At 31, Vipin Rohilla comes across as a sorted individual who is clear about his financial needs. Based in Delhi, his family is complete with his 27-year old wife Naina, 2-year old son Riddhan and his parents. An engineer by qualification, he works with a semi-government company and amongst his several financial goals, the desire to pursue a masters in business administration looms large. “I want to enrol into an executive MBA from a reputed B-School in the next 2- 3 years, which will give a boost to my career,” he says.

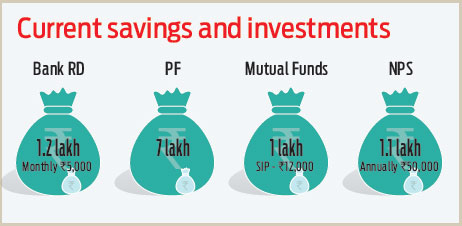

He also plans to buy a house and save for his son’s higher education. I suggest that he defer the plan to buy a house for later, based on his current financial situation. Vipin’s take home salary is Rs 65,000 per month and his savings potential is Rs 35,000 every month. He is on a good wicket, as he does not have any loans that he is servicing for now. He is adequately insured with a term insurance of Rs 1 crore for self and a medical insurance in terms of a family floater of Rs 6 lakh.

Action plan

For a start, Vipin should keep at least two months equivalent of expenses in a liquid fund to meet emergencies. Protection is important and he has done well in terms of taking a pure term life plan of sufficient amount. He has also done well to have medical insurance for his family. The insurance protection is adequate for now, but he could review the health cover depending on the age of his parents. I also suggest that he takes a term plan for his wife when she starts working.

Lean towards equities

Considering his age, it is recommended that Vipin invests more in equities to achieve his goals at a faster rate than how they would at the moment. His contribution towards NPS should grow slowly but steadily to create a part of his retirement fund apart from getting additional tax exemption. I suggest that he continues contributing to this fund every year. Even though he has not clearly set a retirement goal, he should start saving towards it from now.

Moreover, to get the most of the Section 80C benefits towards tax savings, he should invest in ELSS (equity-linked savings scheme), as this is an excellent way to create wealth in the longer term of 10-15 years. I suggest that he should invest more money into ELSS so that equity participation will be enhanced automatically. Although the PPF is a good fixed income option, ELSS contribution is superior. Once he follows this advice, his overall asset allocation will change from the current 90 per cent exposure to debt to 40 per cent in debt and 60 per cent in equities.

Achieving Goals

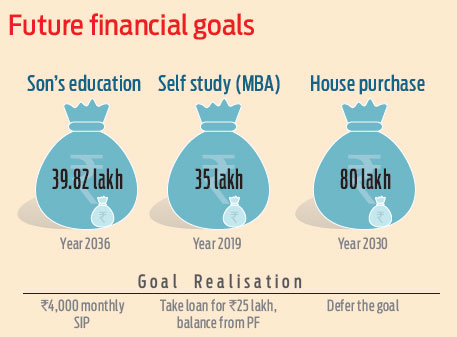

To fund his MBA, the most immediate of his goals, he should take a loan from the contributory provident fund as well as the public provident fund and redeem other investments to arrange for a corpus of Rs 10 lakh and take an education loan for the remaining sum of Rs 25 lakh. Education loans are easily available these days at about 8.5 per cent interest and the repayment can be spread over 10-12 years. He could also use the tax benefit under Section 80E when he borrows.

I am assuming that post his MBA, his salary will go up substantially and the EMI , including principal and interest, on the education loan will be Rs 52,500 every month for five years. Considering this repayment, I recommend that he defers taking a loan to fund his house purchase goal. The easiest of goals is to fund his 2-year old son’s education, for which Vipin should invest Rs 4,000 per month for the next 19 years assuming he needs the funds when his son is 21. This should give him the required corpus assuming a rate of return of 13 per cent per annum compounded.

In the future, I suggest Vipin continue his monthly SIP of Rs 12,000 even when he goes for his MBA. This, he should be able to manage with the savings and settlements he receives from his current job. Investing it in a diversified fund at 13 per cent annum compounded monthly, he should have Rs 3.30 lakh in his kitty at the end of 24 months. He should follow the same format of investing once he completes his MBA as well. This way, he would have saved a good sum which could work out as the down payment for the house he wants to buy a few years from now. Rest of the money needed to fund his house could be borrowed. For now, he should focus on getting into an MBA institute and increasing his income once he completes the course.

A.K Narayan

CEO, A.K.Narayan Associates