The stock markets are a shifting kaleidoscope of ups and downs and are often difficult to peg down. Having said that, equity markets offer investors myriad opportunities to preserve and grow their wealth which come in various shapes and sizes. However, in investing, size does matter. In equity market parlance the size of a company is synonymous with its market capitalisation. According to SEBI guidelines, the top 100 companies in terms of market capitalisation are categorised as large cap companies. The next 150 are categorised as midcap companies and the 251st company and below are categorised as small cap ones. It is important to be cognizant of this because investing in a company of a certain size brings with it unique opportunities and risks. The advantages and drawbacks of large-cap investments are different from that of small and midcap investments. Consequently, the value that each of these investments add to a portfolio is differentiated and unique. According to Vinay Khattar, Head, Edelweiss Investment Research, “The investment environment is challenging and is peppered with constant volatility. Investors should stick to safety and continue looking for value. After the recent sell-off, value is beginning to emerge in select large cap stocks, especially in the private banking and IT sectors.”

The Ongoing Debate: Large Caps or Mid and Small Caps?

Large cap stocks generally belong to well-established companies that have a strong market presence. According to Nitin Bhasin, Head of Research at Ambit Capital, “Quality is back in flavour and so are large caps.”

Mid cap companies on the other hand, are generally those that are up and coming, and are expected to both grow and increase profits, market share and productivity. They are usually in the middle of their growth stage, which, lends them higher risk but also increases their profit potential.

There are various factors that differentiate large cap stocks from their mid and small-cap counterparts, and contribute to their relative benefits.

Large cap companies are generally well-reputed organisations that have been operating for an extended period of time and have seen multiple business cycles. Consequently, they offer investors more stability compared to mid and small cap companies which are in the process of establishing themselves and building credibility. “In the current environment, everybody is sheltering into large-cap investments” believes Anirudh Taparia, Executive Director, IIFL Investment Managers.

Large cap companies are better positioned to ride the volatility of business and economic cycles and are less likely to get affected by extreme circumstances in the economys. Thus, the biggest advantage of large cap companies is the stability they are expected to provide to an investor’s portfolio. Their mid and small cap counterparts are not able to provide a similar kind of stability since their own profitability and longevity is uncertain.

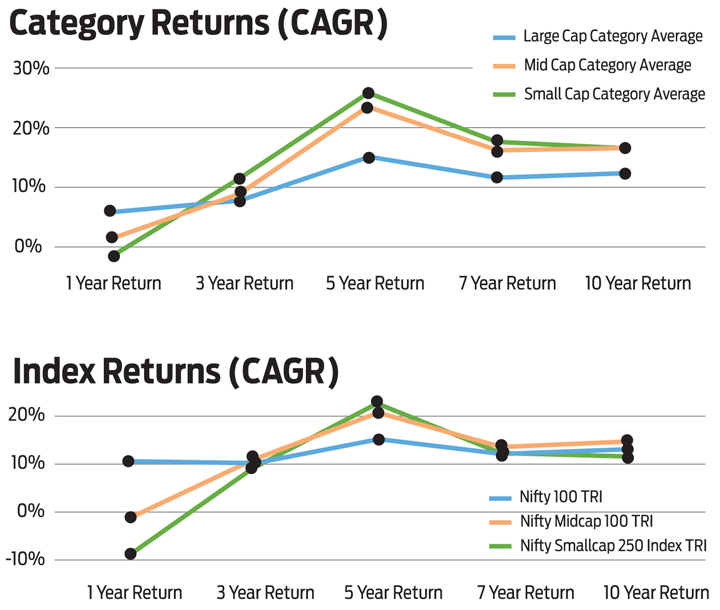

However, since these stocks are mostly on top of their game, they provide little or no opportunity for aggressive growth. Share price appreciation prospects for large cap stocks are limited considering that they are past their aggressive growth years. Mid cap stocks on the other hand offer greater growth potential relative to large cap stocks. According to Vidya Bala, FundsIndia Head of MF Research, “Over a 5-year period, the Nifty Midcap 100’s return of 19.4 per cent annualised is far ahead of the Nifty 50 return of 13 per cent. In other words, mid caps’ ability to generate superior returns in the long term is undebatable. Hence, the question is how to reduce downsides arising from midcaps in the short-term and yet build long term wealth.” Companies that belong to the mid and small cap segment are generally in the early to mid-cycle of their growth with many of them standing at the cusp of exponential growth. Sharing his insights, Prakash Gagdani, CEO, 5paisa.com

says, “Generally, the trajectory for mid and small cap stocks is steep. They go up very fast and go down equally fast. Often, when such sharp and deep movements happen, investors find it difficult to make rational decisions. They either end up selling their investments or resort to rupee cost averaging. Hence, they are not able to reap the true benefits of such stocks.”

