In this era of equity, mutual funds and systematic investment plans (SIP), the relevance of fixed deposits (FD) as an investment tool is often questioned. But surprisingly with low and declining returns it is still the most trusted route to park money for most Indians. In fact, not only FDs but also other traditional asset classes like the National Savings Certificate (NSC), Kisan Vikas Patra (KVP) are facing stiff competition from their modern counterparts.

Evaluating The Essence Of Conventional Instruments

Are traditional tools like fixed deposits losing their appeal?

As per a recent Sebi survey, more than 95 per cent Indian households prefer to park their money in bank deposits, while less than 10 per cent opt for mutual funds or stocks. The survey further noted that, life insurance was the second most preferred investment vehicle, followed by precious metals, post office savings and real estate. The data clearly indicates that though FDs do not factor in inflation, yet it is a preferred tool because of its risk-averse nature.

“The primary reason behind such behaviour is that an average investor in India is risk averse and does not have a clear understanding of the higher historical returns of equity markets. Returns from equity markets whether directly or through mutual funds may be higher but they are associated with market risk and this particular factor is not palatable to an average investor”, said Rahul Agarwal, Director Wealth Discovery/EZ Wealth.

Although, sustained campaign from the mutual fund industry in highlighting the benefits of investing through SIP have made some difference. However, it is believed that it is still a long way to go before an average investor gets comfortable and confident about the superlative returns of the equity markets and starts participating.

“In the present era, even with falling interest rates and tax implications towards maturity, FD investments tops investors’ priority list,” Agarwal added.

Sharing her views on FD investments, Dilshad Billimoria, Director, Dilzer Consultants, said, FD is a traditional investment option like real estate and gold. People are of the opinion that FDs are absolutely safe. “While many are aware, many are not. If the bank goes bankrupt only upto Rs1 lakh is guaranteed as prepayment,” she added.

“While FD may not be the most attractive instrument from a post-tax (marginal rate of taxation on interest income) returns point of view, they are still preferred by many investors on account of risk-free, guaranteed nature of returns and easy liquid nature,” said Ankur Maheshwari, CEO, Equirus Wealth Management.

However, does FD fall flat on its face in an era when tax exemptions are offered for investments like certain SIPs and MFs? If so, then why do people still resort to FD as an investment tool. Commenting on this trend, Ankur said, “While with increased awareness about various financial products, some flows are moving towards MFs and SIPs, FDs are still preferred by many investors on account of risk-free and guaranteed nature of returns and easy liquid nature.”

“However, from Assessment Year 2015-2016 there is no tax advantage in debt funds as compared to FDs if the holding period is less than three years”, said Renu Maheshwari, CEO and Principal Advisor, Finscholarz Wealth Managers.

“As a matter of fact during times of credit risk, fixed deposits are a very good option. The investor can lock in FD at the rates prevailing now. Banks will reduce interest rates as RBI reduces the interest rate. SBI has already started the process. Care should be taken to do it in nationalised and leading private banks only,” she said.

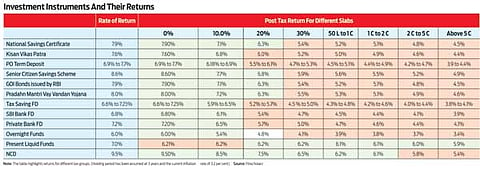

While equity is the glamorous asset with double digit CAGR being the average returns, debt as an asset class can be a place to hide when markets go bad. Debt is a more complex instrument because of the various factors affecting its movement including maturity period, quality of borrower, liquidity, bond supply, interest rate scenario and taxability. Few of these factors affect the prices in same direction and others in opposite direction.

Technically, all fixed deposits, small savings schemes, liquid funds, debt funds, bonds and debentures are part of same asset class – debt. Fixed deposit and other small savings instruments are not tradable and cannot be bought and sold in the market. This puts them in a unique position of being safe but not high yielding.

