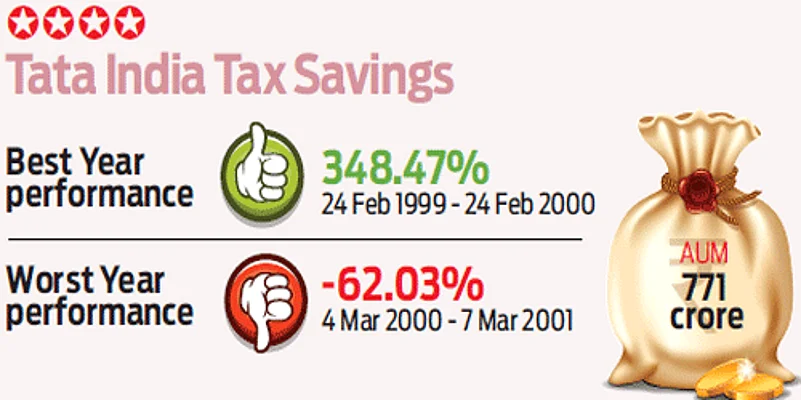

A trait that sometimes goes against this fund is its erratic returns, which if one stays through the three year lock-in, pays off eventually. A mid-cap focused ELSS, with investments in growth oriented companies and an eye for companies with quality management and potential to gain over time have been the hallmark of this fund.

One of the oldest tax planning funds, it has witnessed several ups and downs in the markets and changes its own management team to come out stronger. So, do not write this one off just because it manages a relatively meagre corpus. This small corpus in fact, offers the fund manager the freedom to move across market capitalisation to achieve returns. Where it definitely scores over several of its peers, is in its ability to check on the losses when the markets tank, a trait that augurs well for conservative investors. Invest in this fund to stay through the cycle and longer to gain the most.

Launch Date: March 31, 1996

Fund Manager: Rupesh Patel

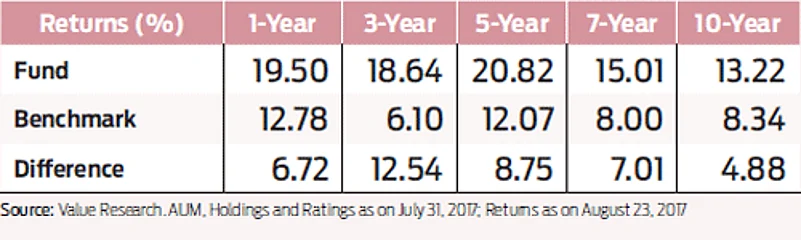

Benchmark: S&P BSE Sensex Index

Expense ratio: 2.53