Insuring yourself and your assets is important. But, it is equally important that you maintain your policy details and keep them safe so that you can access them when you need them the most. From last month, insurers have introduced e-insurance accounts by which policyholders can now manage their policies online.

What you need to do is to open an e-account with an insurance repository which will help you buy as well as keep your insurance policy in the electronic form. The insurance regulator IRDAI has granted the insurance repository licenses to five entities—NSDL Database Management, Central Insurance Repository, SHCIL Projects, Karvy Insurance Repository and CAMS Repository Services to offer insurance repository services in India.

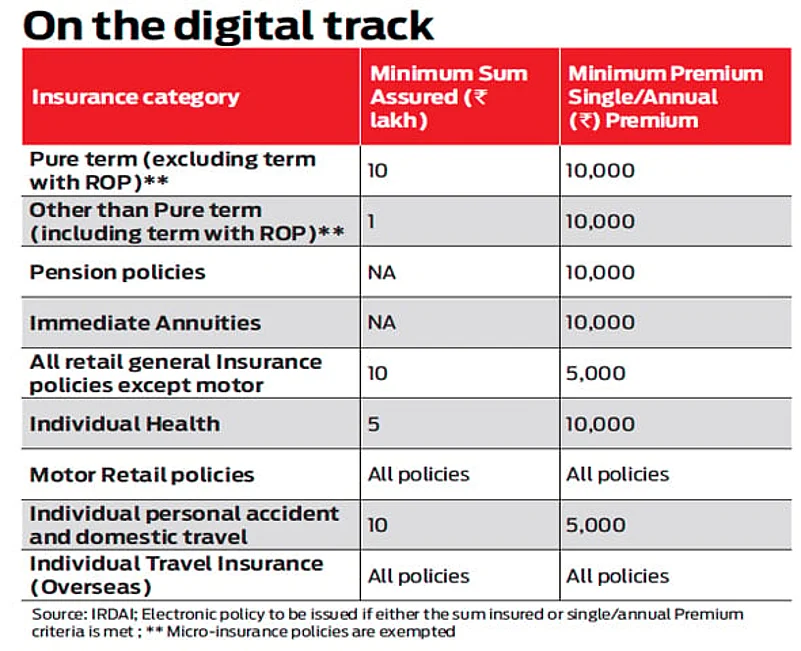

The move comes in after the IRDAI allowed dematerialising of policies in 2013 so that a policyholder may keep all the policies together in an e-insurance account. As a policyholder, you benefit from the e-insurance account as it will help you consolidate all your insurance policies like life, health, motor and other forms through a single account. However, for a start, only life policies can find a way into the e-account, with other types of policies finding a way later. At the moment e-insurance is available based on the cover you go in for or the premium that you pay for a policy (See: On the digital track).

The advantages of doing so include ruling out the possibility of misplacing your insurance policy. With an e-insurance, you need not fear losing your policy bond or other key documents as your policy will be stored digitally. Your nominees will need the original bond at the time of making a claim and dematerialisation is the surest way of safeguarding it. What more, you do not have to shell out any charges to open an e-insurance account and convert your policies into the digital form as insurance companies shoulder this burden currently.

You also have the benefit of not requiring any KYC in the future while buying another policy. This way, effecting any change to your personal and bank details, too, will be simpler—once carried out, they will reflect in all policies. Most importantly, this form of insurance allows you to appoint an authorised representative (AR)— a trusted individual who is aware of your insurance status. Even if your dependents are unaware of the policy’s existence, this individual can step in and guide them through the process.