With the income tax filing deadline for the last financial year, FY2020-21, getting pushed to December 31, 2021, many investors, savers or taxpayers may not have had the time or funds to invest for the next financial year, FY2021-22, from the tax planning perspective. But with the deadline for making tax-saving investments for FY2021-22 fast approaching (the last date being March 31, 2022), now is the time to start planning, if you haven’t already done so.

Master The Tax-Saving Game

Tax planning has to go hand-in-hand with financial planning. Here are strategies to choose the best financial products that meet your dual needs

“The Income-tax Act, 1961, allows various deductions and exemptions from the taxable income to encourage savings and investments amongst taxpayers. Few of them are short-term, whereas others are long-term investments that come with a lock-in period,” says Archit Gupta, CEO, ClearTax, a fintech software as a service startup. Note that tax deductions and exemptions are only allowed under the old tax regime and not the new tax regime, which has lower income slab rates.

The best tax-planning strategy, however, is one that is aligned to your financial goals. For instance, if you are retired, your first priority is probably investing for regular income, but if you have just started working, prepaying an education loan or saving for a car may be at the top of your agenda.

Many of us invest to save taxes without connecting those investments to goals. Avoid making that mistake. “Any taxpayer, irrespective of the age bracket, should first classify the nature of financial goals. Any financial goal to be realised within five years can be classified as short-term, and above that, long-term. For instance, buying a car or saving for a trip would be a short-term goal, while buying a house or saving for retirement would be a long-term goal,” says Gupta.

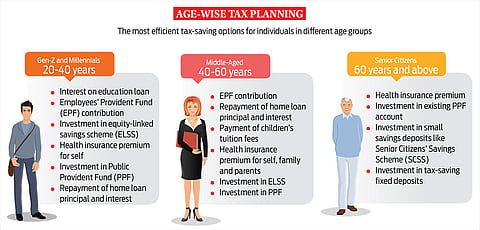

This year, assess your needs before jumping into the first insurance policy or investment that is sold to you just to save taxes. To help you, the taxpayer, we bring tax-saving strategies you can follow depending on which stage of life you are in—20-40 years (Gen-Z and younger millennials); 40-60 years (middle-aged taxpayers with more responsibilities); or 60 years and above (retired or senior citizens).

Millennials: Ambitious And Aiming For Higher Returns

The Gen-Z or millennials, who are probably into their first jobs or are still looking to settle down in terms of their finances and life, is a segment that may have an education loan burden but does not yet have the responsibility to pay for, say, children’s education or bear the medical and other expenses of parents.

Lack of proper planning can lead into the wrong direction. “Many do not work on their tax planning and end up investing in instruments that are not the best options at this stage,” says Harshad Chetanwala, a Sebi-registered investment advisor and co-founder, MyWeathGrowth, a financial planning firm.

Since you have a long horizon and can save and invest systematically for long-term goals, even the tax-saving investments could be more focused towards equities.

Photo: Sandipan Chatterjee

Pabitra Kumar Das, 71, Engineering Consultant

- Used to invest in PPF; now invests more in ELSS for Section 80C benefits and higher returns as liquidity is not a concern. Also gets Section 80D benefit on health insurance premium

- “If one does proper tax planning, one can minimise the tax burden and earn reasonably from tax-saving instruments”

“Millennials are generally risk-oriented, and they try to explore new options available in the market due to which they invest their money directly in the stock market through equities, mutual funds and other financial instruments. They may, however, not be looking at optimising tax deduction by investing in the various saving schemes that are eligible under Section 80C,” says Akhil Chandna, partner, Grant Thornton Bharat, an assurance, tax and advisory firm.

There can be different considerations for different sub-categories of taxpayers. “Unmarried individuals may not have many commitments and, generally, would be at an early stage of their career growth. Hence, they could opt for the new regime of tax. Proper financial planning at this stage will cover any risks that may come in the future. However, for married individuals, the old regime may be more beneficial,” says Sandeep Sehgal, director, tax and regulatory, AKM Global, a tax and consulting firm.

However, make this choice carefully because if you opt for the new tax regime, you can switch back to the old tax regime later only if you do not have business income, as per the present income tax rules. If you have business income, you can change the tax regime only once.

If you opt for the old tax regime, look at avenues that help create wealth and are tax efficient. But a step that comes before you look at investments is having ample insurance cover.

Safety First

Medical insurance is a must-have, whether you have financial dependants or not. The Covid pandemic has only made the need for adequate health insurance more evident. Health cover is not only a protection tool but also offers tax deduction under Section 80D up to Rs 25,000 if the cover is for self, spouse or dependent children. If you pay the premium for health cover for your parents who are senior citizens, the tax deduction is higher—up to Rs 50,000.

