Over the past one year, the portfolio management services (PMS) universe has been under the spotlight more than ever before. Asset management companies (AMCs) seemed to largely focus on retail investors, but over the past few years, this trend seems to be changing. With the number of high net worth individuals (HNIs) on a steady rise in India, it is no surprise that AMCs are looking to tap into this elite class of investors with their specialised set of offerings.

ICICI Prudential Alternatives: In-House BMV Strategy Delivers Alpha Across Timelines

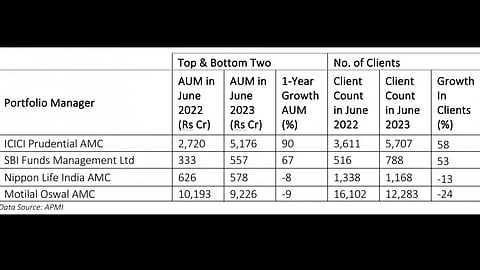

ICICI Prudential AMC leads the charts as a boutique within an institution, registering a growth of 58 per cent in terms of new client addition and 90 per cent growth in assets under management

The Growth Path

In terms of the growth of assets under management (AUM), and addition of new investors, some of the AMCs have shown tremendous rise in both new investor count as well as AUM over the last one year.

Among the mutual fund players, the fastest growing player in the PMS segment was ICICI Prudential AMC, which registered an impressive 90 per cent growth in PMS AUM. This was at a time when names like Invesco Asset Management (India), Nippon Life India Asset Management and Motilal Oswal AMC registered de-growth in their assets.

Incidentally, ICICI Prudential was the first AMC in India to acquire a PMS license, way back in 2000.

Over the past two decades, ICICI Prudential AMC has been instrumental in launching products revolving around different investment themes, with innovative investment strategy, which has also helped it in creating long-term wealth through a range of varied investment offerings on the PMS platform.

The Institutional Set-Up

The PMS vertical is headed by veteran fund manager Anand Shah, known for his consistent performance. The other advantage comes from 20-plus experienced research team members who cover a wide spectrum of over 470-odd stocks, spread across over 25 sectors.

The multifaceted team, guided by portfolio managers with extensive experience and industry recognition form the backbone of the investment process.

Sharzad Sethna, head business development, ICICI Prudential Alternatives explains, “The endeavour is to provide investors with niche offerings under the institutional setup.”

A Reliable ‘BMV’ Framework

The ICICI Prudential PMS team relies on an in-house business management valuation (BMV) framework that aims to identify resilient companies with a potential for long-term growth.

Through this framework, the team identifies strong companies with competent management that are trading at reasonable valuations. Anand Shah, head PMS, believes a well-defined investment process should allow the portfolio manager to stay on the course across market cycles.

Shah explains the BMV framework and how it works.

“Here, we identify industries that can grow faster than the GDP and companies that can grow faster than competitors in those industries. The second focus is on companies with an enduring moat, or companies with a sustainable competitive advantage. And, last, we prefer industries that are consolidating over those that are fragmenting,” says Shah.

Once potential businesses have been identified, the focus shifts to their management teams. Here, companies with a solid track record in terms of corporate governance standards, competency, and engagement with stakeholders pass this step. The last step is valuation.

Shah says: “Good business and good management at any price is not our approach. If the valuation is not right, we are ready to let go of some good businesses as well.”

Offerings And Performance

It predominantly offers contra, private investment in public equity (PIPE) and flexi-cap strategies. Contra and PIPE have delivered superior returns to investors. In contra strategy, the fund managers identifies companies which are going through challenging times due to unfavourable business cycle or due to a special situation, or due to industry consolidation. The contra fund has, over the last one year, delivered 44 per cent as compared to the benchmark S&P BSE 500 TRI at 24 per cent.

Another strategy, PIPE, which predominantly invests in mid- and small-cap companies has delivered 46 per cent return over the last one year and 43 per cent in the last three years.

When it comes to flexi-cap strategy, the portfolio has a ‘core’ and ‘satellite’ element. The core portfolio could be 60-70 per cent and is predominantly targeted towards sectors which are valued on an absolute and relative basis. Over the past year, this strategy has delivered 29.5 per cent return against 23.98 per cent by S&P BSE 500 TRI.

The Final Word

The end result of the BMV framework has resulted in concentrated portfolio with regards to the number of holdings, but diverse in terms of business fundamentals and industries.

Thus far, the BMV approach has helped ICICI Prudential’s PMS offerings to deliver alpha over the benchmark across varying timeframes, and given its consistent performance, in terms of the number of clients added as well.