The reality with stock market investing is that if you are in it, you know that there will be episodes of decline. So far, this year, there have been 15 such instances when the S&P BSE Sensex has fallen by over 2 per cent in a single day. It fell by 6 per cent on August 24, 2015. Yes, there was the usual noise with newspaper headlines screaming of wealth erosion, but there was no spiralling effect of the markets witnessing massive investor exits. It does appear that investors are getting mature, which could be attributed to multiple factors such as heightened investor education campaigns and the experience of investors who have witnessed the lows and the highs.

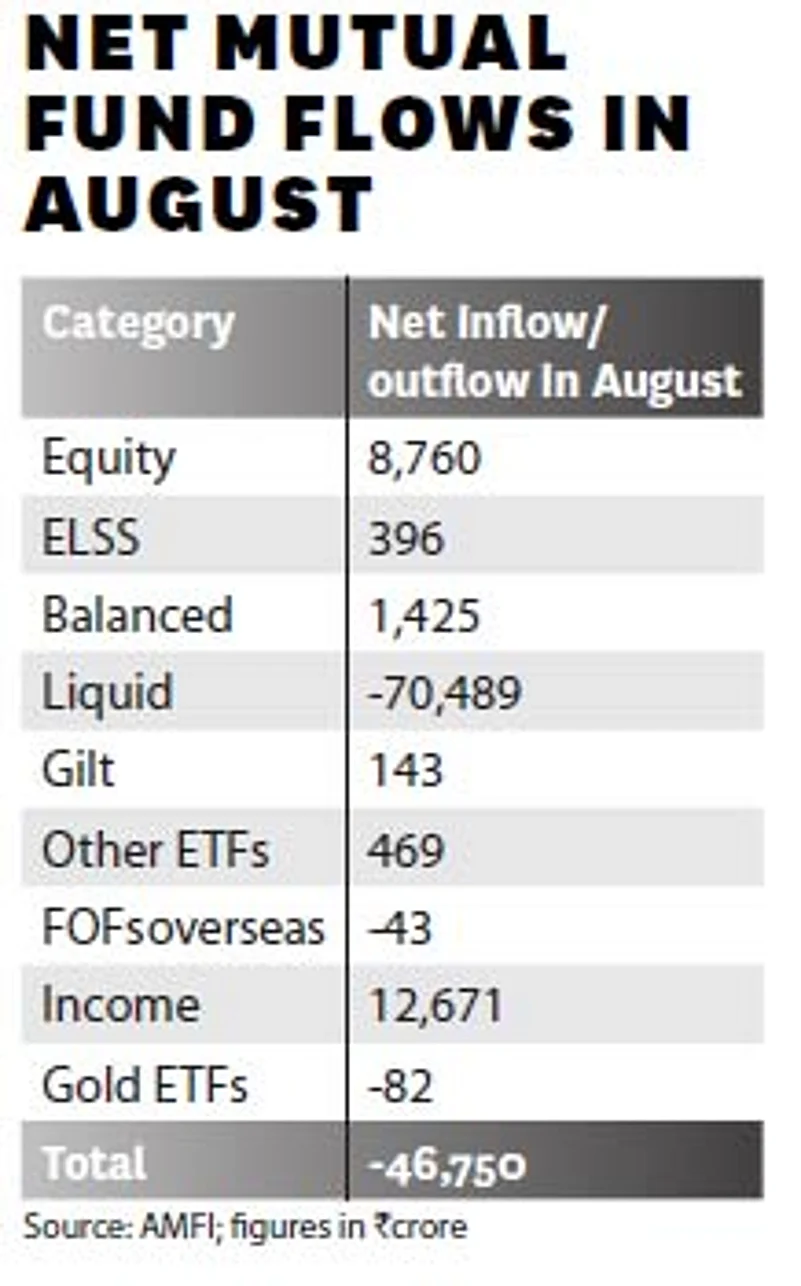

Going by available data, this time around, investors have used the opportunity posed by the falling markets to actually put in their money. Says Srikanth Meenakshi, cofounder, FundsIndia: “We witnessed a significant increase in SIP inflows on August 24 and on some other days, when the markets witnessed a fall.” Even the monthly AMFI data on net equity mutual fund flows indicates a net inflow, despite an overall outflow witnessed by the industry. Although there is opportunity to invest in the market, for those who are already investing precautions should be taken when it comes to benefiting from it.

According to Nitin Jain, President and CEO, Global Asset and Wealth Management, Edelweiss Capital: “For people who are looking for anything greater than 3-5 years, I think, it is a reasonably good time to selectively buy few stocks.” To use market dips to your advantage is an old adage, which, for a change, is actually being practiced. “I have been investing through SIPs for the past two years and have seen the advantage of systematic investments,” says 34-year-old Mumbai-based Pradeep Shankar. He is among the new breed of investors who have faith in the long-term prospects of investing in the stock markets.

“Investors should not panic and should stay invested in these market falls, and, in fact, can look at the corrections as ‘good buying opportunities’,” advises Sunil Subramaniam, CEO, Sundaram Mutual Fund. He further lays out his argument by stating that inflation is trending low, oil prices have fallen, commodity prices are easing and interest rates are expected to remain steady or fall over the next 12 to 18 months. The market fall in August was more to do with global factors than local factors.Wiser with experience Earlier, we would witness either an increase in calls by investors or the redemption would go up anytime the markets fell significantly,” says Meenakshi. This time around, his experience has been the opposite and he has had to warn some investors to reign in their excitement against buying more every time the market falls. Yes, market falls do offer opportunities but that does not mean one should blindly pick what comes their way. “Be selective is what I would advise. Look for value and stocks in the banking and housing finance space,” recommends Jain.

You should know that when it comes to equity investments, there is always something to worry about, things that would derail the market— correction, geopolitical risks, elections, profit margins, valuations, earnings shortfalls, economic growth, changing interest rates, or inflation. At this moment, the GDP growth seems to be intact and in high-single digits, and looks like it will remain so for some years. “Retail investors can continue to accumulate mutual fund units through the SIP route as the volatility can work in their favour,” says Subramaniam.

Use the available opportunity to relook at your existing portfolio and make any changes, if necessary. What is crucial for the growth of your investments is to stay invested in quality investments through bad and good times. And, if you are still a fence sitter, our advice is to start investing than wait for falling markets. Yes, in the short run, markets are impacted by global factors but in the medium to long run, there is nothing that takes away from the India story. To make the most of the opportunity, Simply Invest in Peace the SIP way.

The article first appeared in print in Outlook, September 2015