Compounding is referred to as earning interest on interest. Assume that you invest Rs 5000 for 10 years at a 12 per cent interest rate. At the end of year 1, you will earn Rs 600. This will grow your invested amount to Rs 5600. At the end of year 2, you will earn Rs 672 which will raise your invested amount to Rs 6272. This will go on and on. At the end of the tenth year, you will earn Rs 1664, and while your initial investment of Rs 5000 would grow to Rs 15,530.

Thus, compounding is a continuous process in which returns are generated on the returns until the time your money remains invested.

How to gain from compounding?

You all must be wondering when should you start investing? Is it when you get your first pocket money or when you get a job or when you get married? Well, the simple answer to this question is to start investing as early as you can.

Start early, start young

With early investing comes the power of the scarcest resource which cannot be bought, which is time. With time and the power of compounding, you can create wealth.

Here’s an interesting story: Warren Buffet is widely known as one of the successful investors, who had started investing just at the age of 11. He bought his first stock at 11 and at the age of 15 he had a net worth of $6000 which is quite impressive. Taking motivation from this story, everyone should start investing early to reap the benefits. One of the important reasons to start investing early is the power of compounding.

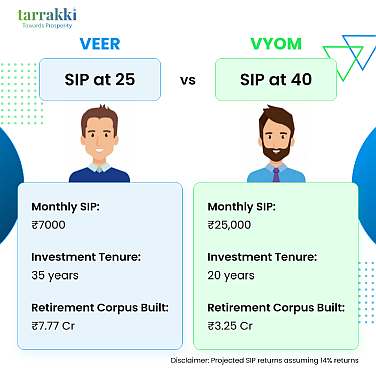

In the image below, we can see that Veer has started investing early whereas Vyom started investing 15 years after Veer started. As seen in the image, Veer is generating returns on the initial returns, because of power of compounding. This means that Veer got a head start which is hard to beat – accumulating Rs 7.77 crores versus Rs 3.25 crores starting 15 years later. In spite of Vyom investing more than 3 times of Veer, he still couldn’t catch up.

One of the important reasons to start investing early is power of compounding.

Lumpsum or SIP – What to choose?

The power of compounding is more amplified in SIP investing vs Lumpsum. This is mainly because of:

Disciplined investing approach- The investor must make periodic investments rather than investing all at once. This is called disciplined investing. Being regular in investing, would pay off in the future with the benefit of compounding.

Patience is a virtue.

Lots of investors want quick returns. Chasing quick returns is not the right strategy to pick. Long term investing is. Power of compounding works well for long term investing. Patience plays a crucial role while investing for long term. Only with patience, the investor can reap the benefit of compounding.

Rupee cost averaging approach

One of the strategies that gives good returns is “buy when the markets are low and sell when the markets are high.” But how can one know when the markets have hit the lowest point? This is where rupee cost averaging approach plays an important role.

To understand rupee cost averaging approach, assume that you are investing Rs 5000 every month, starting the month of June for 6 months, in an equity mutual fund scheme. Due to high volatility present in equity mutual funds, NAV (Net Asset Value) keeps on fluctuating. There is a very low chance that you will be able to invest at the same NAV every month. Look at the illustration in the table below to understand the concept better:

Month |

NAV (Net Asset Value)

No. Of units (Rs 5000/ NAV)

June

50

100

July

40

125

August

46

108.7

September

60

83.33

October

50

100

November

44

113.64

Total

290

630.67

In the table above, the average purchase price of mutual fund units for six months is reduced to Rs 48.33 (290/6). Total units bought are 630. Let’s say you chose lumpsum investing instead of SIP in the month of June, then in such a case, your purchase price would be Rs 50 (NAV). You would have received 600 units (investing Rs30,000 at once for 6 months, so (Rs 30,000/50) = 600units.

SIP investing happens both at the highs and lows of the market. Whereas in lumpsum investing there is a risk of entering the market at a high. SIP investing helps in managing anxiety of the investors.

Conclusion:

Compounding can do wonders if one starts investing early. One does not have to be a financial expert to gain the benefit of compounding. As we saw that the power of compounding amplifies with long term investing, one should be patient and invest for long term. It is also important to be disciplined investor to gain the maximum benefit if compounding. Rupee cost averaging is a wonderful approach used for hedging when the markets are falling downwards. It does not guarantee returns; however, it reduces the risk of investing in volatile markets.

The author is is Co-founder of Tarrakki

DISCLAIMER: Views expressed are the author’s own, and Outlook Money does not necessarily subscribe to them. Outlook Money shall not be responsible for any damage caused to any person/organisation directly or indirectly.