Like most average Indians, Mumbai-based Gaurav Goil had taken a home loan to fulfil the desire to own his own house earlier this year in March. He took a loan of about Rs 50 lakh from Bank of India at 9.6 per cent. A 20-year loan can be a daunting task to service for anyone and Gaurav was looking for ways to reduce the loan burden by looking at various options. Considering lower rate loans that are available with other institutions, the natural inclination was to scout if someone would transfer his loan at a lower rate.

He was able to do so by moving to SBI Maxgain which was available at 9.4 per cent rate. The move saved Gaurav Rs 4 lakh just on the transfer, and not to forget the reduction in the loan tenure from 20 years to 15 years. The move also helped Gaurav to focus on his other financial goals for his 7-year-old daughter and 2-year-old son and his wife. “The switch was very handy and it leaves me with more money in hand to work on my goals to create a corpus for my children’s educational needs,” he says.

The top priority for Gaurav is to take care of his family’s expenses and protecting them against uncertainties with adequate insurance—life and health. He also wants to foreclose the loan earlier if possible, besides saving for his retirement and children’s future. He is doing so by investing in mutual funds for a decade now as he feels it not only earns him better returns but also beats inflation. He wants to invest in a second property too as an investment because he believes that it has a good chance of capital appreciation to take care of his children’s future financial needs.

A plan to act on

Gaurav should recheck his insurance cover and ensure that he has a term plan to match his outstanding loan for the tenure of his loan. Being the sole earning member, he should make sure that his family has the right financial cushion in case of an emergency. Likewise, he should not leave healthcare to chance or employer and take an adequate health insurance for self and family members. The financial impact of a few days of hospitalisation can badly impact investments on other financial goals.

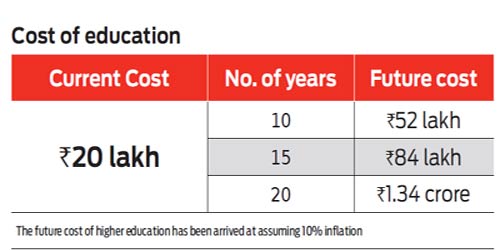

Focus on saving for children as education-related inflation goes up at a faster pace than the inflation that we factor in for other things in life. For instance, if your daughter decides to pursue medicine, which currently costs about Rs 20 lakh, you will need to have a corpus of Rs 43 lakh 10 years from now taking 8 per cent inflation when she is about to enter college. To achieve this goal, you will need to save Rs 21,000 each month earning an annualised 12 per cent return. The numbers would vary if inflation goes up or the returns go down. Make sure to be on course with inflation and returns when you invest for your children’s future as that is one goal where you cannot change the dates.

You are already investing in mutual funds and hence understand the benefits of doing so. Follow the same route when it comes to building a corpus for your retirement to lead a financially comfortable life in retirement.

The Switching Process

STEP 1 : Check for lenders with lower rate. The cost benefit analysis should indicate the money you would save. Check with your lender if they will reduce before approaching others.

STEP 2 : You will need an NOC from your lender along with a foreclosure letter, payment history and list of documents before applying to a new lender

STEP 3 : Post submission of documents, the new lender will do extensive checks before approving the transfer

STEP 4 : The process can now be initiated between the two institutions.