When it comes to life insurance most people are often confused, given the plethora of policies available— term insurance, Ulips, endowment, child plans, and more. The core of every life insurance policy is financial protection by insuring your life. Based on how the policy is structured, life insurance can be divided into traditional plans and unit-linked plans. For the longest time, traditional plans have been in vogue and these typically are comparatively risk-free when viewed along with unit-linked insurance plans or Ulips.

Traditional plans can be participating (with profit) or nonparticipating (without profit). Basically, in the with-profit traditional plan, the insurer shares with you the profit from investment made by that particular plan. The profit is added to your account every year in the form of bonuses. So, in the maturity benefit in with-profit plans is the basic sum insured plus the accrued bonus over the years. In the withoutprofit traditional plans, the death benefit or the maturity benefit is equal to the sum assured.

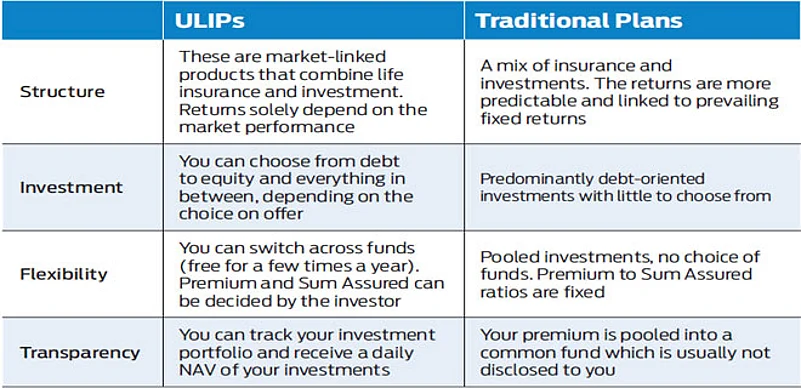

Given the reducing returns from fixed securities, the tilt in favour of Ulips over traditional plans has been gaining momentum. And, with Ulips being more transparent, it suits policyholders who can manage the investment component of such policies on their own as well. If you are looking to choose between the two, it is not an easy process, and Ulips will definitely be better for you if you know your risk profile and understand the nuances of investments and how to manage it to suit your changing insurance needs.