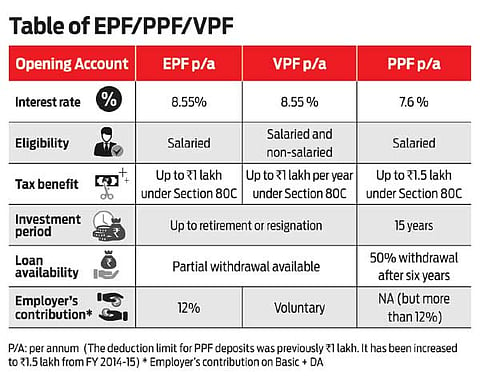

At present, both unorganised sector workers and non-salaried individuals are eligible to open PPF accounts, either at a bank or in a post office. VPF and EPF schemes can only be availed by salaried individuals.

The advantage of VPF is that subscribers can invest any amount unlike in EPF which accepts a statutory 12 per cent contribution. There is also no upper limit for VPF contribution as in a PPF account, in which subscribers cannot invest more than Rs 1 lakh per year.

The advantage of PPF is the flexibility in investing. One can contribute either a lump sum amount or distribute the amount into periodic payments.

As per the latest rate revision, PPF offers an interest of 7.6 per cent. But the rates may change depending on market sentiments as the fund is linked to 10-year government bond yields. Government bonds are among the least risky financial products, and the returns generally remain favourable. VPF interest rate, on the hand, is not linked to government bonds and offers 8.65 per cent interest on EPF account.

For the financial year 2016-17, the Employees’ Provident Fund Organisation, which oversees the contributory fund schemes, had announced an interest rate of 8.65 per cent. The rate of interest was 8.8 per cent in 2015-16 and 8.65 per cent in 2014-15. The rate is higher than the PPF rate of 7.6 per cent.

While the PPF account has to be maintained for a minimum of 15 years and only partial withdrawal is allowed subject to terms and conditions, the money from a VPF account can be withdrawn anytime. Further, if VPF investment is withdrawn before completion of fifth year of service, tax has to be paid on the amount. The PPF account can be extended for another five years beyond the mandatory 15 years.

VPF/EPF Benefits

Suraj Koijam, 51, who works in a private firm in Imphal, says that he prefers to stay invested in EPF. “The saved amount, along with interest, is for my retirement. This will provide me financial support to some extent,” says Koijam.

Investors in EPF and VPF can also apply for a loan against their investments. These two funds offer the flexibility of withdrawal in times of financial need. On the other hand, PPF offers loans on 50 per cent of the available balance at the end of fourth year, which can be withdrawn only after the onset of the sixth year.

In EPF, about 75 per cent of the invested amount can be withdrawn if a person remains unemployed for a month, according to EPFO’s new rules. It allows for complete withdrawal, if an individual is unemployed for more than two months. In addition to this, there are other rules and procedures to withdraw money from EPF. For instance, about 50 per cent of the money can be taken out in case of marriage of self, daughter, son, sister or brother, provided the individual has made contributions for seven years in the fund.

It also allows withdrawal to finance ‘post-matriculation education’ of a child. If an employee is fired, about 50 per cent of EPF money can be withdrawn if the individual challenges the decision in court. Money can also be withdrawn, if an individual falls ill due to certain diseases like cancer, or has mental health issues, or if surgery is required. In case of illness, the EPF account holder has to prove that the Employees’ State Insurance Scheme facilities are not available to them and provide a doctor’s recommendation for surgery or hospitalisation.

In November 2016, EPFO relaxed the rules to continue paying interest to account holders up to 58 years of age, if the accounts have been lying inoperative. The prescribed retirement age under PF is 55 years, which is 36 months more than the previous prescribed limit. In case an account holder dies or has permanently migrated to another country or has withdrawn the entire corpus, it is classified as an inactive or inoperative account.

While PPF and EPF continue to be relevant tax-saving instruments, a middle income investor is looking for better security. In this race, VPF is ahead of both PPF and EPF. The government could introspect all to and make them more attractive.

rajendran@outlookindia.com, nirmala@outlookindia.com