Benjamin Franklin, the founding father of the United States and also a traveller and an inventor, had famously said, “Beware of little expenses, a small leak will sink a great ship.” This holds true for any business and more so for a start-up. We all know that a majority of start-ups fail because they run out of funds. The longer a start-up survives, the more likely it is that it will succeed. “A start-up needs to survive a certain period to know what really works for it. If it survives, it can afford to make course corrections and get back on track. This makes it very important to manage expenses effectively so that it makes the most of the limited resources at its disposal,” says Arvind Pani, co-founder and CEO of Bengaluru based Reverie Language Technologies, a company that provides regional language capabilities to device manufacturers. Founded in November 2009 and having boots rapped till it raised funds a few months ago, Pani knows how important managing expenses are for a start-up. Siddharth Somaiya, 26, founder of Bao Haus Co, a takeout and delivery joint in south Mumbai, serving bao and internationally inspired pan-Asian street food, agrees. “As start-ups, we spend so much of our working capital towards promotional ideas and creating awareness about the brand in the initial phase that it makes it difficult to track expenses. This makes it even more important to focus on keeping a track of expenses and managing them properly. We take a look at how some start-ups are smartly managing their expenses.

Categorise major expenses

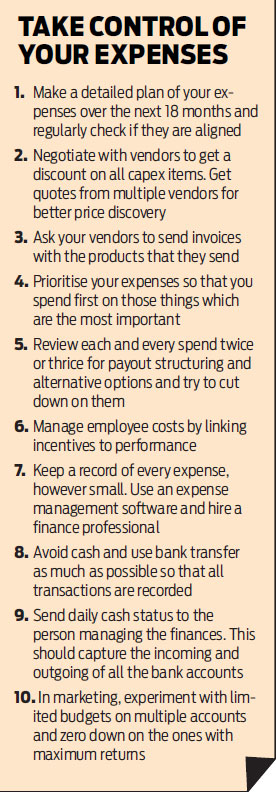

Expenses will vary from start-up to start-up, so it is important to first categorise the major heads for expenses. In case of Joybynature. com, a Delhi-based start-up which sells natural, organic and ayurvedic products online, the major expenses heads are marketing, technology and operations. While marketing spends happen on various online channels, technology spends are related to software and people needed to keep their services user friendly and efficient, and operation spends ensure that the customers have a smooth experience when talking over the phone or receiving products. Being a product company, Reverie Language Technologies incurs IT and software costs plus cost of office space and equipment. But 90 per cent of their expenses are payroll expenses related to engineering, R&D, marketing and sales. Once a start-up knows what its major expenses are, it can look more closely at them to ensure that the funds are being utilised in a proper manner and focus on those expenses that give them the money’s worth.

Expense management will broadly consist of two parts—tracking of expenses, which helps a start-up keep a record of all its expenses, and expense management which helps it manage expenses better.

Tracking expenses

This is achieved by a mix of tools, and professionals who can manage finances. Vista Rooms, an online branded accommodation aggregator, has an in-house team which looks into accounting and expense management, while they also use generic accounting software such as Tally. They are into the process of evaluating online expense management software like Happay and Zoho expense management. Zepo, an e-commerce platform founded in June 2011 that lets you sell and promote your products online, has hired a chartered accountant to keep its book of accounts. They manage their book of accounts in Tally and use Google Sheets for generating expense reports. Joybynature has developed an internal Management Information System (MIS) which allows them to track expenses closely.

Using expense management tools is recommended because they help save time and manage expenses more effectively. Hiring a professional to manage expenses is also necessary as it helps the founders focus on other aspects of running the business. Says Nitin Purswani, 26, founder, Zepo, “As an early stage start-up, we did not have funds to hire a professional financial analyst or get a CFO onboard. So, the first thing we did was to hire a CA who could not only just keep accounts, but also be able to understand our business in and out and advise on our finances, and work with us to analyse and optimise them. Consider your CA as one of the most important team members.” While tracking expenses, it is also important to file all the expenses no matter how small the amount. “We file all our bills no matter how small the amount is. I keep a small book wherein I track all daily expenses by just jotting them down. At the end of the month, it gets tallied,” says Somaiya. The sense of discipline has also stood Vista Rooms in good stead. Says co-founder, Pranav Maheswari, 27, “Track all payments and receipts from day one. Avoid using free cash as much as possible and transactions should be done via bank transfer as there would be a ready record available.” He also suggests that a daily cash status be sent out to the CFO which captures all the incomings and out comings of all the bank accounts.”

Smart expense management

Negotiate with vendors:

“We ensure that all capex items are strongly negotiated for and appropriate clauses included in MoUs with the providers to take into account quality and timeliness of delivery. For higher spend items, get a quotation from multiple vendors for better price discovery,” says Shailesh Mehta (42), CEO and co-founder, Joybynature.com. At Zepo, Puruswani believes that there is always a scope for reducing costs by up to 10 per cent either via vendor negotiations or by finding better vendors.

Prioritise expenses:

At a start-up, resources and cash are limited, so if there are 20 things that need to be done, figure out the one or two that are the most important as there might not be enough funds for everything. Sometimes this could be something you learn over time. “In marketing, experiment with a limited budget on multiple channels, and then zero down on the ones with maximum returns—follow this as a religion,” says Mehta.

Review expenses:

Reviewing your expenses on a regular basis is an important part of the expense management process. At Zepo, the last month’s financial books are analysed in the first week of next month, which helps them keep a tight grip over their expenses. “In case any expense has unusually increased, we get a chance to control it immediately. Also, every month, we pick up some expense heads and work towards reducing them,” says Puruswani. Mehta recommends keeping a very keen eye on spends and reviewing them twice or thrice in terms of payout structuring and alternate availability if the spend amount is over a certain value.”

Manage employee costs:

For companies like Reverie and Zepo, it is important to manage employee costs as payroll expenses are a major expenses head and a recurring cost. “We believe in giving incentives to our employees, so it is important how we structure the compensation. We have a fixed pay and link the incentives to performance, so that we keep monthly expenses within control,” says Pani. At POSist, restaurant management software launched in January 2012, the management knows that in case of employee welfare budget, it will never be enough if you give people too much freedom. It will also get cut often if it is left on management’s whims and fancies. So, to ensure it doesn’t happen that way, employee welfare fund is allocated as a percentage of the total salaries paid out, ensuring that they do not outspend per employee and yet spend the minimum required always.

Use what you learn:

If you are tracking and managing your expenses smartly, you can use your learnings not only to reduce expenses but also take major business decisions that could affect the course of your start-up. “Tracking expenses allows us to have a clear picture of funds available, which tells us when we need to change course, or adapt to the available fund situation. This results in spend optimisation, thereby reducing costs,” says Mehta. At Vista Rooms, expense tracking helps in planning better for any unforeseen and unavoidable expenses, get better returns on investments and easy and accurate reporting of expenses to all stakeholders. Funds are like food for your start-up. You can eat up too much or too little and either way it could harm your start-up.