While most of us survived the tough days of cash crunch during demonetisation using our plastic cards and digital wallets, the ones who suffered the most were the informal sector workers who accept most of their payments in cash. Without a basic savings account in the bank, most of them use the piggy bank approach to savings which often lands them in sticky situations where their money lies idle, also losing its value over time due to inflation.

For most individuals who employ domestic help at their homes, helping them in times of need rarely goes beyond paying salaries in advance, lending money in times of need or paying their children’s school fees.

Taking the lead

While such acts are commendable, Mumbai residents Priya Nair-Malviya and Garima Devrani have gone a step further to truly transform the lives of people they employ at their homes.

Consider the precarious financial situation of Sangeeta Jadhav, who has been employed with Malviya for over 15 years. Jadhav’s goal of educating her daughter prompted Malviya to recommend buying a traditional money-back life insurance policy entailing an annual premium of Rs 12,000. “She was very keen that her children should study. Her youngest child is a girl. I thought the corpus will come in handy when she passes her 10th standard exams. Last year, she received one moneyback payout, which we advised her to invest in a fixed deposit. We are also encouraging her to buy a house by obtaining a loan,” says Malviya. Malviya, who runs her business of baking cakes and pastries from home, has now inducted Jadhav into this business to help her enhance her income.

Oral and maxillofacial surgeon Dr Garima Devrani has made educating her employees on the benefits of financial literacy her mission. She has ensured that all her employees are covered under the Pradhan Mantri Jeevan Jyoti BimaYojana (PMJJBY), she is also funding her driver’s health insurance premium. “I have advised them to pay premiums even if they switch to another employer,” she explains. She has also helped her domestic help, 30-yearold Vanita Patil, open an account under Sukanya Samriddhi Yojana and invest towards her daughter’s education. Dr Devrani has paid the initial deposit and gets her to invest at least a month’s salary in this account every year. “Often, they are reluctant to visit bank branches and approach officials. Helping them open bank accounts is a responsibility that employers should take on,” reckons Devrani.

Towards a financially inclusive society

To start with, you can help them with documentation to open bank accounts. It will also help them obtain loans from banks rather than borrowing from money-lenders at an exorbitant rate of interest.

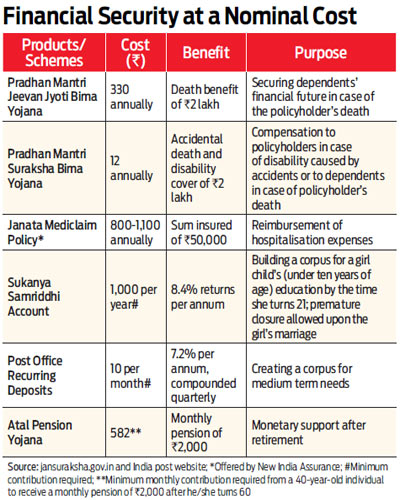

Getting them enrolled under PMJJBY and Pradhan Mantri Suraksha Bima Yojana (PMSBY) and paying the nominal premiums (Rs 330 and Rs 12 respectively) every year will ensure that they are insured against risks to life. Often, individuals in the economically weaker sections see their savings get wiped out due to illnesses in family. While a government-supported health scheme on the lines of PMJJBY and PMSBY is yet to be rolled out, you can opt for health insurance policies from general insurers. “Being a doctor, I understand the importance of health insurance. For a small amount, you can insulate your employees against medical emergencies. For an annual premium of Rs 3,000, I have purchased a health cover of Rs 1 lakh for my driver,” she suggests. Likewise, facilitating opening of accounts under Sukanya Samriddhi Yojana and Atal Pension Yojana can secure your household help’s retirement and their children’s future. Government-backed schemes are not the only options available, you can explore the alternatives offered by private players as well.

“During occasions like Diwali, you can offer to direct the bonus into a fixed deposit rather than handing out cash,” suggests financial planner Pankaj Mathpal, CEO, Optima Money Managers. “Some employers, though well-meaning, end up getting their domestic help or drivers to invest in equity mutual funds through SIPs,” says Mathpal. While it helps create wealth over the long-term, you must realise that individuals in the economically weaker sections may not have the capacity to take risks and stomach volatility in the near term. “Educating them about financial products is something that every employer should aim to do,” says Mathpal.

Philanthropy apart, these actions could prove to be beneficial for you too. In a space where the attrition rate is high, your support could help you earn your employees’ loyalty and long-term commitment. This is your chance to push your helpers up in the socio-economic ladder. Money does not discriminate. When it comes to money, the only real divide is just whether you have it or not.