When you are sending or remitting money overseas, under the liberalized remittance scheme (LRS), all resident individuals, including minors, are allowed to freely remit up to $2,50,000 per financial year. However, the tax implications vary when you are remitting money for different purposes. Read on to know more.

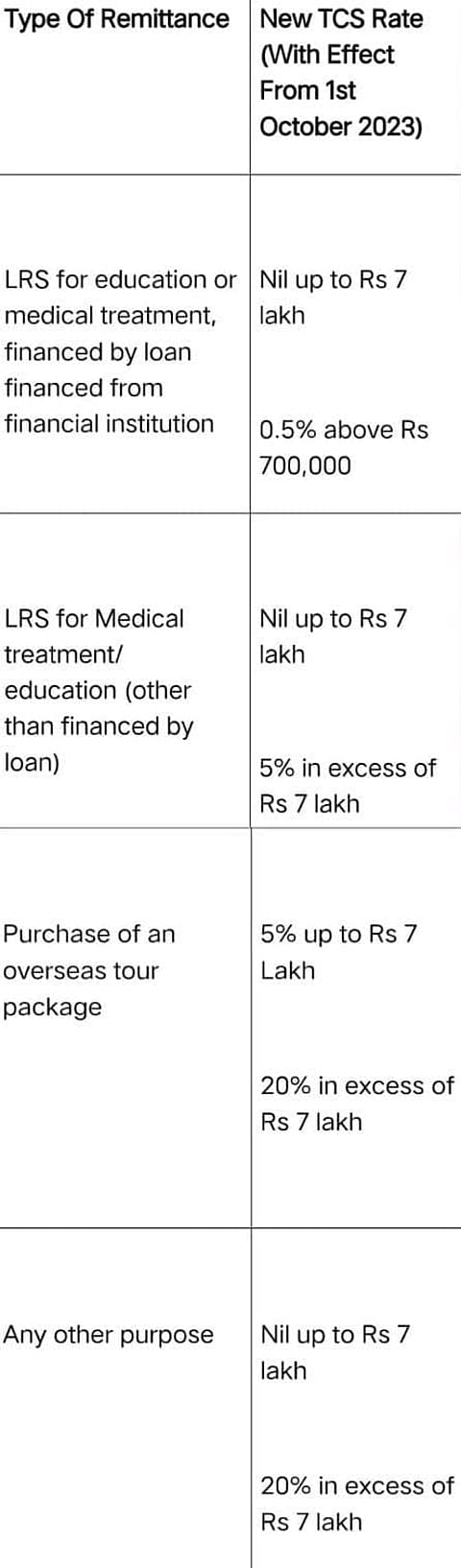

Tax Implications On Foreign Remittances: Here are the instances in which the new rate of tax collected at source (TCS) is applicable when sending money abroad.

Foreign tour packages

Online shopping from a foreign website

Investing in a foreign asset or instrument

Giving loans or doling out gifts to relatives living overseas.

Buying stocks of foreign companies

Purchasing property abroad

Immigrants remitting funds to their foreign bank account