Large cap companies tend to provide stability through a slow but gradual growth in capital appreciation. They are not really known to provide high growth rates since they are already well established. However, a big benefit of being well established is that these companies can share their earnings with investors through dividend payouts. Unlike the mid cap ones, which need to plough back their profits in order to grow, large cap companies can give out profits by way of dividends. These dividends can show impressive accumulated returns in the long term wealth creation process. In the words of Khattar, “Investors should adopt a balanced approach. Stay anchored to large-cap investments and look to mid cap stocks for alpha.”

Availability of data can be both, a boon as well as a bane. In case of large cap companies, data with respect to their performance, growth, future plans etc is easily available. This ensures that there is little to no information asymmetry and that analysts/investors can study the company in detail to arrive at an informed investment decision. However, the ubiquity of data also means that there is very little room for superior stock picking. Mid cap stocks on the other hand, tend to trade under the radar. Small and mid cap companies tend to be less researched and therefore there might be a valuation gap between its current market price and its fair value.

Quality of management and business is one of the key parameters that investors consider while making investment decisions. Large companies usually have good quality management that have proven their metal by making good decisions, delivering performance and growing their business. Corporate governance continues to be a big issue for small and mid cap companies.

Many large cap companies represent diversified businesses, established over a relatively long period of time. This makes them less vulnerable to market changes and provides instant diversification. Small and mid cap companies often operate in a niche due to which they are unable to give similar diversification benefits. However, if they succeed in the niche that they are operate in, then the gains can be manifold.

Large cap stocks are widely held and hence have higher liquidity. This means that they are relatively easy to get in and out of as the impact cost of such trades is not very high. Small and mid cap stocks on the other hand are not widely held and hence the impact cost of trading such stocks is very high. As Taparia puts it, “Due to lower liquidity in this segment, the impact cost of trade is higher which further exacerbates the fall in the stocks”.

What Is The Macro-Economic Environment Telling Us?

Investing decisions should always be made taking into consideration one’s risk/returns requirements and investment time horizon. Additionally, one should also pay heed to the macro-economic and investment climate to ensure judicious allocation of investments “The Indian markets have been in a structural bull run since 2014. This is expected to continue for the next decade. However, the bull run will not be linear in nature and we will see periods of consolidation and volatility”, feels Taparia.

The Indian economy and its stock markets are currently facing both external and internal headwinds. “Central banks are now less accommodative as growth in developed markets is firming up. Consequently, we are seeing an environment of rising rates and tighter liquidity. In general, risk taking seems to have reduced”, says Anand Radhakrishnan, Chief Investments Officers (Equities) at Franklin Templeton Asset Management. The ongoing spat between US and China over trade is making investors vary and raising concerns of an all-out trade war. Worldwide, investors are concerned on the impact this could have on global trade and growth. During June 2018, US President Donald Trump imposed a 25 per cent duty on Chinese imports worth $50 billion after accusing China of stealing intellectual property. The Chinese were quick to respond with tariffs of their own on $35 billion of US imports. Overall, this game of outfoxing did not augur well for stock markets in Asia. Additionally, the Government of India has reportedly increased import duties on some agricultural and steel products that are imported from the US in retaliation to Washington’s new global tariffs on steel and aluminium. The revised tariff is expected to come into effect from 4 August, 2018.

Political uncertainty at home is making markets choppy and adding to investors’ caution. The recent no-confidence motion tabled by the opposition in the ongoing monsoon session of the parliament, inspires little confidence and further endorses the view that political instability will continue to have an impact on market sentiment. Add to that, key state elections later this year and then the general elections next year, will give a further fillip to political risks. “We expect the market volatility to remain over the next few months and quarters due to the busy political calendar (state elections) towards the end of the year as well as the news and sentiments leading up to the general elections will keep the markets on their toes. The market is bound to swing to developments and new flows emanating from this political arena”, shares Prasanth Prabhakaran, Senior President & CEO, YES Securities (India).

