Mumbai-based Vibhor and Vibha Sahni, with two sons Kanadh (7) and Shaurya (1.5), were introduced to financial literacy in the 30s. Vibhor, who works in the IT industry, has made investments in several financial instruments like mutual funds, systematic investment plans and equity. Every alternate month he gives Kanadh a few assignments in shopping with a budget of Rs 500 to Rs 1,000. While making his sons savvy on spending, he complains how an average household lacks this knowledge when it comes to raising children.

Money Smart

Teach your child how to manage pocket money and achieve goals. Time to inculcate financial discipline

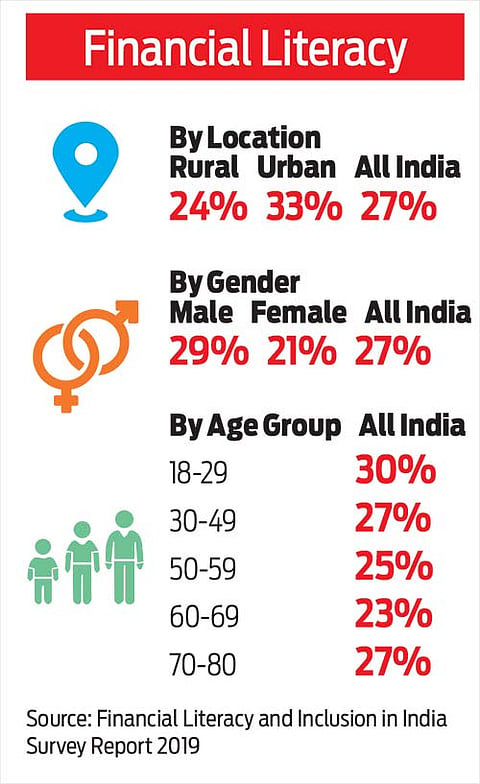

According to a report on Financial Literacy and Inclusion in India 2019 by the National Centre for Financial Education, only 24 per cent rural and 33 per cent urban Indians are financially literate. In gender distribution, females account for only 21 per cent, while males account for 29 per cent in financial literacy.

In a typical Indian household, elders take decisions and children remain aloof of financial literacy—a concept that is fast gaining popularity and is becoming an important part of the education curriculum. Although only a few schools have started imparting it.

India is two generations behind in teaching financial literacy, according to Vishnu Karthik, CEO, Xperiential Learning Systems and Director, The Heritage Schools.

Job losses and salary cuts are the new normal amid the pandemic. It is, thus, all the more important that children know the worth of money and are aware of the criticality of budgeting, expenses, savings and investments. You can get in touch with special tutors if your kid’s school does not offer such education. In fact, institutions like Sebi, National Centre for Financial Education and Reserve Bank of India (RBI) offer courses, education materials and exercises for children. And these are well-acclaimed and relevant for specific age groups.

The good news is that in September, RBI launched a National Strategy for Financial Education 2020-2025. The apex bank plans to introduce financial education in school curriculum for classes VI to X by March 2021. It also plans to develop content for financial awareness among students of higher classes — XI-XII, through co-scholastic approaches and reinforcing financial literacy as an integral part of vocational education (ITI/Polytechnic courses), by March 2022.

This, no doubt, is a daunting task, even for the country’s central bank. A senior RBI officer on condition of anonymity says, “Although we have prepared a blueprint, a bigger challenge would be to find experts who could become the bridge between financial literacy and kids. It is not a subject that can be taught through books, and our aim is to focus on practical experience.” He adds that educational institutions will play a crucial role in expanding this.

Vishnu Karthik, Director of The Heritage Schools, feels that financial literacy is not about teaching concepts but about introducing fundamental paradigms of the nature of money. He points out that the five paradigms to introduce are power of compounding, delayed gratification, entrepreneurship, financial independence and behavioural biases.

Karthik explains these paradigms could be taught in the nascent years of childhood. He says, “Delayed gratification can be taught at the age of 2-3 years, and a lot of research is there to support this. In fact, all great investors have this quality. Delayed gratification is when you argue what is more important, and this can’t be taught later. The idea of compounding should start at the age of 4-5 years. The other skills like savings, investments, compound interest and time value money can start at the age of 8, 9 or 10 years. From 10 years you have to inculcate long-term views.”