Life insurance is the most commonly-bought product for tax saving, even if it’s not required. Life insurance is a must-have for anyone who has financial dependants or expects to have soon. But instead of buying just any life insurance plan, go for term insurance, which is a simple and effective product as it gives maximum cover at the least prices, compared to other policies. Premium paid for life cover is eligible for tax benefit under the overall Rs 1.5 lakh deduction under Section 80C.

Focus On Growth

With the insurance safety net in place, you can confidently look at tax-efficient investments for wealth creation. While it is always recommended to invest in a mix of instruments for a balanced portfolio, younger investors can invest a bigger share in equities as they have a longer time frame. However, choose as per your risk profile and financial goals.

Hirak Talukdar, 33, a Kolkata-based senior design engineer, and Paramita Sinha, 30, a homemaker, plan to retire early and have invested in products that help them prepare for this goal, while being tax efficient. They believe that proper tax planning is important so that one chooses the right investment avenues to maximise returns. “I invest a major chunk of my savings into equity (mutual funds and stocks) as they give high returns in the long term and are also beneficial in terms of income tax (deduction and taxability of returns),” says Talukdar.

If you are comfortable with the risk that comes with equity, then equity-linked savings scheme (ELSS) is a suitable tax-saving instrument for long- or medium-term goals. These offer tax deduction of up to Rs 1.5 lakh per financial year under Section 80C and have a three-year lock-in, which can help young investors be disciplined, stay invested and not switch with every market move. You can also invest in a systematic investment plan (SIP) of ELSS but each instalment will have a three-year lock-in (see The Twin Benefits Of ELSS Investing).

Apart from offering the deduction benefit, ELSS funds are also more tax-efficient. Their returns are taxable only if long-term gains exceed Rs 1 lakh a year. “In addition, any equity investment-related long-term gains (which includes mutual funds and stocks) where STT (Securities Transaction Tax) is paid, are exempt from capital gains tax up to Rs 1 lakh. So, while tax should not be the sole criteria to sell a fund, this provision may be used to act on exit recommendations and to realign equity mutual fund portfolios with current buy-and-hold recommendations,” says Anup Bansal, chief investment officer, Scripbox, a digital wealth management service.

Look At Stability

A mix of investments balance a portfolio. So, for long-term plans, invest in tax-efficient debt products as well. Talukdar, for example, has chosen Public Provident Fund (PPF) as it is “a high-security investment without any tax on the returns”. The couple invests in National Pension System (NPS) as well for its long-term nature and tax efficiency. Debt funds are also a part of their portfolio; while debt funds do not offer the deduction benefit, they are taxed at a lower rate when held for more than three years. “I chose debt funds over fixed deposits and recurring deposits for long-term investment as they help me save tax on capital gains,” says Talukdar.

If you are risk-averse and want to invest in fixed-income options, PPF or tax-saving fixed deposits (FDs) are good options, but their returns are usually less than that of market-linked instruments. Also, lock-in periods are longer—15 years for PPF and at least five years for tax-saving FDs.

“Millennials who plan to start their investments for retirement early can also consider investing in NPS to build a retirement portfolio,” says Gupta.

Middle-Aged: Settled, With More Responsibilities

If you belong to the age group of 40 to 60 years, chances are your salary is higher than before. In this case a chunk of your 80C tax-saving basket will get covered by your Employees’ Provident Fund (EPF) or NPS contribution. If you have home loan EMIs, the remaining can be exhausted by home loan principal prepayment and kids’ tuition fees.

It is also likely that you have adequate life insurance, and the premiums, in addition to the EPF/NPS contributions and home loan EMIs, exhaust the Section 80C tax limit.

“Those who have a lesser contribution to EPF can consider using children’s tuition fees under Section 80C. Certain financial goals like children’s education and retirement can become a priority. Hence, you can use a blend of ELSS and PPF as well,” says Chetanwala.

Focus On Long-Term Goals

Dipankar Chakraborty, 45, a Delhi-based general manager of an IT firm, and his wife, Tapti Roy, 36, a PhD research scholar, understand that tax-saving is not limited to getting a higher in-hand salary. “Tax saving is important not just for increasing the net salary but also for fulfilling future goals like retirement,” he says.

If your risk appetite is low, you can reduce the allocation to market-linked instruments such as ELSS and increase the chunk you invest in PPF and tax-saving FDs.

Tax-saving FDs come in handy if you want to book profits in equity and park the returns in debt instruments for mid-term goals such as children’s education, which may be five to six years away. PPF, which offers a tax deduction up to Rs 1.5 lakh per year but has a 15-year lock-in, can be used for retirement planning. The interest and maturity amount on PPF are both tax-free and it allows partial withdrawal after five years.

