Investing In ELSS

Down But Not Out

ELSS is not merely for tax savings. Nor should you avoid it in favour of direct investing

- Consider it a part of your overall asset allocation strategy due to the various benefits it offers

- In the current scenario, investors must review their asset allocations, as markets have witnessed ups and downs over the past few months

- Investors should not wait till the end of the fiscal year to invest in ELSS, and view it as a tax-saving device

- Investors should spread their investment during the year, either in SIPs or purchases during corrections

- Investments should be made with a minimum three years perspective to benefit from tax deductions

- ELSS offers exceptional gains in the long term (7 to 10 years)

- Consider selling your ELSS fund after three years, but the gains are better in the long run

- The three-year lock-in period should be kept in mind. An inappropriate fund that does not align with your financial goals could mean a setback after three years

***

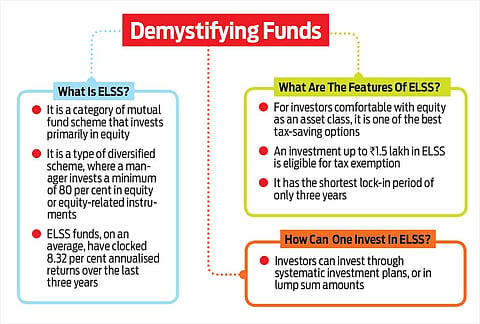

When an investment instrument with a track record shows massive degrowth, one wonders where to invest. This is the case with Equity Linked Savings Scheme (ELSS). These open-ended equity mutual funds can offer great returns with a sound tax-saving option of up to Rs 1.5 lakh per annum under Section 80C, with three-year lock-in period. Even after attracting long-term capital gains, it holds more post-tax promises than other instruments. ELSS gave an annual return of 14.76 per cent, 5.47 per cent and 11.18 per cent in the last one, two and three years as on December 9, as per Value Research data.

However, of late they took a beating as pandemic-led disruptions shook the equity markets in the first half of 2020. This impacted various categories of mutual funds and ELSS was no exception. As per data from Association of Mutual Funds in India (AMFI), equity-oriented MFs continued to witness a net outflow for the fifth month in a row. The outflows in open-ended growth and equity-oriented schemes nere a massive Rs 12,917.30 crore in November 2020 as compared to Rs 2,724.95 crore in October 2020. ELSS witnessed a degrowth of 380 per cent year-on-year (Y-o-Y).

All Fall Down

Multiple factors were at play. The pandemic and ensuing lockdown forced people to scramble for safety with businesses shutting down, unemployment at an abysmal ligh and investments getting wiped out in no time. Hence, many had little choice but to run for redemptions instead of saving or staying invested for long, suggest experts. The race for fast liquidity, especially after the markets corrected, partly caused these huge outflows in MFs.

Investments in ELSS can be either done directly or through MF advisors and distributors. Experts say that the culture of work-from-home gave time and flexibility to investors to trade and invest directly in equity, rather than go through the MF route. But there are lurking dangers. In a booming market, overconfident investors with little research or knowledge can earn and lose money.

As Sorbh Gupta, Fund Manager, Quantum AMC, aptly points out, “Some investors have done their homework and are buying equity with a long-term view. However, a lot of them are getting into the market with a short-term trading mindset and will face trouble during the market correction.”

The number of folios or a unique number given to each MF investor, and funds mobilised during November, were lower than October. The redemption amount has simply shot up. Data reveals there was an ELSS outflow of Rs 804.06 crore in November compared to Rs 274.38 crore in October. This shows investors continued to book profits, given the surge in equity markets. Nobody wanted to wait.

Riding Tax Advantage

Since ELSS is predominantly viewed as a tax-saving instrument, the major inflows usually happen in the last quarter of the year when tax-saving takes precedence. This can happen now too. However, given the job losses and pay cuts, investors may continue to shift out. Their worry isn’t about tax outgo, but the liquidity in their hands.

Besides, when incomes remain stagnant, the allocations for tax-saving products get impacted. Also, uncertain times compel people to get conservative and risk-averse. They avoid equity investments with lock-in periods, even if they are for only three years.

“The extended deadline for filing taxes and underperformance of ELSS funds could be a reason for investors to re-consider investing and shift to conservative Fixed Deposits (FDs) and Public Provident Funds (PPFs) to park their surplus cash,” points out Tarun Birani, Founder and CEO of TBNG Capital Advisors. Despite low returns, both are considered safe investments compared to ELSS.

Rewards With Risks

While most retail investors eye lucrative returns with added tax benefits and short lock-ins, they fail to see the market risks. “Investors often look at returns as a priority when investing in ELSS, but fail to regard their risk appetite and the risk involved in specific funds. Remember higher rewards usually involve higher risks,” cautions Birani. This is how myopic decisions are taken. It is advisable to hold on to investments, reap rewards as markets correct, rather than sell at the first instance and quit.

With markets on an upswing, we may expect inflows in the near future. “Investors should see this in the overall context of recent outflows across equity-oriented mutual fund categories. I think the trend is reversing and we should see an acceleration in the pace of inflows in funds, including ELSS in the coming months,” says Neelesh Surana, CIO, Mirae Asset Investment Managers.

Choices To Make

The question is how long can you remain risk averse and let your money stagnate? Investors need to review their existing asset allocations, and use this window to exit poor performing products. After all, it is the long-term discipline that works best in markets.

Surana feels this is the right time to invest, rather than exit investments. “ELSS instils a sense of long-term discipline in investors, and that is a prime requisite to invest in equity. Therefore, I would suggest ELSS ought to be considered as core to an investor’s asset allocation strategy,” he advises. The lock-in period should be considered because an inappropriate fund that does not align with your goals could mean a setback after three years.

Here, Systematic Transfer Plan (STP) can come handy by offering periodical shift of investment from one scheme to other. This facility gives investors a shield to protect investment during market fluctuations. Ankur Maheshwari, CEO, Equirus Wealth, advises, “For future equity investments, take the STP route over the next six months. Also, from a mutual fund diversification point of view, it will be helpful to spread the MF investment in two to three schemes.”

Fund managers can use the flexibility of ELSS to invest in different stocks during volatility. “ELSS is a product where Sebi has not mandated any allocation limits based on market capitalisation,” explains Gupta. However, the real game lasts longer. “You could consider selling your ELSS fund after three years, but the gains are way better when invested for the long run,” explains Birani, while being optimistic about the future of this equity-linked fund.

himali@outlookindia.com