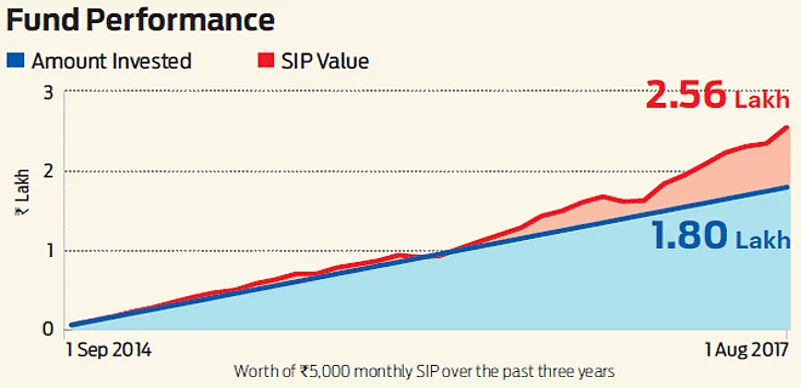

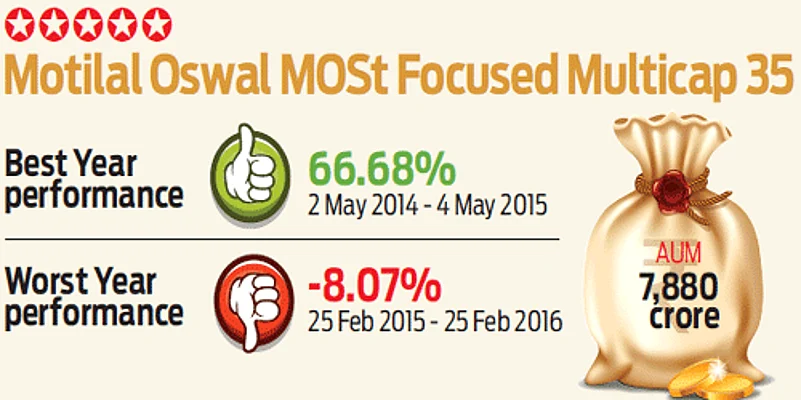

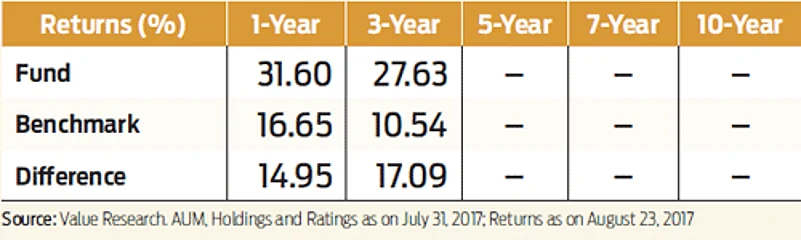

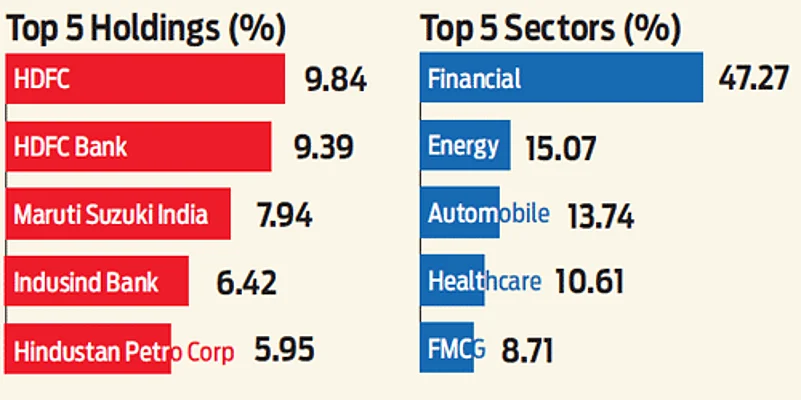

Although less than five years old, we still shortlisted this fund because of its unique investment style. The investment objective of this scheme is to primarily invest in a maximum of 35 equity and related instruments across sectors and market capitalisation. Stock picking becomes key in a fund like this and so does the risk entailed when investing in it. However, going by the short performance history, the investment discipline is reflected in this fund’s out performance compared to its benchmark by a huge margin.

Not a fund for the faint hearted, as the fund manager has the flexibility to move across market capitalisation and sectors, making it a fund that is predominantly driven by the conviction of the fund manager. In its short existence, it has fared well and has benefited from the rising markets. Its performance will be tested for a down market phase, which will need to demonstrate its ability to contain losses when the markets tank.

Launch Date: April 17, 2014

Fund Manager: Gautam Sinha Roy

Benchmark: Nifty 500 Index

Expense ratio: 2.09