Chakraborty and Roy have chosen to invest in Voluntary Provident Fund (VPF) scheme and a retirement (insurance) plan as a way to prepare a retirement kitty. “I consider VPF a safe option and it will get me additional benefits post-retirement,” Chakraborty adds.

Photo: Tribhuvan Tiwari

Dipankar Chakraborty, 45, General Manager at an IT firm; Tapti Roy, 36, PhD Research Scholar

- Avail of Section 80C benefits through a retirement plan (insurance plan). Have opted for the Voluntary Provident Fund scheme

- “Tax-saving is important not just for increasing the net salary, but also for fulfilling future goals like retirement”

Look Beyond Section 80C

The Section 80C limit is Rs 1.5 lakh, which gets easily exhausted. But there are many other tax-saving investments. NPS, which invests in different asset classes such as equity, corporate bonds, government securities, and others, is one such option.

“A middle-aged taxpayer can consider additional investment in NPS for the long-term goal of retirement planning. NPS offers an additional tax deduction of Rs 50,000 under Section 80CCD (1B), over and above the 80C Rs 1.5 lakh limit,” says Gupta. So, in all, you can avail tax benefit of Rs 2 lakh through NPS.

Health insurance premiums for self, family and parents can be used to get tax benefit under Section 80D.

Education loan is another instrument with dual benefits—tax-saving under Section 80E and, of course, being able to pay for your child’s education. “One can plan taxes to have a higher education loan to claim the interest paid as 100 per cent deduction under Section 80E. This loan can be taken not only for children but for self and spouse too,” says Suneel Dasari, founder and CEO, EZTax.in, an online income tax filing portal. This may even be useful if you are planning to up-skill yourself.

Senior Citizens: Risk-Averse, With Focus On Regular Income

Taxpayers in this age group may not have goals such as EPF, children’s education or home loan repayment, most of which come under Section 80C. Even life insurance premiums may not be relevant as at this stage you are not likely to have financial dependants. The focus should, therefore, be on low-risk investments and regular income.

“The aim is often to settle all personal debts like personal loans, credit card dues and other debts (which do not offer tax benefits) before retirement. At this life stage, people tend to invest in tax-saving instruments that offer more tax-free maturity amounts and a stable source of income,” says Chandna.

Hirak Talukdar, 33, Senior Design Engineer; Paramita Sinha, 30, Homemaker, Kolkata

- Use PF contribution, PPF, life insurance and NPS to save tax under Sections 80C and 80CCD. Also have family floater health insurance, which qualifies for deduction under Section 80D

- “Proper tax planning is important so that one chooses the right investment avenues to maximise returns”

One of the important aspects to consider is liquidity. One way to do that is to convert fixed assets to shore up cash reserves. “The investments should be as tax-efficient as possible,” says Dasari.

Senior citizens can look at small savings schemes such as tax-saving FDs and Senior Citizens’ Savings Scheme (SCSS), both of which are part of the 80C basket. However, the interest earned from tax-saving FDs is taxable and, hence, their post-tax returns usually do not beat inflation.

SCSS is a government-backed retirement benefits programme in which senior citizens can invest a lump sum, individually or jointly, and get regular income along with tax benefits.

While other expenses reduce, medical expenses increase for this age group. A senior citizen can get tax deduction on health insurance premiums and on expenditure (on self or dependant) towards specified disease or ailments, under Sections 80D and 80DDB. Moreover, Rs 1 lakh or the amount paid, whichever is less, is applicable as a standard deduction for resident individuals of age 60 years or more.

In all this, investing some amount in equities to get higher returns should be considered. Invest funds you don’t need immediately. Pabitra Kumar Das, a 71-year-old engineering consultant who lives in Kolkata with his wife, Gopa Das, 63, a homemaker, has changed track and now invests in ELSS. Das used to invest in PPF for tax saving, but now invests more in ELSS for the inflation-beating returns and the 80C benefits. He further avails medical insurance premiums to the maximum extent. “ELSS schemes have a lock-in of three years. So, usually these funds give better returns, primarily because the fund manager gets more time to plan for higher returns. Therefore, if the investor can afford to wait for three years, he/she can look for a higher return on investments,” says Das.

The new tax regime can be an option for senior citizens if they do not have enough tax-saving avenues to invest in, depending on their circumstances. “Senior citizens with only retirement income may opt for the new tax regime as they generally don’t look to make new payments to avail tax deductions. So, if there is not much income to show, the new tax regime may be suitable to pay relatively less tax” says Sehgal.

The adage “nothing is certain but death and taxes” holds true even today. Planning your taxes as per your life stage and needs will help you deal with this certainty and make it an effective part of your financial plan. So, make sure your tax planning fits your financial goals.

meghna@outlookindia.com