Any citizen who is or has been an income tax payer shall not be eligible to join Atal Pension Yojana (APY) from October 1, 2022, according to a notification issued by the Department of Financial Services, which comes under the Ministry of Finance, in the Indian official Gazette on August 10, 2022.

Taxpayers Can’t Join Atal Pension Yojana: Who Can Enrol In APY And What Happens To Existing Subscribers?

The government has amended its pension scheme for the unorganised sector, Atal Pension Yojana, to exclude income taxpayers from joining the social security plan from October 1, 2022.

APY is a social security pension scheme launched by the government about seven years ago to benefit workers in the unorganised sector who could otherwise not afford a pension plan.

“From 01.10.2022 income-tax payers shall not be eligible to join APY. Amendment in APY for better targeting of pension benefits to the underserved section of population. Effective in prospective manner from 1st Oct. Income-tax payers enrolled before 1st Oct to continue in the scheme,” tweeted the Department of Financial Services.

Who Can Enrol In APY Now?

Any individual who is not liable to pay income tax on their earnings can enrol in the government’s APY scheme.

If any individual who is liable to pay income tax but still manages to open an APY account, the government will close the account and refund the money to the depositor.

The notification said that if any APY subscriber who joined on or after October 1, 2022, is “subsequently found to have been an income-tax payer on or before the date of application, the APY account shall be closed and the accumulated pension wealth till date would be given to the subscriber”.

What About Existing APY Subscribers?

If you have already enrolled in APY and are an income tax payer, you will stay enrolled. The new rule is applicable from October 1, 2022. “Income-tax payer enrolled before 1st Oct to continue in the scheme,” as mentioned earlier, the Department of Financial Services, tweeted in this regard.

How Much Can You Contribute To APY?

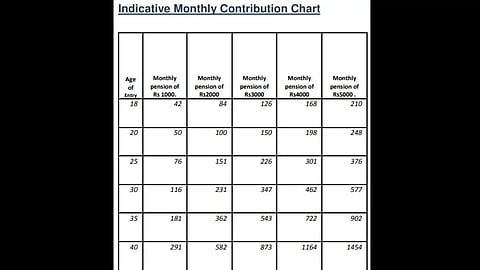

You can get Rs 1,000, Rs 2,000, Rs 3,000, Rs 4,000, or Rs 5,000 as a monthly pension after you attain 60 years, depending on your monthly income. The government of India guarantees this pension till you are alive.

Suppose you are a 25-year-old and wish to get a pension of Rs 1,000 per month after you attain 60 years. For that, you will have to contribute Rs 76 per month. Likewise, if you want Rs 5,000 per month, then you will have to contribute Rs 376 per month (see table).

What Is The Withdrawal Process For APY?

When you attain 60 years of age, you must submit a request to the associated bank or post office to draw the guaranteed minimum monthly pension. If you wish to receive a higher monthly pension, check if the investment returns are higher than the guaranteed returns specified in the APY scheme.

By default, the nominee of APY is your spouse, and upon your death (subscriber), the “same amount of monthly pension is payable to spouse (default nominee),” read an FAQ from NSDL.

In case both you and your spouse have died, persons whom you nominate (son/daughter or any other person) will be eligible for the return of pension wealth you accumulated till 60 years of age.

What If You Die Before 60 Years?

In case of your death before 60 years of age, your spouse will get an option to continue contributing to your APY account for the remaining vesting period, i.e., till the time you would have attained 60 years. For example, suppose you die at 43 years of age, then for 17 years, your spouse may contribute (60-43). Your spouse will also be eligible to maintain her own APY account apart from maintaining yours.

“The spouse of the subscriber shall be entitled to receive the same pension amount as the subscriber until the death of the spouse. Such an APY account and pension amount would be in addition to even if the spouse has his/her APY account and pension amount in own name,” read an FAQ from NSDL.

Or else, your spouse or nominee can choose option 2, wherein the entire accumulated corpus until your death under APY will be returned to them.