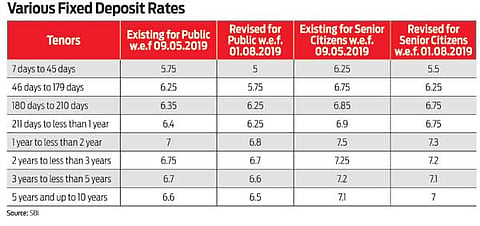

Many banks have been diminishing interest rates on fixed deposits due to a reduction in RBI policy rate and surplus liquidity. The RBI so far this year cut the repo rate by a combined 110 basis points, leading to a sharp fall in bond yields. Returns on fixed deposits are calculated on a certain rate that is determined at the time of booking and remains the same throughout the deposit term, said Agarwal. Currently, interest rates on FDs offered by various banks typically ranges between 3.5 - nine per cent, depending upon the tenure and amount.

Interest income from FDs is fully taxable as it is added to one’s total income and gets taxed at slab rates applicable to one’s total income. This tax is deducted at source by the bank at the time the bank credits the interest to the account subject to some conditions.

Investing in tax saver fixed deposit, a type of fixed deposit with lock-in period of five years, one can get tax deduction of a maximum of Rs1.5 lakh, under Section 80C of the Indian Income Tax Act, 1961. But the interest earned is taxable.

Alternately, are other traditional forms of asset allocation like NSC and KVP are also losing attractiveness? Sharing his views on this, Agarwal said, the NSC is a fixed income investment scheme that can be opened at any post office. Primarily, NSCs are tax-saving investments as the principal amount invested allows tax deduction under Section 80C up to the Rs1.5 lakh limit. However, the interest earned on NSCs attracts a slightly complicated tax treatment. The annual interest earned from NSC (for the first four years) is deemed to be reinvested hence exempt from tax and also eligible as a further deduction under Section 80C (subject to the overall annual limit of Rs1.5 lakh). However, the interest earned in the fifth year (that is on maturity) is not re-invested hence taxable as per the investor’s applicable slab rate. Interest is compounded annually but paid out only at maturity without any TDS deduction.

The KVP is a small saving certificate scheme that has been reintroduced in the Budget 2014, which was earlier discontinued in 2011. Unlike other specified investment instruments, KVP does not come under the Section 80C deductions, and returns are completely taxable under the head, Income from Other Sources. Harping on the importance of these traditional investment tools, Renu said instruments such as FD, NSC, KVP or Post Office schemes have their own place in portfolios, especially for retired investors and investors falling under the lower income tax bracket. 2019 is a textbook example of how traditional instruments can prove useful in times of uncertainty. When credit risks in the market became unpredictable, these instruments provided a haven to retail investors. However, new tax laws have made them somewhat unattractive for investors in higher tax brackets.

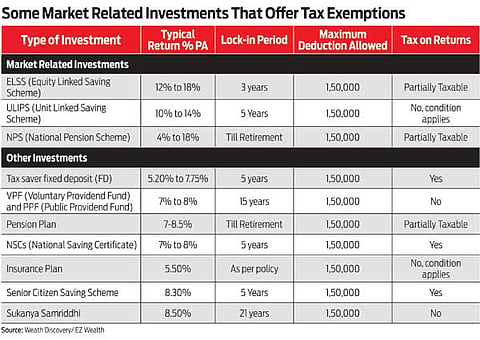

Which are the market-related investments that offer heavy tax exemptions? Renu further added, in fixed income segment PPF is the most tax efficient investment with an EEE option (Exempt at the time of investment (80 C), Exempt at the time of interest accrual and Exempt at the time of withdrawal. No wealth tax either).

Agarwal suggested there are some market-related investments that offer significant tax exemptions. These include Equity Linked Saving Scheme (ELSS), and Unit Linked Saving Scheme (ULIPS), which remain the most popular. Other tax saving investment products include NPS, VPF, PPF, NSCs, pension plan, insurance plan, Sukanya Samriddhi Yojana, and Senior Citizen Saving Scheme.

Thus an analysis of FD revealed that all is not lost and it will continue to occupy its strong foothold in the coming days.

aparajita@outlookindia.com