Suzlon Energy (SUZLON) is launching its Rs 1,200 crore rights issue from October 11 to 20, and the listing of new shares will be on November 3, while the allotment date is October 31.

Suzlon Energy launches Rs 1,200 crore Rights Issue Today—Know Processes, Income Tax Liability

Companies raise capital via rights issue; however, it is up to you whether to exercise your right or renounce, and based on that choice, the respective taxation laws apply

All eligible Suzlon Energy shareholders can purchase the additional shares in the ratio of five shares for every 21 held in the right issue.

In a notice to the stock exchanges, Suzlon Energy said the new shares have a face value of Rs 2, with a premium of Rs 3, so the total price share is Rs 5. As of October 10, Suzlon Energy’s share price on the Bombay Stock Exchange (BSE) was Rs 7.65, so the right issue shares are being given at a discount to the market price.

“Issue of 5 equity shares of Rs. 2/- each for cash at a premium of Rs.3/- on rights basis for every 21 equity shares held,” Suzlon said.

Suzlon Energy’s chief financial officer Himanshu Mody said in an interview to PTI back in August that they are looking to raise money through right issue of up to Rs 1200 to pare their refinanced debt.

What Are Right Shares?

According to Section 61 of the Companies Act, 2013, whenever a firm wants to raise its subscribed share capital by issuing new shares, existing shareholders should get the first chance to buy, which is done by sending them a letter of offer subject to certain conditions. For example, suppose a company has 10,000 subscribed shares, of which you alone hold 5000 shares, so your holding percentage is 50 per cent (5,000/10,000 shares).

Now, if the company offers a rights issue of 2000 shares, the total subscribed shares become 12,000, and if you do not buy additional shares, your holding would be reduced to 41 per cent (5,000/12,000).

It is up to the shareholder whether he wants to keep the old holding percentage after the rights issue, although he has the option to buy first. So, in essence, before the company offers the shares to outsiders, you are given an exclusive right to buy the shares first.

Where Does the Incidence of Taxation Arise?

Mihir Tanna, chartered accountant and associate director of SK Patodia and Associates, a Mumbai-based auditing firm, explains that a shareholder has three options in the right issue.

● Exercise their rights: The taxation laws apply when the shares under rights allotment are transferred to your Demat account.

● Ignore their rights: There is no tax incidence if you do not sell or exercise your rights, but your holding percentage post-right issue will decrease if you ignore the rights.

● Renounce their rights: Renouncing means you are selling these rights in the market. Do note: you are not exercising or buying your right shares; rather, you are selling your right to the shares. “In case shareholders renounce the rights, taxability arises immediately,” adds Tanna.

How To Calculate Taxes?

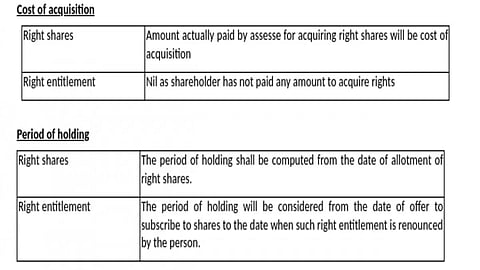

Taxation aspects arise on two occasions: Renounce and Exercise. But you must check two aspects, i.e., cost of acquisition and holding period, before calculating tax for Renounce and Exercise.

Taxability depends on capital gain, and while calculating capital gain, shareholders need to check two important aspects, i.e., cost of acquisition and holding period, says Tanna.

The following table explains how the cost of acquisition and period of holding differs in the case of exercising rights, i.e., buying the shares and renouncing, i.e., selling the right to purchase the shares in the market.

Capital Gains Taxation With Example

● Suppose you bought 200 shares for Rs 50 on January 1, 2019, and you got a right issue offer from the company of Rs 45/share for 100 shares on May 1, 2020.

● You buy 50 shares in the rights issue at Rs 45 each and sell the rights to the remaining 50 shares at Rs 60 each on May 1, 2020.

● On October 1, 2020, you sell all your 250 shares (200 original+50 right shares) for Rs 65.

In this example, you exercised your rights (bought 50 right shares) and renounced some of your rights (sold 50 right shares), and then sold off your entire shareholding (200 original+50 rights).

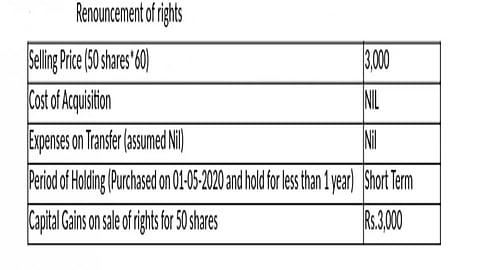

Renouncing 50 Shares

You sold your right to 50 shares at Rs 60 each. You got these rights from the company for free; hence, there is no acquisition cost, and since you got these rights in May and sold them in the same month, short-term capital gains tax will apply. Refer to the table below for a tabular representation.

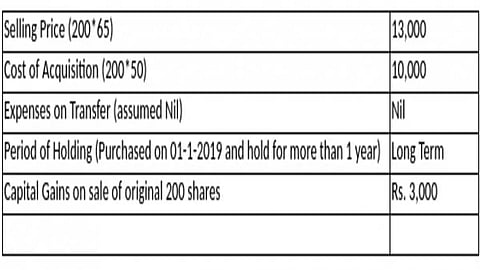

Selling of 200 Originally Bought Shares, i.e., Not During a Rights Issue

You purchased 200 shares at Rs 50 each on January 1, 2019, so the total acquisition cost is Rs 10,000, and sold them on October 1, 2020, for Rs 65 each after one year and eight months. Hence, a long-term capital gains tax will apply.

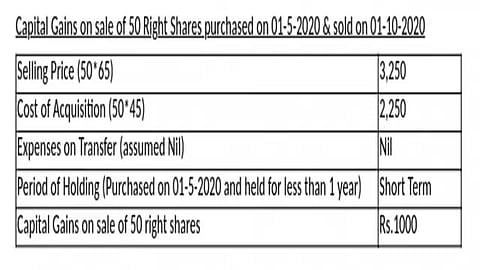

Selling of 50 Shares Bought During Rights Issue

You received 100 shares in the rights issue, sold 50 rights (shown in the above example), and exercised your rights to buy the remaining 50 shares at Rs 45 each. So, when you sold your 50 shares, which you purchased in the rights issue at Rs 45 each, for Rs 65 in the market, you gained Rs 20 per share, which is your profit. Since you bought these 50 shares in May 2020 and sold them in October 2020, short-term capital gains tax will apply.