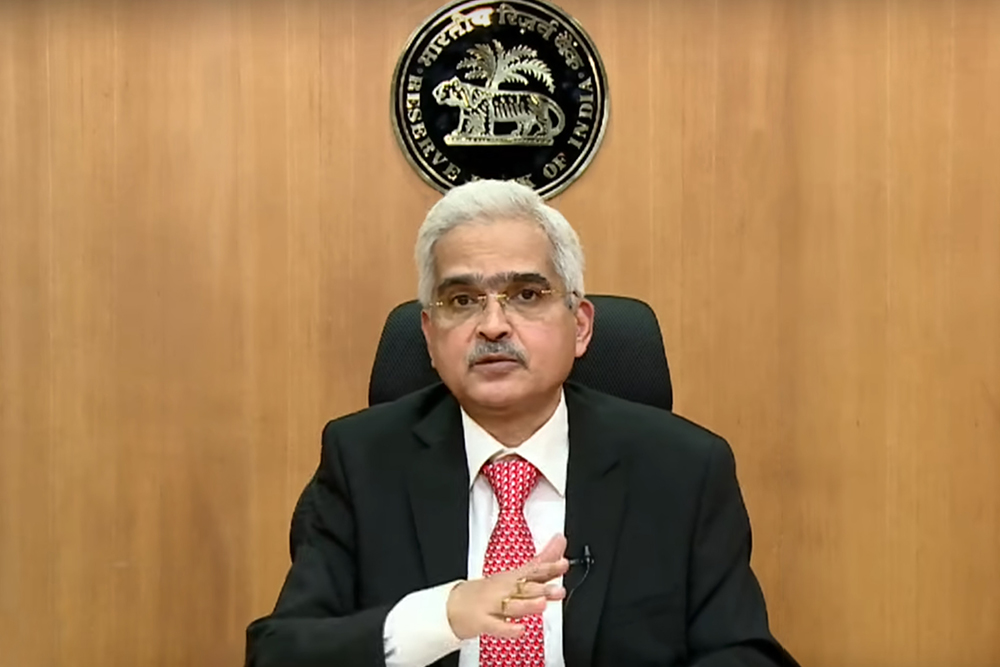

Amid the second wave of the Coronavirus pandemic, Reserve Bank of India (RBI) on Wednesday announced a series of measures including loan restructuring for individual and small businesses. It also opened Rs 50,000 crore on-tap window to ease access to emergency health services to boost the provision of immediate liquidity for ramping up Covid-19 related healthcare infrastructure and services in the country. Here is what RBI Governor Shaktikanta Das said:

Why the new measures

As the financial year 2020-21 — the year of the pandemic — was drawing to a close, the Indian economy was advantageously poised relative to peers. India was at the foothills of a strong recovery, having regained positive growth, but more importantly, by flattening the infections curve. In a few weeks since then, the situation has altered drastically. Today, India is fighting a ferocious rise in infections and mortalities. New mutant strains have emerged, causing severe strains on healthcare and medical facilities, vaccine supplies and frontline health personnel. The fresh crisis is still unfolding. The measures proposed by RBI are the first part of a calibrated and comprehensive strategy against the pandemic.

Term Liquidity Facility of Rs 50,000 crore

To boost provision of immediate liquidity for ramping up Covid-related healthcare infrastructure and services in the country, an on-tap liquidity window of Rs 50,000 crore, with tenors of up to three years at the repo rate, is being opened till March 31, 2022. Under the scheme, banks can provide fresh lending support to a wide range of entities, including vaccine manufactures, importers/suppliers of vaccines and priority medical devices, hospitals/dispensaries, pathology labs, manufactures and suppliers of oxygen and ventilators, importers of vaccines and Covid-related drugs, logistics firms and also patients for treatment.

Banks are being incentivised for quick delivery of credit under the scheme through extension of priority sector classification to such lending for around a year. These loans will continue to be classified under priority sector till repayment or maturity, whichever is earlier. Banks may deliver these loans to borrowers directly or through intermediary financial entities regulated by the RBI.

Loan restructuring for individuals and small businesses

Borrowers, ie. Individuals and MSMEs, having aggregate exposure of up to Rs 25 crore, would be eligible to be considered under Resolution Framework 2.0. However, the facility would be available only to those borrowers who have not availed restructuring under any of the earlier restructuring frameworks, including under the Resolution Framework 1.0 announced in August last year. They can invoke restructuring of their loans till September 30, 2021, which would then have to be implemented within 90 days of invocation.

For those borrowers who availed restructuring of their loans under Resolution Framework 1.0, where the resolution plan permitted moratorium of less than two years, lending institutions are being permitted to use this window to modify such plans to the extent of increasing the moratorium period and extending the residual tenor up to a total of two years.

Rationalisation of Compliance to KYC Requirements

The RBI also decided to rationalise certain components of the KYC norms including extending the scope of video KYC for new categories of customers such as proprietorship firms, authorised signatories and beneficial owners of Legal Entities, and for periodic updation of KYC. It also enabled submission of electronic documents as identify proof, apart from introduction of more customer-friendly options, including the use of digital channels for the purpose of periodic updation of KYC details of customers.

Credit to MSME Entrepreneurs

With a view to incentivise credit flow to the micro, small, and medium enterprise (MSME) borrowers, in February 2021, Scheduled Commercial Banks were allowed to deduct credit disbursed to new MSME borrowers from their net demand and time liabilities (NDTL) for calculation of cash reserve ratio (CRR). In order to further incentivise inclusion of unbanked MSMEs into the banking system, this exemption currently available for exposures up to Rs 25 lakh, and for credit disbursed up to the fortnight ending October 1, is being extended till December 31.