Understanding the importance of investing at an early age can lead to creating wealth in the prime years of one’s life. Investment is simply a financial instrument developed to allow money to grow. The money generated through the right investments can help an individual in achieving personal and professional goals which include covering income gaps in time of crisis, saving and creating a nest for retirement, and meeting particular commitments such as debt repayment, marriage, or the acquisition of assets like house, car, etc.

Investing at a young age is the finest move, any person can start with a little guidance; it will undoubtedly assist in the creation of wealth, but how? Let us explain why investing early may help one build a money bucket for old age and most importantly early retirement which is important for this generation.

Higher risk appetite

Early in life, investors' risk-taking ability or tolerance is higher than later in life. Young investors can start investing in stocks and equities. Investors need to understand the concept of investing & Compounding, where large caps have given approximately 12 – 14 per cent return in the long term.

Lower living expenses

At a younger age, when we start working, we have more liquidity for investment in our pockets as our expenses and responsibilities are less. We do not need to think of spouses or children and parents might also be working. The moment we have our income is the time to start the habit of investing, even if it's just a small amount. It also helps to suppress the habit of overspending, which is common in the early years.

With lower expenses, we can devote more money towards investment in riskier investment instruments like equities and equity mutual funds.

Compounding can make a difference

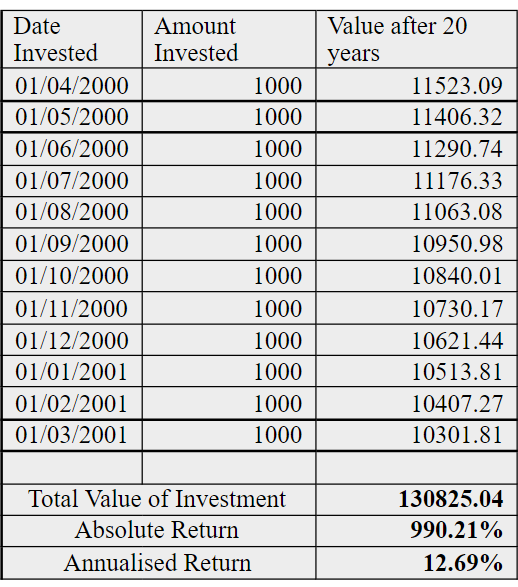

Investors can gain from compound interest if they invest early. The term "compound interest" refers to reinvesting the income from your investment. For example, if two people invest in the same mutual fund or any other investment instrument at the same interest rate and for the same maturity period, but one starts 5 years sooner than the other, even if the year of starting difference is only 5 years, the early investor would receive a 45-50 percent higher return. Therefore, we have an option of SIP returns where you start investing with a small amount of 1000 which keeps on compounding for 20 years.

Time plays a significant role

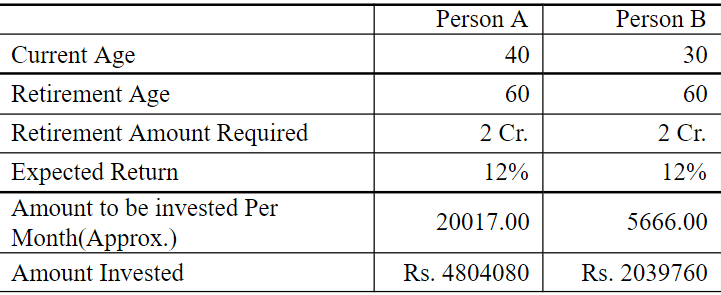

If you start investing early, there are huge benefits you gain through compounding over the years which in turn gets you favourable returns in long-term tenure. Furthermore, investing through ELSS funds helps save taxes. Therefore, investing early can offer a person a sense of financial independence and security. The earlier we invest, the bigger the investment nest is and the better are the chances of financial security in our life. In terms of investment, because time is the most valuable and limited resource we have, we may best utilise it and maximise our wealth by investing early.

Investing early, therefore, serves as a significant benefit.

The author is Executive Director, Findoc.

DISCLAIMER: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.