The most critical planning for your life after retirement hinges on asset allocation. It calls for intuitive allocation and time-based rebalancing of your assets like equity, debt, gold, cash, crypto and real estate. Let’s focus on two asset allocation regimes – equity and debt.

Glide To Your Retreat

Go heavy on equity when you’re young and shift to debt funds as you age, then de-risk yourself for the most blissful life in retirement

Around 90 per cent of the variability in portfolio returns could be explained through asset allocation, according to Determinants of Portfolio Performance, a landmark 1986 study by Brinson, Hood, and Beebower in the Financial Analyst Journal.

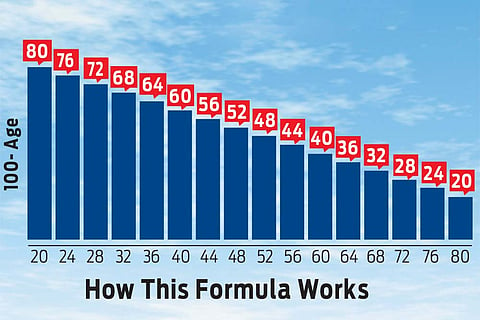

We can divide the process of asset allocation for equity and debt in three stages. In stage one, you focus on maximum savings and investment, when your account balances are low and your goal is long way off. You have time to recover from market downturns and, so, your risk appetite is high. Invest a large chunk of your assets in equity funds in this stage. A simple rule of thumb is to have ‘100 minus age’ invested in equity mutual funds, and the remainder in debt mutual funds.

Put simply, subtract your age from 100 for the ideal asset allocation. Let’s say you are 20. By subtracting your age from 100, you get an asset allocation ratio of 80:20, where you invest 80 per cent in equity and 20 per cent in debt. You will rebalance this to 60:40 twenty years from now. At retirement, you should have 40 per cent in equity and 60 per cent in debt. This theory, where equity investment in the portfolio glides from 80-40 per cent at retirement is called the moniker “glide path”.

In stage two, say you are within five years from retirement, and your account balances are considerably high. But you are also exposed to return sequence risk. Let’s say, you are 57 and suddenly the market tanks 50 per cent. Almost 43 per cent of your asset allocation in equity is cut to half and you have only five years to recover. One way to fix this is to de-risk your allocation. Ideally, your equity investments, closer to retirement, should be less than 20 per cent.

The third stage is for enjoying your freedom. Research suggests that risk-taking ability reduces drastically as you age. Once in retirement, adverse market impact has little time to recover as no new investments are added. Therefore, the best strategy is to keep your equity allocation constant to avoid market risks.

Hence, the thumb rule is to take all the risk in equity early in life but drastically de-risk as you reach those golden years.

The author is Founder and CEO, Kuvera.in