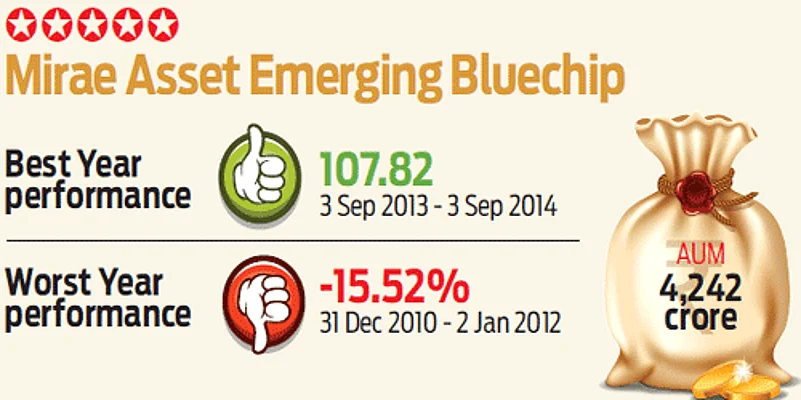

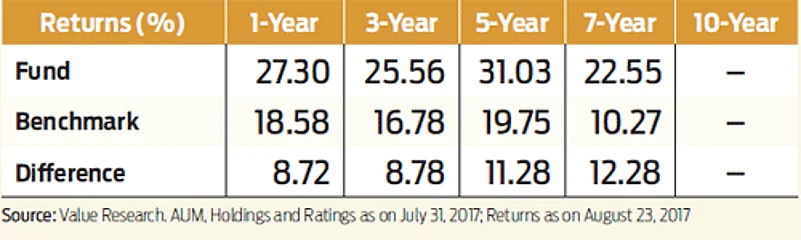

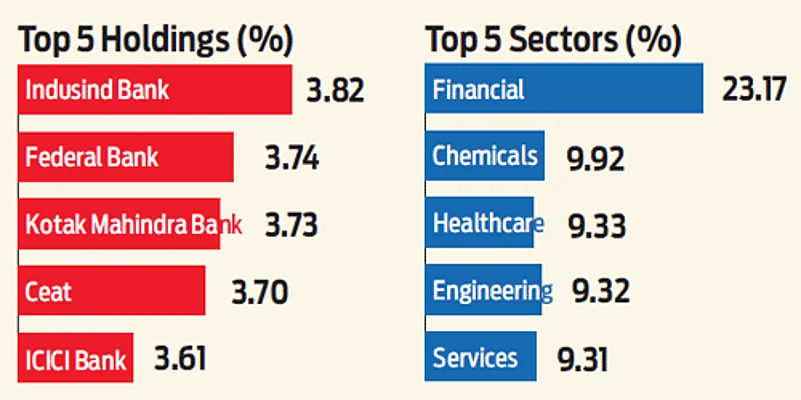

Not a very old fund, but it features because of its pretty clear investment objective. This fund invests in companies which are not part of the top 100 stocks by market capitalisation and have market capitalisation of at least Rs 100 crore at the time of investment. The fund has repeatedly outperformed its benchmark Nifty Free Float Midcap 100 index since its launch in 2010. The reputation to stick to investments in quality stocks in its universe, which are well diversified and follow the rules to cut into its portfolio, has paid off well.

The fund manager does invest in quality companies, he also seeks to invest in companies with growth prospects and good returns on capital employed. The strategy to buy good companies at reasonable prices has worked for the fund, which does tend to have a higher allocation to midcaps. Like some other funds in this list, this too is yet to be tested for its performance in a down market phase.

Launch Date: June 22, 2010

Fund Manager: Neelesh Surana

Benchmark: Nifty Free Float Midcap 100 Index

Expense ratio: 2.39