Today, more number of people are taking to entrepreneurship because the cost of starting a business is lower than what it was before. That said every successful start-up makes its mark only after it has successfully identified or created an opportunity and implemented it. For instance, Michael Dell, founder, Dell, found the opportunity in doing away with middlemen and started his own company that dealt directly with customers and built individual specific computers. He soon turned his fledging startup into a multibillion-dollar enterprise. Closer to home, MakeMyTrip started offering online airline ticketing based on fare comparison and option, which practically rung the death knell for travel agents.

Unleash your ideas

Successful business ideas are often ahead of the curve and so, you need to focus on new trends and technologies. Today’s new breed of young entrepreneurs are also willing to take risks and find out if a new business opportunity can work out right for them.

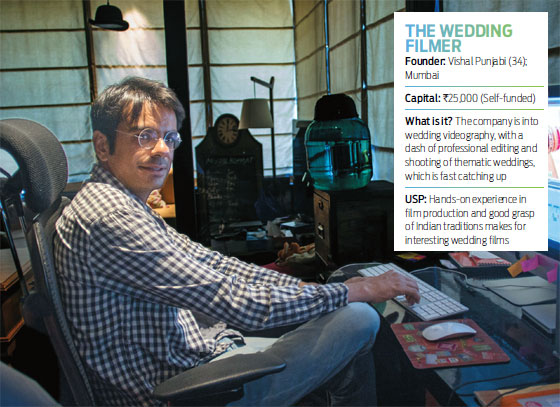

Take the instance of Vishal Punjabi, who gave a new paradigm to the concept of wedding videography and turned his venture, The Wedding Filmer, into a business worth investing in. He says: “Knowing and reaching out to the right market at the right time was the key to our success.” He plans to scale up his business now.

Likewise, sports and lifestyle footwear is a very crowded market; yet, Aayushi Kishore found her calling and launched Globalite Sport with her father, a veteran in the Indian footwear industry. She says: “We saw an opportunity to produce affordable footwear, which could compete with the big brands. Now, we sell about 7,000 pairs of footwear online every day.”

Coming up with great ideas is not easy, but it is more difficult is to put them into action. Most great ideas fail if they are not executed properly. To turn your dreams into reality, you need to take the right first steps.

For instance, after discovering a huge potential for e-learning in India, IT professionals Diwakar Chittora and Shilpi Jain, both 32, started Intellipaat.com in 2011.

For instance, after discovering a huge potential for e-learning in India, IT professionals Diwakar Chittora and Shilpi Jain, both 32, started Intellipaat.com in 2011.

Says Diwakar: “After developing the idea, it was imperative that we built and implemented an efficient business model. We assessed the company’s mission and vision and assembled an effective team comprising the best of the industry professionals, who have numerous accolades in their respective fields.”

The duo started with just Rs.50, 000 as the initial capital and broke even within the first month itself. With robust planning and thorough market research, they are now profitable, have substantial operations funding, and are open to investor interest.

Incubating ideas

You don’t need a garage or a campus incubator to start operations. These days, several entities, such as Jaarvis Accelerator, nurture start-ups in their early stages. EduRev, a start-up in the online education space, started by two Chandigarh-based youngsters Kunaal Satija and Hardik Dhamija, is among those newly-launched start-ups being mentored by Jaarvis Accelerator. Says Satija, founder, EduRev: “We needed money, but, we also needed talent and support, which could not have been done on our own. Jaarvis is playing the exact role of an accelerator, from funds to advice and execution. To summarise it, EduRev and Jaarvis together is the perfect recipe for growth and success.”

Besides a place, one also needs capital to launch a business. Typically, raising money from friends and family can be easier and less complicated than from professional investors, such as venture capitalists (VCs) and private equity funds. Professionals are more likely to inspect every comma and semicolon in your business plan as well as claim a high return on investment.

Says Tushar Srivastava, co-founder, Nurturey, a start-up which offers ‘digital tools’ to support parental needs: “I would strongly recommend bootstrapping in the early stages. It’s difficult to find any external investor and, even if you do, they will take a huge equity. Most entrepreneurs don’t realise that it takes several rounds of funding before they build a successful business. External funding could lead to equity dilution.”

A start-up budget is a crucial element of validating your business idea. And while taking a few risks during the launch is a great strategy, maintaining a budget is just as vital. Prior to launching your services in multiple areas, pilot it into clusters to understand the working capital and ancillary costs better before expanding.

Says Pratish Sanghvi, co-founder, Grab, a delivery service for restaurants: “From inception, Grab was built with the mindset that unit economies should always be validated and hence, within five months of business, we were profitable. The major portion of our investment, apart from the set-up, was going to be towards technology, which was not very difficult to gauge.”

For Intellipaat, investing heavily in the key areas was important. Says Diwakar Chittora, founder and CEO, Intellipaat.com: “Intellipaat has been self-funded and fiscally independent from the day of its inception. Our main areas of investment have always been quality product, support and personnel acquisition.”

Running out of funds is one of the worst repercussions. Having an emergency fund is the best way to tide over unexpected expenses. So, one should maintain running expenses of at least six months to a year to remain afloat. Says Punjabi: “Recently, it came to our attention that our official email account was being hacked by a shady company. It cost our business six months worth of work. The only reason we managed to stay afloat was by dipping into our emergency funds.”

Nurturing ventures

While entrepreneurs are thriving across small and big towns in India, the people and platforms that support them are increasing as well.

While entrepreneurs are thriving across small and big towns in India, the people and platforms that support them are increasing as well.

Adds Chittora: “On an average, 2-3 events are organised in the major cities where entrepreneurs can present their ideas to venture capitalists. This was not the case even five years ago.”

Today, there are various platforms and entities, such as incubators, accelerators and start-up events which are geared towards speeding up the growth and success of start-ups. They are often a good path for an entrepreneur to build a customer-centric proposition and scale up quickly. Most incubators like StartupVillage and Jaarvis have their own in-house seed fund and provide shared office space and networking opportunities. Moreover, service tax exemption up to Rs.50 lakh a year is also available for government-approved incubators.

The few organisations mentioned here are effective because they are able to take on a limited financial risk by diffusing minor sums across a better number of investments, such as testing ideas, markets, and building teams or strategies.

Entrepreneurs, particularly those in their early stages of starting up, should understand what else an investor can offer, besides hard cash. Taking money from the right investor at the right time can quite literally mean the difference between success and failure, and ensure the survival of your entrepreneurship.