Amidst ongoing geopolitical tensions and concerns regarding market direction, HSBC Mutual funds released a study showing markets have given significant returns in 3 years after huge corrections. It called on investors to note that though markets dipped 5 per cent last week, they had appreciated by 28 per cent as of September 30, 2024.

HSBC MF Study On Huge Market Corrections

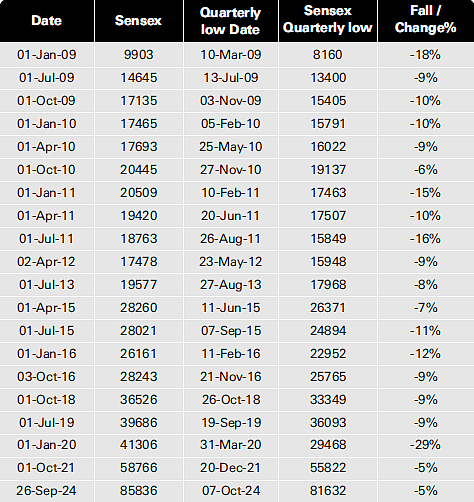

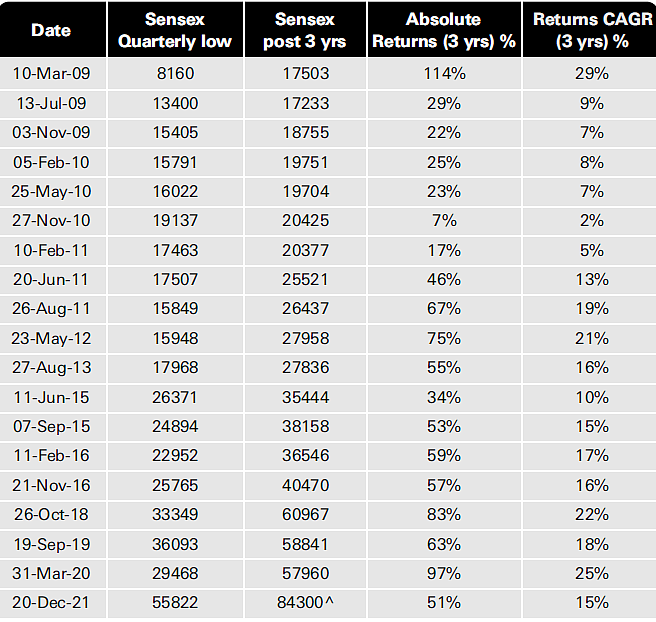

HSBC Mutual funds analysed Sensex data for the last 15 years on quarterly intervals when the equity market corrected over 5 per cent. During the first quarter of 2009, after Sensex corrected by 18 per cent due to the global financial crisis of 2008 - 09, it delivered 114 per cent absolute returns (29 per cent CAGR) over the next 3 years as of March 2012.

Similarly, in three months from January 1, 2020, Sensex fell 29 per cent due to the Covid-19 outbreak. Within 3 years of that fall, Sensex delivered 97 per cent absolute returns (25 per cent CAGR). The mutual fund cited 20 such instances of Sensex corrections ranging from 5 per cent to 29 per cent in the last 15 years. However, after 3 years of each instance, the equity market has returned, 2 per cent to a maximum of 29 per cent post such corrections.

The fund house said that the Indian economy is at the cusp of a robust medium—to long-term growth cycle, evident from the strong GDP growth print and various economic indicators. "The Indian government continues to focus on structural growth enablers such as capex on infrastructure and sustained push towards manufacturing and exports," it said. Further, strong consumption trends across sectors will act as a tailwind for a growth cycle.

RBI’s consistent pause stance since April 2023, and expectations of upcoming rate cuts have further enhanced India’s growth outlook. HSBC mutual fund said that India's export outlook also looks positive.

"India’s export will grow at 15 per cent as India has set a target of USD 2 trillion by 2030. Indian exports have grown 10 per cent CAGR compared to pre-Covid era, 1.7x of nominal GDP growth," it added.