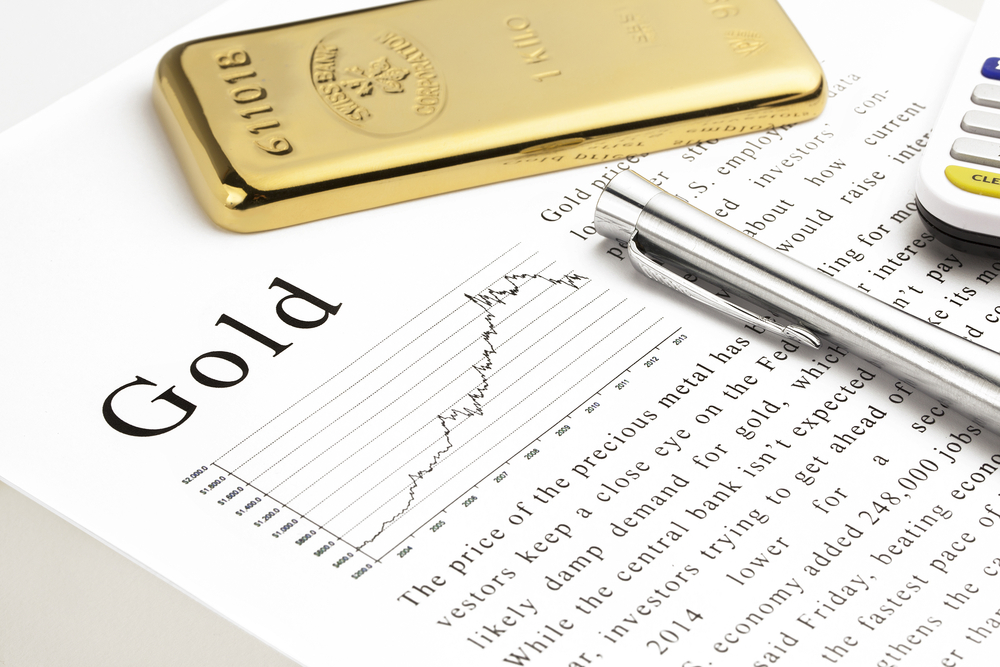

Mumbai, January 7: Gold, on COMEX, rose to six-year high, primarily on back of weakness in dollar index. Further, heightened geopolitical tensions between Iran and US attracted buying in the safe haven asset.

According to HDFC Securities, gold prices in the national capital hit an all-time high on Monday, (January 6) zooming up to Rs 720 to Rs 41,730 per 10 gram following a pick-up in safe-haven demand for the metal amid weak equities and bullish global trends.

On the other hand, silver also witnessed increased buying as it surged Rs 1,105 to Rs 49,430 per kg from Rs 48,325 per kg in the previous trade. Gold had in the previous trade closed at Rs 41,010 per 10 gram.

"Safe-haven demand continued in the precious metal with word of war between the US and Iran. Along with a weaker rupee, rise in international gold prices supported domestic gold prices to trade at life-time high level," shares Devarsh Vakil, Head (PCG-Advisory), HDFC Securities.

Within the global market, gold traded with gains at USD 1,575 per ounce and, likewise, silver also quoted a higher price at USD 18.34 per ounce.

Sharing his views on the issue, Navneet Damani, Head Research, Commodities & Currency, Motilal Oswal Financial Services says, “Apart from trade war related concerns, further updates on the US-Iran tensions will also be in focus, giving further direction to the precious metal pack. We continue to maintain our positive bias on gold, targeting the level Rs 42,700 followed by Rs 44,300 and maintain support at Rs 38,600. On COMEX, major resistance is at $1630 with the support of $1520 followed by $1435.

International gold prices at COMEX climbed as much as 2.3 per cent to $1,588.13 an ounce, the highest level since April 2013, and traded at $1,575 an ounce. Along with the other Asian currencies, the rupee traded with a loss of 25 paise amid higher crude oil prices.

In the morning trade, the rupee depreciated 31 paise to 72.11 weighed by the spike in crude oil prices, amid rising concerns over US-Iran tensions.

The Sensex crashed nearly 788 points on Monday as heightened tensions in the Middle East kept investors on the edge. The domestic market witnessed intense sell-off in line with global stocks after US President Donald Trump warned Iran of major retaliation if Tehran carries out any attack against America to avenge the assassination of commander Qassem Soleimani.

In December, trade war concerns had eased-off, despite which metals continued to gain. After a lot of ups and downs in trade talks, December turned out to be an overall positive month as both US and China made substantial progress with ‘Phase one’ deal talks. Dollar was weighed down against its major crosses after the two countries announced to agree on ‘Phase one’ that reduces some US tariffs in exchange for what US officials said, would be a big jump in Chinese purchases of American farm products and other goods. China has agreed to import at least $200 billion in additional US goods and services over the next two years on top of the amount it purchased in 2017. Apart from trade talks, other uncertainties like Brexit, Middle East and Hong Kong tensions are being keenly watched by investors.

(with inputs from Press Trust of India)