The last date for filing your income tax return (ITR) for the financial year 2021-22 is just two days away.

Here’s How e-Filing Intermediaries Can Help You With Tax Filing As Last Date Nears

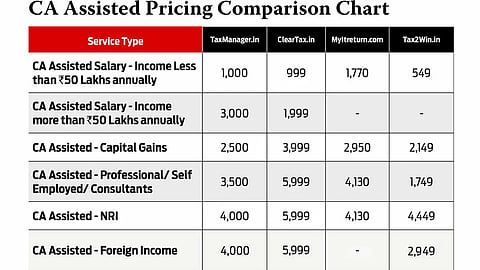

The due date to file income tax return is just two days away. If you are finding it difficult to do it yourself, you could take the help of experts. But this comes at a price depending on the source of income and its complexities. Rather, you could look at these e-filing intermediaries instead.

Even if you have all the necessary paperwork ready, there could still be some few loose ends, which could require some expert advice. Here, you could get in touch with some reliable e-filing intermediary to sort things out for you at an affordable price.

These intermediaries are “authorised individuals who can file your tax return”.

Says Deepak Jain, chief executive, TaxManager.in, a tax e-filing and compliance management portal: “The income tax department launched a scheme in 2007 for Electronic Furnishing Return of Income with the motive to integrate and consolidate the interactions between the Income Tax department and taxpayers.”

MyITreturn.com, TaxManager.In, ClearTax.in, Tax2Win.in, H&R Block, Taxsmile.com, Taxspanner are some of the more popular e-return intermediaries.

Typically, most people who procrastinate on filing taxes are apprehensive about the complexity and the arduous task of filling multiple forms.

Says Archit Gupta, founder and CEO of Cleartax, a tax portal: “Cleartax simplifies this process with a new technology called pre-fill and AI-based validations. ‘Pre-fill’ helps auto-import tax filing information with the help of a PAN number, thereby removing the hassle of manual entry. On Cleartax, customers can upload their capital gains statements from several broking firms and automatically compute capital gains within a few minutes. To date, Cleartax has saved over two million man-hours in income tax filing and an average of Rs 20,000 in tax. It has also partnered with over 40,000 organisations to provide tax filing services for its employees and partners. Cleartax also has ‘live chat support’ and ‘expert-assisted e-filing’ for users who need ITR filing help.”

Benefits Of Tax Filing Through An E-Return Intermediary

There are some benefits of filing tax through an e-return intermediary:

- It is a quick process, and an easy and convenient way for taxpayers to file their tax returns.

- Taxpayers can receive refunds within a period of one or two months.

- The information provided by the taxpayer through an e-return intermediary are secure and confidential.

Filing tax through e-return intermediaries reduces any instances of mistakes or errors, as the system immediately points out any inaccurate data and notifies the user to enter the correct information.

Things To Keep In Mind Before Approaching E-Filing Intermediaries

Sharing your vital information with an unknown person can be uncomfortable for any individual. Therefore, it is advisable that you check out the list of intermediaries available at the income-tax portal before continuing with them.

“Although the current list is not available, you can ask an e-filing intermediary to provide a user ID and organisation to check its validity,” says Jain.