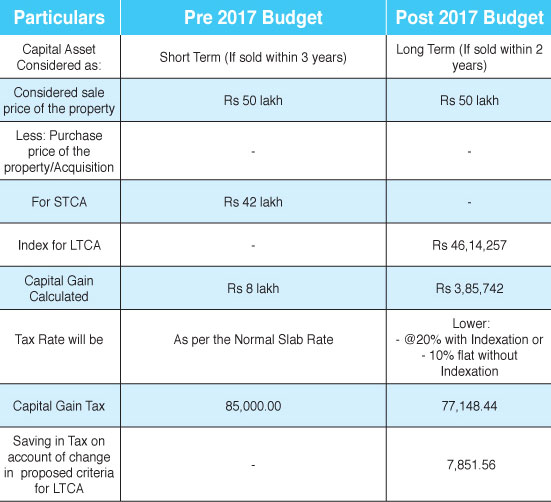

If you are planning to sell a house, well there is good reason to cheer. The holding period for capital gains on sale of immovable property i.e. land and building to qualify as long term capital gains (LTCG) is proposed to be reduced to 2 years from 3 years. Courtesy the Union budget 2017, also the base year for calculation of such capital gains with indexation benefit is also proposed to be shifted from 1981 to 2001.

These steps are expected to reduce the capital gains tax burden on property sellers and thereby make movement of immovable capital easier. At present the capital gains on land and building to qualify as long term capital gain has holding period of minimum 3 years. If a property is sold within three years of buying (acquiring) it, any profit from the transaction is treated as a short-term capital gain in the hands of the individual.

This is added to the total income of the owner and taxed according to the slab rate applicable to him. Indexation takes into account the impact of inflation during the holding period and accordingly adjusts the purchase price, thereby reducing the tax burden for the seller. Also the owner can claim various exemptions in case of long-term capital gains, but no such benefit is provided for short-term gains.

With above example you are 9.2 per cent effective savings on sale of immovable property after 2 years of purchase for seller. Hence this would aim at encouraging the sellers to disclose the correct sale price.