The year of digital money

Adoption to digital wallets in recent times is a sign of consumer maturity

The presumption that we are moving to a cashless society is passé. In 2015, Akodara, a small village in Sabarkantha district of Gujarat went cashless. It was possible for this nondescript village to go cashless because ICICI Bank adopted this village. Other factors like a mobile phone in each of the 200 households with about 1,000 people in the village which is primarily into farming and milk production helped this move. The only other place in India, where there is no exchange of cash is among the Sentinelese, who inhabit the Andamans.

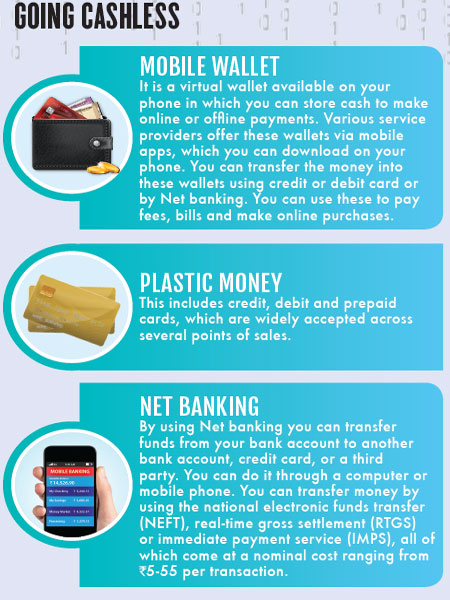

From time immemorial, money has played an important role in our lives. The way money is perceived has changed—barter economy to currency as we see it today. There are several problems with money as we see it today—it takes up space, is relatively hard to transfer from one person to another, and moves slowly through the financial system. Yes, money’s form has changed from notes to plastic to digital and what not, but its role is irreplaceable. The convenience of less cash has been well utilised by technology and today, that is what is driving us to adopt digital payments.

As much as we leapfrogged the telecom revolution by taking on to mobile phones like fish to water, we Indians have it in us to move from physical cash to digital cash. In fact, knowingly or not, a lot of the way we transact is now electronic or digital. Most people know their salaries have reached them when their mobiles ping. The adoption to digital wallets in recent times is again a sign of consumer maturity—they want friction free movement of money. The volume of money transfer by way of RTGS or IMPS and any of the other available options is an eye opener.

Tap or Swipe?

That is all it takes to move money and the first to realise its importance was the ubiquitous insurance industry. More than a decade ago, health and motor insurance, went the cashless way to settle claims. For those who remember; the move was predicted to be a failure from the start. Yet, ask anyone today to cough up the bill at the garage or the hospital and then raise a claim and chances are you will be considered a weirdo. Among the financial products, insurers—life, health and vehicle—demonstrated how digital payments could change the paradigm for consumers. Consumers, realised the cost benefit working to their favour made a quick shift.

Suddenly, it was cool to pay premiums online and to even look up for a policy online. In comparison, even among those who had internet banking, its usage was mostly restricted to checking the balance and statements. In comparison, people trawled the net suddenly got structured to suit a digital consumer, with lower pricing, which was in-line with the economic benefit of doing away with the intermediary. Several other financial products have over the years realised the benefits of going digital from investing in a wide range of instruments to paying taxes. In fact, tax filing has been online for some years now.

The diminishing role of physical currency is palpable among the millennial, who like everything else around them have taken to the digital way of life. That does not rule out the existence of cash. Cash will continue to play a role in our lives, even as we look at alternatives to it—a loaded e-wallet is nothing but cash in digital form. Digital money will play a larger role in our actions now because there is a concentrated effort by the government, industry players and us to make a shift and move to digital money.

Adopting technology is the prime mover, and simplifying the way one uses the digital world to transact is the clincher when it comes to successful transition of people to digital money.

Impact on your Money

All good things come with some limitations. A problem that we could face as we increase our dependencies on low cash and move towards digital is the possibility of moving to a much lower interest rate regime. Today, several bankers across the world have started to offer only online banking and mobile banking, with the physical bank nowhere to be seen. Closer home, several lenders are offering loans at differential rates based on the borrower’s social media trail. The same is the case when it comes to investments in mutual funds, which charge less for direct investors compared to those investing through an intermediary. The less-cash economy has already dealt a severe blow to the real estate industry, which has witnessed steep fall in prices and lower sales.

Financial trail by way of storing records in digilocker and maintaining electronic proof of savings, investments and even insurance will mean a natural extension to the way you keep money and transact. This year will be interesting as the new age payment banks and improved digital footprint by way of 4G services will make financial transactions witness a greater shift to digital platforms.

There will be a cost to technology and the naysayers will still argue that cash will always be king. There will also be data scare owing to our increased dependency on the digital way of life. There will also be concerns over privacy and frauds. But, the upside of all these concerns is that we will be more clued into how we earn, save, spend and invest money. To get you a flavour of things to come, we got several experts to share their views on the changes in banking, insurance, credit and stock markets and its impact. That could be your new year essential read. Happy New Year!