Let me tell you a story about a girl who stood up against all odds life threw at her. Meet Pooja Sunil Ghorpade, whose story is a tough one and will give you an accurate understanding of all aspects of an education loan. Having lost both her parents at a young age, she has had to fend for herself.

Her desire to invest in herself made her to take the valiant decision of pursuing a PG diploma in Clinical Research and Business Management. The fee she had to cough up for this one year course was a lot more than what she could afford. She tried her luck at getting financial help from her near and dear ones, but could not succeed. It was during these attempts that a friend advised her to consider taking an education loan.

At that point in time, taking a loan seemed like a challenge to her. Her visits to banks so far has strictly been limited to opening an account, depositing or withdrawing cash. This was going to be the first time when she would be taking a loan. After doing a quick research on what banks look for and what they offer, she decided to go for Bank of Baroda’s education loan. The particular scheme that she opted for was one for girls and had a favourable repayment schedule.

“I applied for the required loan at 11 per cent interest rate for a period of five years,” she points out. In order for the bank to issue a loan, one has to secure a seat in the institution where one intends to study. “I had to pay a big noticeable amount as admission fee, which I borrowed from my cousin with a promise that I would repay him this as soon as I received the loan,” she recalls.

Borrowing made easy

Remember the taboo associated with taking a home loan until a decade ago? Today it has become the most practical thing to do in order to secure your dream of owning a house. In fact, the government is encouraging people to take a home loan to fund their biggest financial asset. In similar vein, realising the rising cost of education and a higher education-linked inflation, the government has made education loan a special lending area.

Inflation is growing at more than 10 per cent every year in the education sector. For example, an MBA in India will cost approximately between Rs 7.5 lakh to Rs 25 lakh, whereas MBA abroad may cost anywhere from Rs 20 lakh to Rs 50 lakh. According to data from the Finance Ministry and RBI, in 2015- 16 there was a 16 per cent growth in education loan disbursements. Banks have been instructed to lend to students based on priority and there is also scope for tax benefits that student borrowers can claim and benefit from. These loans are fairly standardised. A candidate with good credentials is bound to get a loan with the same interest rate and tenure irrespective of which bank she applies to.

In 2015, to make education loans a common enabler of dreams, Vidya Lakshmi portal was introduced, bringing all education lenders under a single platform. It also allows students to apply centrally and track their loan applications. In just three steps, this portal lets one apply for education loan through a single form and then apply to multiple lenders and track the status of their loan application. At present, over one lakh students have already registered for education loans using the portal and many have also benefited from it.

Like any other loan, even education loan looks for a guarantor. In Pooja’s case, as she has no parents or siblings, she had to depend on her uncle. She was not sure of what the future held for her but she was determined to not burden her uncle with this loan. “I submitted all required documents including my KYC documents, my uncle’s income proof as security, and the admission slip as bank had asked for. After submitting all the documents they sanctioned the loan in just eight days,” she says.

Loans are not just for education within India. One can borrow to study abroad, just the way Ahmedabad-based Rudresh Jha did. “I wanted to study abroad and knew it will be an expensive proposition. I borrowed Rs 23 lakh from HDFC Credila and found the entire loan disbursal process smooth,” he recounts from Canada, where he is currently based. “Education loan was very helpful for me to pursue higher education in a foreign country. I am now looking forward to get a job opportunity to repay the loan amount as soon as possible,” he adds.

As per the Indian Banks’ Association (IBA) norms, banks can lend up to Rs 10 lakh for courses in Indian colleges and up to Rs 20 lakh for courses abroad. Banks may consider lending higher amount in special cases at their discretion. In India, top education loan providers include banks like State Bank of India, ICICI Bank, Axis Bank, Punjab National Bank, IDBI Bank and NBCFs like Credila amongst others. Education loan provider institutes in India include Global Student Loan Corporation, International Student Loan Program and Avanse Financial Services, etc. First things first, in order to apply for an education loan, you have to check whether you meet the criteria.

Education Loan Checklist

When applying for an education loan, you will need documents and will have to follow procedures to be eligible to avail the loan

Documents

- Admission letter

- Statement of cost of study, including fee, examination fee, stationery, boarding and lodging expenses and anything else one may incur

- PAN Card, AADHAAR card of student and parent/guardian

- Proof of identity and proof of residence

- IT returns or IT assessment order of previous two years of the co-borrower

- Statement of assets and liabilities of parent/guardian

The borrowing process

- You could create your login on www.vidyalakshmi.co.in and follow the procedure with a single education loan application. Alternately, you could apply for the loan with your bank or any preferred lender

- The loan is disbursed during the course period based on the course schedule

- Simple interest is charged on disbursed sum

- There is a one year or six months of grace period provided, so you can start repaying the loan after completion of the course

- The EMI starts after moratorium period is completed

Studying Abroad

- Admission letter and I-20 form from foreign institution

- Passport and Visa copy

- Affidavit confirming that no education loan has been taken in the past or defaults

In most cases, an education loan is the first loan that the student takes on her name. Hence, ensuring a steady repayment and maintaining a good track record and credit score is important for the students or they may run the risk of facing challenges in availing other loans in the future. It is therefore important for the parents and students to have a cautious approach and do a thorough and detailed financial planning. Education loan takers should keep in mind that an education loan is like any other commercial loan and banks sanction a loan after evaluating the credit worthiness of the borrower.

