Warren Buffet said, ‘You know that retirement is coming. It isn’t as though it just shows up one day and takes you by surprise, so you need to get ready for it’ and he couldn’t be more right. One retires from work to be able to enjoy the latter part of life. However, it’s not always rainbows and butterflies. No wonder retirement connotes a new chapter in your life; a new beginning that brings new freedom and opportunities to enjoy the undiscovered parts of life but what we often tend to forget is that it could also bring with itself unforeseen hurdles and doubts if not planned properly.

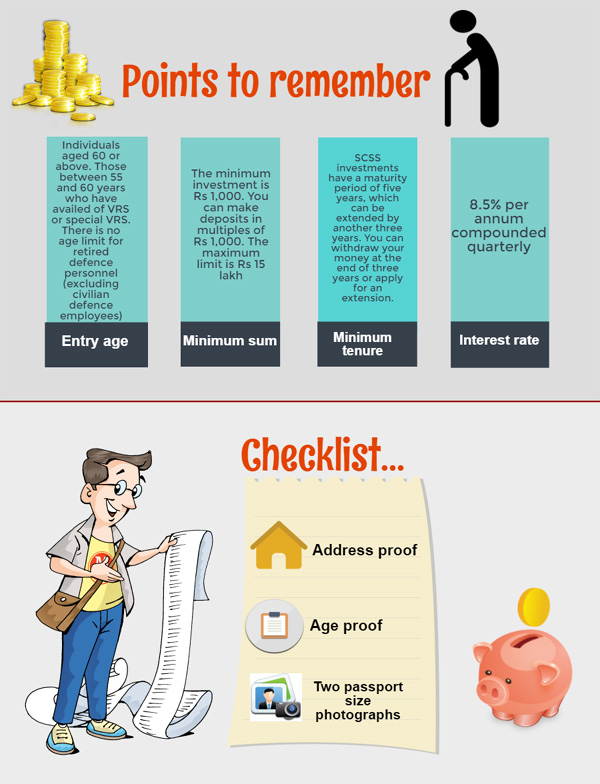

While there are numerous financial instruments that are tailored towards retirement, Senior Citizens Savings Scheme (SCSS) is one that offers you a complete package with assured returns, safety of capital, regular payouts and also offers tax benefits under Section 80C of the income tax act. SCSS is a fixed deposit scheme that gives senior citizens assured returns at regular intervals. According to this scheme, a senior citizen can invest a lump sum amount and earn interest on a quarterly basis.

At the end of the maturity period of five years, the investor gets back the original investment. For example, if you invest Rs 1 lakh at an interest rate of 8.6% for five years, then every quarter you would receive Rs 2150 with a maturity amount of Rs 1,43,000.If you're senior citizen looking for a regular, stable stream of income after retirement, this scheme is a good option.