The retail real estate sector, which was hit hard by the covid-19 pandemic, is now showing signs of robust growth, more so from the hinterlands, as indicated by the increase in home loans from these districts, according to a recent report by the State Bank of India.

Tier-III, Tier-IV Towns Lead Growth In Residential Home Loan Demand Post-Covid: SBI Report

Work from home during covid led to a rise in demand for residential projects in tier-III and tier-IV districts across India, which subsequently led to an increased demand for home loans in these places.

Source: SBI Special Research Report

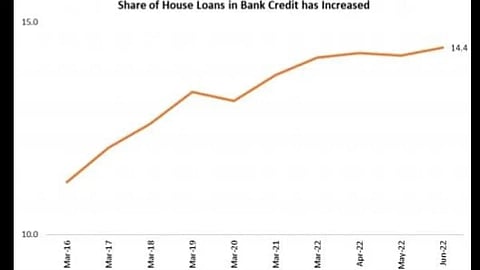

The share of housing loans, which contribute to 50 per cent of retail or personal loans by scheduled commercial banks (SCBs) has increased to 14.14 per cent in June 2022, up from 13.1 per cent in March 2020 at the start of the nationwide lockdown, the report titled Emerging Trends In Residential Housing said.

According to the report, work from home has emerged as the dominant factor behind the increased growth in demand for home loans across tier-III and tier-IV town and districts.

The spurt in demand for home loans has been driven by tier-III and tier-IV cities rather than the tier-I and tier-II cities, the report said. The demand for home loans in these two categories combined have risen by 4 per cent from 32 per cent in FY19 to 36 per cent in FY 22.

According to the report, the fresh disbursal of home loans has increased more in tier-II, tier-III and tier-IV districts in FY 2022 than in tier-I districts. The ticket size of loan disbursed in smaller districts has also increased in tier-III and tier-IV cities. The average ticket size of loans has also increased in tier-III (1.3 times) and tier-IV (1.4 times) districts as compared to tier-I (1.1 times) and tier-II (one time) districts between FY22 and FY19.

Punjab and Karnataka (five each) rank among the top-20 tier-III districts in terms of fresh loan disbursal. Uttar Pradesh tops the tier-IV list with six among the top-20 districts for fresh home loan disbursal.

Source: SBI Special Research Report

Not only this, the number of women borrowers taking home loans in tier-III and tier-IV cities has also been on the rise. Chhattisgarh, Gujarat and Haryana account for the maximum number of women home loan borrowers among the top-20 tier-III and tier-IV districts across India. Interestingly, these 12 districts (six from Chhattisgarh and three each from Haryana and Gujarat) have a 49 per cent women population, the report revealed.

Work From Home In Covid

According to the report, the trend of work from home during the covid lockdown led to an increase in home loan demand in tier-III and tier-IV towns and districts. As companies shifted to a work from home module, many outstation employees returned to their native places to cut down on living cost in the overcrowded metro and tier-I cities. Now with many companies, especially in the tech and IT industry continuing with a hybrid or a work from home module, the demand for upscale residential projects in tier-III and tier-IV cities has seen a boost.

The government’s AMRUT and Smart City projects has also given a boost to this growth in the residential real estate sector in these category towns and districts, the report said.

Housing Prices Up In Smaller Town

According to the report, housing prices have increasingly significantly in smaller cities and suburbs than in the major cities over the last year.

Tier-II cities, such as Vishakhapatnam, Guwahati, Raipur, Surat, Vadodara, Jaipur, Lucknow, Dehradun and tier-III cities such as Coimbatore have witnessed a higher growth in housing price than tier-I cities.

The increasing trend of work from home and freelance jobs has led to an increased demand for homes, and consequently, home loans in smaller cities and towns across India, the report concluded.