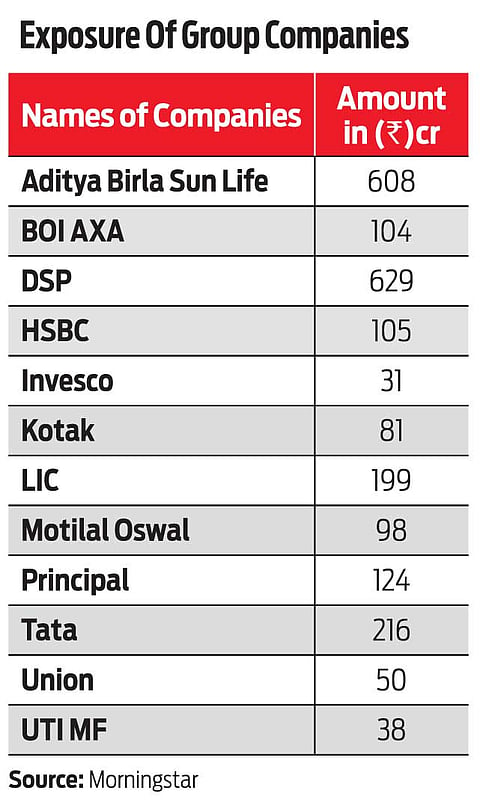

Over the last year or so, there is a distinct credit crisis looming large over the Indian investment landscape. In September 2018, the Infrastructure Leasing and Financial Services (IL&FS) fiasco shook the sector. The banking and the NBFC sectors are still experiencing the aftershocks. In the aftermath of IL&FS fiasco, debt mutual funds, credit risk funds, fixed maturity plans (FMP), investors, NBFCs, banks and other financial institutions have begun to feel the heat. Moreover, mutual funds investors are staring at a lot of insecurity in debt mutual funds schemes, primarily in the credit risk fund category. Due to this, investors have started to panic while many of them are mulling options of switching to safer investment bets. Major mutual funds that have exposure in IL&FS securities are LIC MF, DSP Credit Risk Fund, Aditya Birla Sun Life, Tata Capital, Principal Cash Management, Invesco and Mirae Asset. Besides, Life Insurance Corporation of India (LIC) and provident fund body EPFO also have their share of exposure in the troubled infrastructure giant. From the mutual funds industry Kotak Asset Management, ICICI Pru AMC, HDFC Mutual Funds, UTI Mutual Funds and others have exposure in these entities.

Credit Crossroads That Shook India

An insight into the debt-laden IL&FS; hit by leverage and illiquidity

Another dent in the mutual funds industry came in early April this year when Kotak Mana Mutual Fund declared it has deferring full payments to its fixed maturity plan (FMP) unit holders till September 2019. Zee Group asked Kotak to wait till the month-end for releasing due payments. However, Kotak said there will be no delay in repayment of principal amount for the 183 series FMP schemes. The AMC said, the scheme has invested in non-convertible debentures (NCDs) of two Essel Group companies. At the time of investment in the 183 Series FMP, CARE had given a AAA rating, which was later downgraded to D. The cause of the crisis was a sharp drop in the prices of the Zee Entertainment shares due to which the company could not service the debt on time. HDFC Mutual Fund too had similar exposure in the Zee group. An email sent to Kotak AMC did not elicit any response till the time this article was written.

However, a spokesperson from HDFC said, the scheme HDFC FMP 1168D MF has been extended by 380 days and investors have been “rolled-over.” HDFC MF has an exposure of Rs1,155.82 crore while Aditya Birla Sun Life has Rs2,861.36 crore in the Subhash Chandra promoted group, according to Morningstar. Zee has sought time till September to clear FMP dues. ICICI Prudential AMC has Rs795.20 crore in the same group. In the aftermath of delay in payments, Sebi ended up sending notice to Kotak MF and HDFC MF seeking details of the deal they had entered with Essel Group for delayed payment of FMP maturity.

PSU banks’ exposure was the second wave of crisis that preceded the FMP imbroglio. In February this year, CARE Ratings downgraded Rs1.2 lakh crore worth of bonds, loans and deposits issued by DHFL. In a single day, it downgraded multiple notches to BBB from AAA in September 2018. It is feared that the DHFL crisis may instill fear among investors who are likely to stay away from debt mutual funds. According to an estimate, PSU banks have around Rs40,000 crore exposures of which State Bank of India alone has Rs12,000 crore. Banks are already reeling under `10 lakh crore bad loan burden.

Jason Monteiro, AVP Mutual Fund Research and Content, at Reliance Wealth Management, said burgeoning and unchecked debt is the root cause of the issue. Some fund houses reacted bit too late and ultimately investors suffered due to the debt defaults.