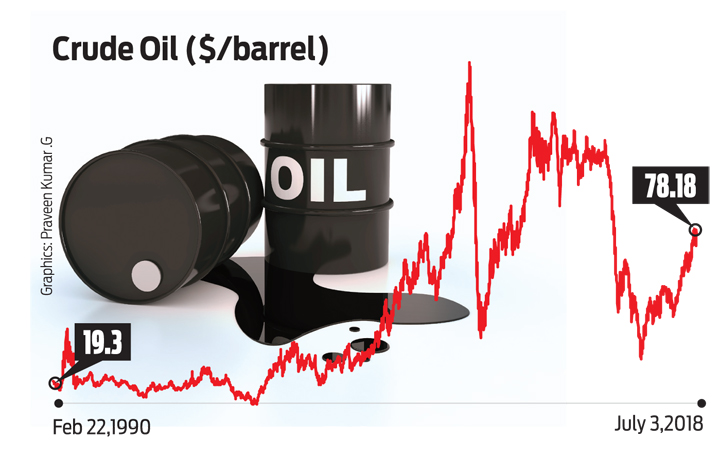

Crude oil prices continue to trade at elevated levels and offer little respite in terms of stability. Crude at current levels will drive a steep increase in petroleum imports, impacting the current account deficit as well as inflation. “Crude oil prices need to stabilise for markets to experience sustained strength”, says Khattar. Weakness in the India Rupee further exacerbates the countries woes and has a negative impact on stock markets.

Overall, the investment environment is uncertain and one in which investors should tread cautiously. “In such an environment, investors could consider multi cap or large and mid cap funds, which look to provide necessary stability and generate potentially good returns”, advises Radhakrishnan.

What Are The Markets Indicating?

“The market rally in CY17 was characterized by poor quality stocks delivering strong returns. Similarly, a combination of huge liquidity surge and an improving macro resulted in increased investor risk appetite for small/mid caps. This led to healthy outperformance for small/mid caps in CY17. For instance, whilst BSE Sensex index delivered 28 per cent returns in CY17, BSE Mid-cap and BSE Small-cap indices delivered 48 per cent and 60 per cent returns respectively. Note however that since the beginning of this year small/mid caps have seen fair bit of correction (and continue to do so) as the euphoria around Indian equities started fizzling out and as broader market valuations started to normalize”, shares Bhasin.

Markets are likely to be volatile in the coming 12-18 months. In such a scenario, the question on top of every investor’s mind is - Should I invest in small and mid cap funds or large cap funds?

Way Forward For Investors

The answer depends on an investor’s risk appetite, investment objectives and investment horizon. “While taking into consideration an investor’s risk appetite and time horizon, we would recommend investors to look at large cap investments. Investors should have more exposure to large cap investments and look for good value in mid cap investments”, advises Taparia. He further adds, “We see value in select domestic consumption plays, private banks and NBFCs.”

Small and mid cap investments should form a part of an investor’s investment portfolio, since in the long term, they have potential to generate alpha. According to Radhakrishnan “Mid and Small Cap valuations are now normal and hence investors should also consider taking a strategic exposure to unique businesses that have the tenacity to weather more volatile environments”. He suggests, “In such an environment, investors could consider multi-cap or large and midcap funds for investing”.

Stock or fund selection is not an easy task in the best of the markets. While one should have a sufficiently long time horizon for investing in any equity asset, as far as small and midcap funds are concerned, one should look at a time horizon of atleast five to eight years. Jimeet Modi, Founder and CEO, SAMCO Securities opines “When looking at investment opportunities, investors should look for stocks that offer 15-25 per cent growth potential and are available at the lower band of their historical valuation”.

Questions To Ask While Choosing An Investment

- What is the value being generated?

- What is the margin of safety?

- How large can the future opportunity be?”

While selecting a fund for investment, investors need to be more judicious when it comes to selection for mid and small cap funds. This largely due to two reasons. Firstly, the universe of large cap companies is smaller than small and midcap stocks. Secondly, small and midcap stocks are under-researched compared to large cap stocks. Therefore, the stock selection capability of the fund manager is more important, from the perspective of long-term returns in a midcap fund relative to a large cap fund. “In the current market scenario, exposure to large cap investments should be higher. Investors can opt to invest in equity diversified or large cap funds which can potentially provide more stable returns. Retail investors should approach markets judiciously, through the SIP route”, advises Gagdani.

Investor Wins

While the jury is still out on this one, the general sentiment is leaning towards the stability that large-cap investments provide coupled with strategic exposure to mid and small cap investments. Bala suggests, “There is no need for investors to skew their portfolio towards large-cap stocks or largecap funds. The Nifty 50 1-year return of 10.7 per cent as opposed to the -2per cent fall in the Nifty Midcap 100 index appears to suggest that investors should stay with largecap stocks. However, it can also imply that quality midcap stocks are currently available at lower prices.” She further adds, “Instead of trying to time market-cap segments, it makes more sense to build a core portfolio with a mix of large and midcap stocks, where one does not have to keep rejigging large and midcap exposure.”

In the stock markets, there really is no one size fits all philosophy. At the end of the day, investors should invest in companies or funds that are capable of meeting their risk/return needs within the desired time frame. As Modi succinctly sums it up, “The idea should always be to buy great businesses at reasonable prices. It is time to buy large cap stocks that have been beaten down to midcap prices”.

The author is a CFA - Strategic Consultant in Financial Markets