Education loan usually commands an interest rate from anywhere between 12 to 16 per cent, depending on various factors that the banks consider. The bank uses marginal cost of funds based lending rate (MCLR), plus an additional spread to set an interest rate. At present, the additional spread is in 1.35-3 per cent range.

Some banks provide a relaxation period of 6 months after securing a job or a year after the completion of studies for repayment. The repayment tenure is generally between five to seven years, but can be extended beyond that as well.

For loan amount up to Rs 7.5 lakh, your tenure of loan can go up to ten to fifteen years. As you are paying simple interest on the principal during the study period, your EMIs also get reduced to a great extent.

Repaying the loan

It is not surprising that parents prefer their children taking education loans to single-handedly funding their education. Nothing instils a sense of responsibility, academic and financial discipline in the lives of their children more profoundly than an educational loan. Rather than dipping into their retirement corpus and making their own future shaky, they prefer equipping their children with financial responsibility for the time when they leave the nest and are independent. As the Chinese proverb goes—give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime. This holds true when it comes to education—equipping children with financial responsibility and discipline for the future is the right thing to do, even when you can afford to spoon-feed them.

Unlike other forms of loans where the repayment starts soon after the loan is sanctioned, in case of education loan you are not burdened to start the repayment of the loan while you are still studying. Education loans run on the basic premise of study now and pay later, which is a deferred payment. This pay later in lending parlance is known as the moratorium period—the time period bank offers the student to find a job and start working before starting the loan repayment.

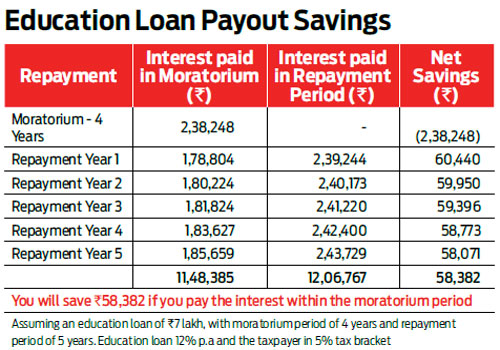

The time period between finishing your education and starting of loan repayment is a good time to save money and build a financial corpus. Says Ajay Bohora, Co-founder, MD and CEO, HDFC Credila Financial Services, “The repayment responsibilities are being seen by numerous parents as an opportunity to inculcate the habit of financial discipline in their children. More informed parents also view education loan as an opportunity to help their children build their own credit history on credit bureaus.” The moratorium or waiver period varies from bank to bank, starting from a year in most cases. However, do not think of this waiver to be free of cost, as banks start charging the interest on education loans from the day the loan is disbursed.

In fact, it will be in your interest to start repaying the loan as soon as you can, even if it means you could start paying some of the loan in the moratorium period. “We at PNB have an education scheme where with minimal premium we take care of loan in case of any mishap,” says Moloy Kumar Bose, DGM - Circle Head, Mumbai suburb, Punjab National Bank. This facility is nothing but a built-in insurance policy which acts as a safety net during untimely death. “This loan automatically adjusts the outstanding loan, so that it is not a financial burden on the co-borrower or parents.”

As a student availing an education loan, you must understand that this loan is a credit facility provided to you so that lack of finance does not hamper your educational aspirations. Says Harshala Chandorkar, COO, TransUnion CIBIL, “Students must be diligent in repaying their education loan once they complete the course and gain employment. Credit discipline is critical for their professional and financial growth and timely repayment of education loans will also help them build a good credit history and score.”

You can claim tax deductions under Section 80E of Income Tax Act on the education loan that you take. Section 80E of the IT Act allows for deduction on the interest paid on the repayment. This deduction is allowed only for the individuals paying interest on the loan for themselves, spouse or children or for the student to whom you’re a legal guardian. You can deduct the entire interest amount paid from your taxable income. The principal amount does not qualify for any tax deduction. The tax benefit is available only when the loan is taken from an approved lender.

Meanwhile, Pooja is determined to start repaying her loan as soon as she gets a job to reduce her financial liability. “I want to make sure I do not delay the repayment on this loan, as a lot is at stake for me,” she says. Hers is a story of grit and determination and proof of how education loans can help the needy realise their dreams. “I have been paying EMIs for the past one year and am happy that I took this decision and I reinvented myself to my liking,” says a proud Pooja.