But, what led to such an event? It all began last year with the downfall of IL&FS. The NBFC in March 2018 had postponed bond issuance worth Rs2,275 crore at `65 to a dollar rate. At current rate of `70 to a dollar, the figure went up to Rs2,460 crore. While citing reasons for this delay, the infrastructure financier had said, a higher yield or return demand from investors forced the company to take this decision.

Again, in September 2018, IL&FS failed to service payments on bank loans along with interests, short term and term deposits. It also could not meet redemption dates for commercial papers. As the NBFC failed to repay loans, going ahead IL&FS piled up huge debt amounting to Rs91,000 crore, that is reverberating across sectors.

Therefore, can we say that MFs are hitting the exit button? According to Rachit Chawla, Founder and CEO, Finway, an NBFC, LIC Mutual Fund, Aditya Birla Sun Life, DSP, Kotak Mahindra and BOI Axa Mutual Fund have exposures in IL&FS and its group companies. “They have to maintain liquidity so, they are definitely pushing the exit button hard. However, many have not been able to exit,” he said.

Amid this chaos among investors, FMPs and credit risk funds saw net outflows in April this year. FMPs recorded Rs17,644 crore worth outflows while credit risk funds recorded Rs1,253 crore outflows in April, a data released by the Association of Mutual Funds in India (AMFI) revealed.

Giving reasons for net outflows and subdued response to FMPs and credit risk funds, N S Venkatesh, CEO, AMFI, said, “Overall nervousness in the markets owing to credit events, rating downgrades and defaults, coupled with global trade imbalance, and uncertainty over outcome of general elections has led to investors getting into wait-n-watch mode. We expect investors would return in a big way, as corporate earnings improve.”

Nimesh Shah, MD and CEO, ICICI Prudential AMC said, any fixed income investment is exposed to three key risks, credit risk, interest rate risk and liquidity risk.

Chawla added, the IL&FS crisis was a pure outcome of wrong policies and risk assessment by fund managers. On a query whether there was a crisis in debt mutual funds segment due to a series of payment misses, he said there is definitely a liquidity crisis due to this as NBFCs, which have exposure are under tremendous pressure.

“As a result, disbursements are being slowed down, hitting the real estate sector very hard. If still no resolution is made, NBFCs will have to declare huge losses going forward,” added Chawla.

Last year, after the fiasco came to light, Sebi swung into action. The market regulator initiated a probe to dig into the role of credit rating agencies. After a detailed probe, it found that rating agencies failed to alert investors on time about the falling credit profile of the infrastructure giant. Major rating agencies including ICRA, CARE and IndiaRatings had given highest rating to IL&FS. Ironically, after the defaults surfaced some of these agencies did not wait long to downgrade IL&FS bonds.

This colossal exposure makes mutual funds vulnerable, puts them at the receiving end of payment defaults and delays in redemptions of units with their borrowers missing payments deadlines. Though, the credit risk mutual funds come with promise of higher returns, they also come with higher risk of losing money if the funds’ ratings get beaten up. This is what happened in the IL&FS case also.

Karan Gupta, Wealth Manager, Sykes and Ray Securities added, “Lately there has been a lot of insecurity in the debt category of mutual funds schemes, and also in the credit risk category. To address these issues, it is important to analyse the features of this very category of schemes” he said. The usual time horizon for such schemes is over three years. Panicking in the short run is uncalled for as investors should have accounted for the credit risk prior to the time of investing in such schemes.

A money market expert who did not wish to be named said, credit risk funds invest mostly in securities with low grade ratings like AA and below that. Investors with an urge to earn higher returns, go for these credit risk funds as they often end up reaping profits in double digits, he further added.

However, these credit funds come with a higher risk of volatility as well. “If a fund says a fixed maturity plan (FMP) has three years of maturity period, then the fund manager should monitor the scheme throughout these three years instead of waking up at the end and finding the scheme had crashed.”

