Individuals have been building up expectations from Budget 2023, especially given that the Indian economy has shown promise so far and proved to be one of the few bright spots in a slowing global trend. The prospects have been based on the belief that the government will continue the momentum on the measures taken last year to address the tax concerns of individuals.

Filling The Gaps In Individual Taxation

Revision of income tax slabs, expansion in deduction limits for some tax-saving instruments and specific measures to help salaried individuals are expected in the coming year

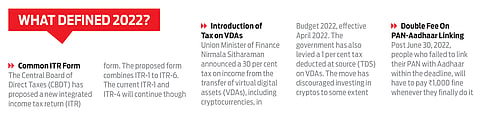

With the intent to move to a trust-based governance regime, the Finance Act 2022 introduced a scheme for voluntary filing of ‘updated returns’, within a specified timeframe, with additional tax payment of 25 per cent and 50 per cent, depending on the period of delay. The amendment has been beneficial for those who missed filing their tax returns. However, the provisions do not help in cases where a refund is sought, where claim for loss must be made, or where there is a decrease in tax liability. This has been causing genuine hardship where income has been reported in excess, or a credit for overseas tax or exemption has not been claimed. Hence, further amendment is required to broad-base the intended benefit.

The amendment to cap the surcharge for all long-term capital gains (LTCG) at 15 per cent has been hailed by individuals, as this has resulted in reducing tax on LTCG on unlisted shares (including foreign shares), debt mutual funds, sale of property, etc., thereby improving the investment climate.

Budget 2022 also introduced specific provisions for taxing virtual digital assets (VDAs) to address the uncertainty of taxation of such transactions.

What’s Expected Ahead?

Following are some specific areas that individuals may expect from Budget 2023:

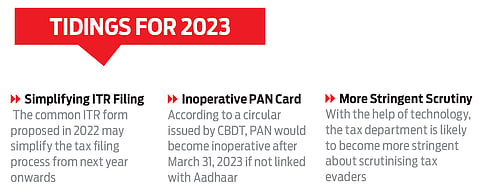

Revision Of Tax Slab Rates: To make India more competitive in the region and to attract and retain capital, a roadmap is expected for the simplification of the tax law and for lowering of tax rates across levels. While individuals may be hoping for an increase in relief measures, they can expect removal of some of the exemptions and deductions.

Increase In Limit For Some Deductions: With a view to provide taxpayers with higher disposable income, while also increasing capital formation within the country, Budget 2023 could likely consider increasing the limits of the available deductions/exemptions as follows:

- Contribution to Provident Fund, insurance premiums, and other specified investments could be increased to Rs 2.5 lakh under Section 80C of the Income-tax Act, 1961.

- Standard deduction could be increased from Rs 50,000 to Rs 1 lakh.

- The deduction for interest earnings from savings account could be extended to bank deposits too, with the limit increased from Rs 10,000 to Rs 50,000.

- The deduction available under Section 80EEB, which allows the taxpayer to claim deduction on the purchase of an electric vehicle, on the interest component of a car loan EMI, up to Rs 1.5 lakh, may be extended for at least two years, up to March 31, 2025. This deduction is subject to certain conditions.

What Can Help The Salaried?

Taxability Of Contribution To PF: Contribution by the employer in excess of Rs 1.5 lakh to the Employees’ Provident Fund (EPF), National Pension System (NPS) and approved superannuation fund is taxable in the hands of the employee. On withdrawal, the same PF/superannuation balance (including what was already taxed earlier) would be taxable in some circumstances (for instance, if five years of continuous service is not rendered). This appears to have been an unintended consequence and, hence, a specific provision in the Income-tax Act, 1961 to provide exemption in respect of contributions already taxed earlier, could be expected.

Taxation Of Employee Stock Options: In case of mobile employees who qualify as non-resident (NR) or not ordinarily resident (NOR), and exercise stock options, only pro-rata value in respect of the number of days spent in India during the period granted to vest is subject to tax in India, based on Organisation for Economic Co-operation and Development (OECD) commentary and various judicial precedents. Since the Income-tax Act, 1961 does not specifically provide for pro-rata taxation in respect of mobile employees, to mitigate litigation, it is recommended that the Act specifically provide for pro-rata taxation for mobile employees who qualify as NR or NOR.

Extending Last Date To File Tax Returns: Currently, the last date to file tax returns for a tax year is within nine months of the end of the financial year. However, many tax jurisdictions follow the calendar year as their tax year, and a much longer filing period leads to the inability to claim foreign tax credit due to the absence of proof of taxes paid overseas. Budget 2023 could consider allowing 12 months from the end of the FY, as the last date to file a tax return.

Given the buoyant state of the economy and the significant increase witnessed in tax collections, individuals are hopeful that Budget 2023 would reduce their tax burden and that tax rates would be aligned with corporate tax rates.