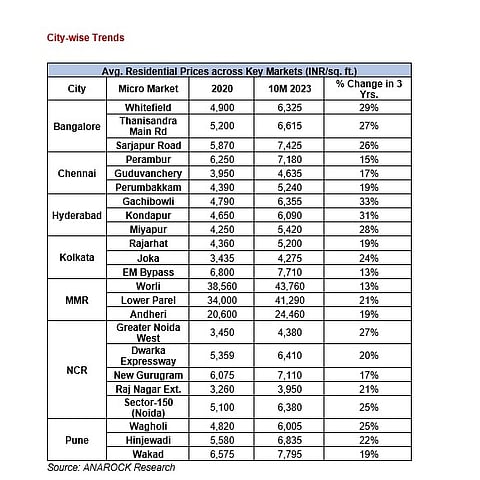

Driven by robust demand, the average residential prices in key micro markets across the top 7 cities in India have witnessed a significant surge in the last three years, between October 2020 and October 2023.

Average Residential Prices Surge Across Top 7 Cities in India; Hyderabad Leads The Pack

Bengaluru's Whitefield and Pune's Wagholi Witness 29% and 25% Price Increases, Respectively. MMR and NCR Also See Strong Price Growth

According to ANAROCK Research data, Hyderabad's Gachibowli recorded the highest 33% jump in average residential prices between October 2020 and October 2023, followed by Kondapur with a 31% rise. In Gachibowli, the average residential prices as of October 2023-end stand at approximately INR 6,355 per sq. ft. In the corresponding period of 2020, average prices in this locality were INR 4,790 per sq. ft.

Bengaluru's Whitefield comes in third with a 29% jump in this three-year period – from INR 4,900 per sq. ft. as on October 2020 to INR 6,325 per sq. ft. by October 2023.

Key areas in MMR and NCR also saw average prices surge between 13-27% in this three-year span. In NCR's Greater Noida West, average prices have increased by 27% in the period. In MMR, Lower Parel saw average prices appreciate by 21%.

"The end of October, marking the end of the festive season, typically denotes the culmination of the year's peak housing sales period. Barring discounts, 2020 was a year of price stagnation and a year most developers would prefer to forget," said Prashant Thakur, Regional Director & Head - Research, ANAROCK Group. "The scenario in 2023 is markedly different – backed by strong demand, housing sales across the top 7 cities have created a new peak this year with sales far exceeding the previous peak of 2014. Led by both robust demand and increased input costs, there has been a significant surge in average housing prices across key micro markets in the top 7 cities."

Prashant Rao, Managing Director, Poulomi Estates said, "In recent years, Hyderabad has experienced remarkable strides in infrastructure development, aligning it with other major metropolitan cities in India. This transformation has attracted both domestic and multinational companies, particularly in the IT sector, leading to a surge in economic activities. As the 'City of Pearls' continues its evolution, the escalating property prices not only mirror market dynamics but also underscore the city's magnetic allure. This positions real estate in Hyderabad not only as a compelling investment opportunity but also as an attractive prospect for end-users seeking to be part of the city's flourishing growth story."

Ravi Aggarwal, Co-founder & Managing Director of Signature Global (India) Ltd., shared insights on the recent Anarock report: "Property prices have surged in the last few years, driven by various factors such as increased input and construction costs, rising land prices, and heightened demand. Moreover, there is a noticeable shift in homebuyer preferences towards larger homes with enhanced amenities, contributing to the upward trajectory of prices. Despite these increases, the industry has successfully absorbed the higher costs, and demand remains substantial. Aspirations are now high, especially among the growing middle class, and working-class individuals are seeking value homes from branded developers. These homes offer not only more amenities and living space but also meet the evolving expectations of modern living. We have observed a trend where customers are inclined to invest in homes that provide a combination of modern amenities, timely delivery, and the right location offerings from branded developers."

Key Highlights:

Hyderabad's Gachibowli, Kondapur, and Miyapur witnessed the highest average price rises in the last three years, with 33%, 31%, and 28% hikes, respectively.

Bengaluru's Whitefield, Thanisandra Main Road, and Sarjapur Road saw average prices appreciate by 29%, 27%, and 26%, respectively.

Pune's prominent localities for average price increases are Wagholi (25%), Hinjewadi (22%), and Wakad (19%) – all three in the city's IT influence zone.

MMR's top three micro-markets to witness high price rises are Lower Parel, Andheri, and Worli with 21%, 19%, and 13% increases, respectively.

NCR's top three localities for average price increases are Greater Noida West, Sector 150 (Noida), and Raj Nagar Extension (Ghaziabad) with 27%, 25%, and 21% hikes, respectively.

Chennai's prominent localities for price rises are Perumbakkam (19%), Guduvanchery (17%), and Perambur (15%).

Kolkata's top three prominent micro-markets which recorded high price rises are Joka, Rajarhat, and EM Bypass, with a surge of 24%, 19%, and 13%, respectively.

This surge in average residential prices is a reflection of the strong demand for housing in India, particularly in the top 7 cities. With the economy expected to continue growing in the coming years, it is likely that housing prices will continue to rise in these markets.