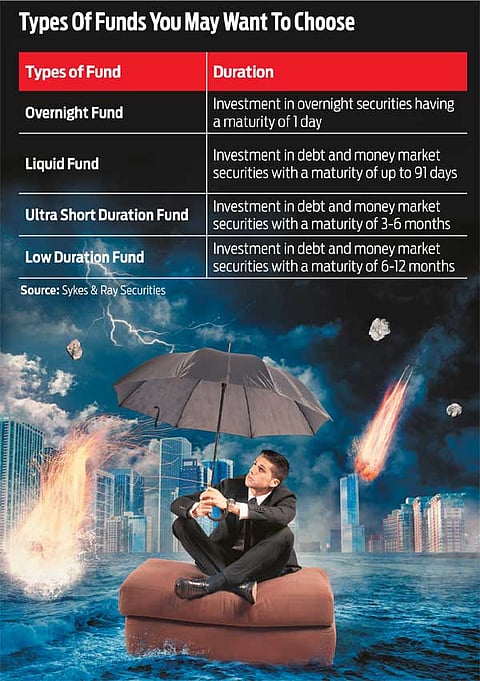

What should investors do in this case? When asked this question, Chawla of Finway added, “A better alternative for investors is to go for a Nifty Index Fund comprising 50 top companies of India, as there will always be enough liquidity, no matter what and it will continue to grow in long run with the economy. Investors should expect around 14 per cent return if invested in the long run, which is far better than liquid fund and then waiting to get the money back.” Nireen Mamaji, CFP, Moneyworks Financial Advisors said, “If you have invested in any of the credit risk funds, stay invested until the crisis blows over. Do not redeem at a capital loss as the NAV will appreciate after some time. Just stay invested.” She further added, “Investors should invest in short-term funds that is, low duration or ultra-short and only AAA paper. Avoid credit risk funds and avoid any exposure to AA and below.”

Commenting on the same idea, as to what investors should do, Gupta said, a 200-300 basis points over usual low duration and ultra-short term category of schemes come with its own credit risks. Thus, if the time horizon of the retail investor is shorter, it is prudent to explore categories of debt mutual fund schemes with corporate papers having a lower maturity of the under lying debt instruments.

It is to be noted that fund managers, at the time of picking corporate papers in the credit risk fund, are taking precautions to avoid corporate papers being downgraded in the ratings, which impacts the NAV and the performance of the end investor. At the same time, this very credit risk can only be mitigated and not eliminated altogether, concluded Gupta.

Ratings Are A Part Of Credit Investments

The IL&FS defaults have prompted many market writers to invoke the Lehmann Crisis; there was an uncanny similarity in the absence of cynicism during the US sub-prime boom and India’s NBFC surge. Nimesh Shah, MD and CEO, ICICI Prudential AMC, in a conversation with Ashfaque Ismail lists out two-three broad reasons for the IL&FS crisis as well as advises what investors should do: Excerpts

Why did this crisis happen and how come no one saw it coming including industry veterans?

Any fixed income investment is exposed to three key risks, credit risk, interest rate risk and liquidity risk. Thus, by far the market risk was handled very well by the MF industry. However, of late there has been some challenges in the liquidity risk front. One of the common characteristics of the recent credit crisis was borrowers relying on short-term market borrowings to finance long-term use of funds which resulted in liquidity mismatch.

Did ICICI Pru AMC has had exposure in the entities at the centre of crisis, like IL&FS, Reliance Capital, Yes Bank and Zee.?

ICICI Prudential AMC had nil exposure in IL&FS, Reliance Capital, YES Bank and other NBFC names where there were credit related issues.

What steps can be taken to reinstate investors’ confidence in credit risk, debt mutual funds as, FMPs saw net outflows of Rs17,644 crore and credit risk funds saw net outflows of `1,253 crore in April 2019?

Just as volatility is an integral part of equity investments, rating upgrades and downgrades is part and parcel of credit investments. At ICICI Prudential AMC, we believe a well-run debt fund would have investments diversified assets across sectors and should avoid concentration at individual scheme level. Such an approach is likely to help avoid adverse impact of such credit events and is likely to aid in delivering better risk adjusted returns. We would urge the investors to not chase Yield-to-Maturity (YTM) as the sole metric indicating the potential future performance especially in case of Credit Risk Funds. As a fund house, we are positive on credit risk funds given that yields are at elevated levels.

ICICI Pru has been largely unscathed in these events? What were the steps taken by the fund houses to strengthen your risk management?

We were always conscious of the risks involved in managing a credit risk fund. As a result, before launching our scheme in this category, in order to mitigate such risks, we instituted an independent Investment Risk Management team. The responsibility of the team is to oversee the credit evaluation and approval processes. Owing to this process, the investments are made only after conducting thorough credit due diligence and requisite credit approvals.

The process of credit due diligence considers both qualitative and quantitative factors. Qualitative aspect would take into account aspects such as management profile, industry outlook, competitive positioning, key risks and mitigation while quantitative parameters would include financial and operating parameters.

What’s the philosophy of the fund house in credit decision-making, which has helped investments?

While we do not abide by any strict philosophy as such, we do have some basic tenets, which include the following:

(1) Avoiding concentration risk on individual scheme level

(2) Focus on client selection

(3) Do not solely rely on external credit rating

(4) Refrain from chasing Yield-to-Maturity

(5) Credit investments to be approached from a bottom-up perspective

(6) Credit decisions should be based on internal due diligence and factoring in liquidity risk

Owing to all of these steps, ICICI Prudential has been able to deliver a positive investment experience for its investors.