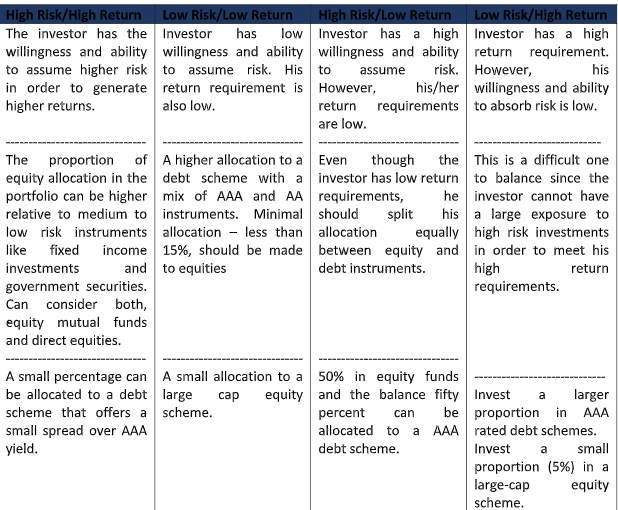

Financial markets, whether debt or equity witness ebbs and flows, alternating between periods of positive movements and periods of negative movements. Ideally, every investor would like to build an all-weather portfolio that can weather the shifting dynamics of financial markets. The good thing is that there is a very simple way of achieving this – portfolio diversification through asset allocation. Now, if it is so simple then every individual should have an optimally diversified portfolio that mitigates portfolio volatility and maximises overall return. However, that is not always the case. This is because, an asset allocation strategy should be customised and should reflect the specific risks, return requirements and investment time horizon of the investor. Once the necessary analysis has been done, individuals usually fall into one of the following four buckets:

Below, is an indicative asset allocation strategy that an average investor can refer to as a first step towards achieving optimal portfolio

diversification. *

*These asset allocations are indicative. Will change as per an individual’s profile.