It is difficult to put a price to one’s life. But, for the sake of taking adequate life insurance one needs to exactly do so. The concept of putting a price to one’s life is known as the human life value (HLV), which is nothing but an estimate of the financial value of one’s life. Life insurers use this to arrive at the amount of insurance that a person should take, which is known as the sum assured in a life policy.

HLV as a concept was propounded by Prof. S. S. Huebner which had brought about a new economic philosophy of life insurance by linking one’s earning capability as the base to arrive at the sum assured against one’s life. There are various methods to arrive at HLV, such as income replacement and expense replacement, as well as one that thoroughly examines your financial life to arrive at the value of life.

Arriving at HLV

Though, it is not easy to estimate one’s economic worth, but over the years, one’s annual earnings is taken as a base to start. A very rudimentary method of arriving at the HLV is to arrive at what one earns post income tax, cost on self-maintenance and personal expenses that goes towards maintaining one’s family members. Finally, multiply the number of years one would work to provide for their dependents which should roughly be the HLV.

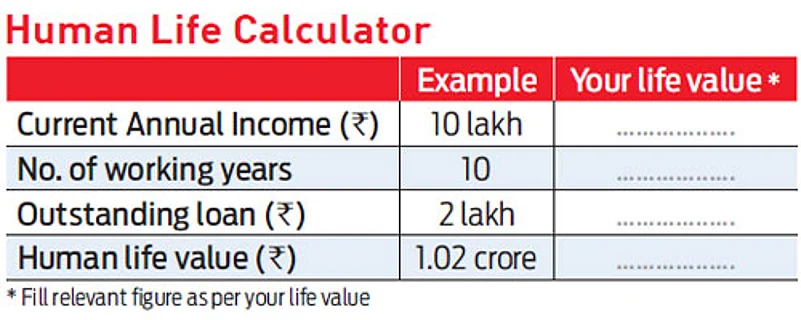

Let’s take an example – estimate your income each year until you expect to retire, at say 60 years. Ideally, this income stream should factor inflation. For the sake of simplicity, assume that the annual growth in income and inflation are the same. This way, the HLV is nothing but the annual income multiplied by the number of years till you turn 60. So, if you are 50 today, you need life insurance for the next 10 years, which means your insurance cover should be 10 times your current annual income.

However this is not a precise way of arriving at HLV, because it misses on the rise or fall in future earnings, rise in costs and the number of years one may be actually employed for. One way to be adequately insured is to review one’s life insurance cover once every few years so that one could bridge any gaps. This way, you would be near your life’s worth than be grossly under insured, which is a grave cause of concern for your financial dependents.