He adds that these concepts also help us to make career choices. “If you truly start understanding money, you can easily decide if you want to work for money or you want money to work for you.”

According to financial literacy experts, a significant drawback is that Indians look at things with a very short-sighted view. For example, financial literacy is not only about the appreciation of money, but it is also about how to prevent its destruction. Many people in India spend money buying two to three flats and lock in substantial sums in these overvalued apartments that are not even built. Thus they create giant white elephants. A behavioural change could be introduced when a new generation is taught about financial concepts, and they make conscious decisions, based on their understandings.

Schools have now started imparting financial literacy, like Heritage School and Shiv Nadar, to name a few. Col Gopal Karunakaran, CEO of Shiv Nadar School, says, “Financial literacy with entrepreneurial acumen is one of the key modules offered at the school. It is delivered by in-house anchors, domain experts and industry veterans. In financial literacy sessions, core competencies, principles of banking, investments, loans and social security schemes are addressed. This year, various sessions were organised with an external expert, for Grade XI students, which were very well-received.”

He adds that teachers also use project-based learning that involves a real-life situation with some aspect of finance. “Integrated into the curriculum, our students also undertake fundraising activities for large-scale festivals and projects, enabling them to develop money management skills. In another flagship programme —‘Colloquium’ — Grade X students are given an opportunity to innovate, design and develop entrepreneurial projects by using tech skills learnt in class to solve real-world problems, which are presented to industry captains. The projects include financial aspects like raising capital, pricing and profit.”

Notably, Indian education system is one of the largest in the world with more than 1.5 million schools, 8.5 million teachers and 250 million children. But many people working in private and government schools, on condition of anonymity, argue that it would mean extra burden on kids. But if we see the potential, there is a vast untapped resource, which if tapped, could help India to build a stronger economy.

Vivek Mehra, Technology Entrepreneur and Financial Literacy Coach, who organises workshops and coaching in several schools and educational institutions, says, “Imparting financial skills to kids and young teens is a lot easier if it is made entertaining.” He adds that it is not necessary to make it a part of the curriculum.

Citing own example, he says, “I have often asked 12-14 kids to identify the real-cost of small purchases they make. If they refrain from buying the second Rs 100 ice-cream cone during the visit to a mall, what can they gain by investing it over a 10-year period? That becomes an introduction to compounding and the concept of delayed gratification.”

For older teens, he uses a design-thinking-based game approach. Says Mehra, “I conduct a workshop to walk them through the time value of money, inflation and compounding principles, and build an understanding of basic investment strategies and instruments available. The students identify their own individual short-term, intermediate-term and longer-term goals (including retirement planning). At the end of the workshop, I give them a corpus of Rs 1 crore in play-money, which they are free to invest over six months using any one of the online money management sites. We meet periodically to see who is on the top of the leader-board with the most gains.”

Mehra charges Rs 2,000 per head, per session and admits that charges depend on the type of group. He conducts free sessions for government schools and economically weaker sections. During the pandemic, he has been carrying on with his financial education programs online using apps like Zoom and Microsoft Teams.

In India, financial literacy is still an emerging career, and not many people have forayed into it. Some of these financial education resources are empanelled by the Sebi. They conduct programmes for individuals or groups charging between Rs 500 and Rs 10,000 per session, depending upon the audience.

Some of them even take in-house personal sessions. There are institutions like Financial Literacy Advisory Body of India (FLAB) and digital platforms like Finsafe, which a provide hosts of solutions like Financial Literacy Software in the form of virtual learning centres, games and simulations, certified financial education certificate training, consulting and program development.

Notably, even in developed countries like the US, gaming programs to teach financial literacy have been on the rise. Teachers and parents play several games like Uber game, where students adopt the role of an Uber driver with two kids and try to pay the mortgage. The interactive game is created by Financial Times and helps children to manage money during different challenging circumstance of life. There are a host of online gaming apps available too. So, it’s time to let your kids outshine you, primarily because money matters!

jyotika@outlookindia.com