HDFC asset management company (AMC) has launched two target maturity mutual funds focused on government securities (G-Sec) with a minimum subscription amount of Rs 100.

HDFC AMC Launches 2 Target Maturity Funds, Minimum Subscription Amount Rs 100: Know Details

HDFC AMC has launched the HDFC G-Sec 2026 and HDFC G-Sec 2031 target maturity funds with a minimum subscription sum of Rs 100.

The schemes' new fund offers (NFO ) are open from Nov 1-9.

HDFC G-Sec 2026 and HDFC G-Sec 2031 are index funds and will track the Nifty G-Sec Dec 2026 and Nifty G-Sec July 2031 index. The funds have no entry or exit load nor dividend option except growth.

HDFC G-Sec 2026

HDFC G-Sec 2026 has a duration of 4.2 years, and it seeks to replicate the performance of the three most liquid portfolios of government securities, maturing in six months ending December 31, 2026.

The selection of G-Secs is based on the composite liquidity score. The fund house said the composite liquidity score is calculated by allocating 80 per cent weightage to the aggregate trading value, 10 per cent weightage to number of days traded, and 10 per cent weight to number of G-Sec trades in the three-month period prior to June 30, 2022.

Table showing NSE Nifty G-Sec Dec 2026 Index Portfolio it will take.

Source: HDFC AMC

Fund manager Vikash Agarwal said both funds would follow a roll-down approach—the risk will keep decreasing as the maturity date nears.

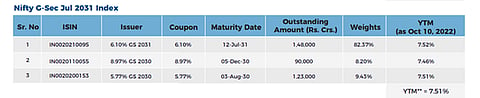

HDFC G-Sec 2031

It has a duration of about 8.8 years, and it will track the performance of G-Secs maturing in a 12-month period ending July 31, 2031.

The fund will select the three most liquid G-Sec maturing in a 12-month period ending July 31, 2031. The selection will again be focused on the composite liquidity score based on the trades data available during the three-month period prior to June 15, 2022, with a minimum outstanding amount of Rs 25,000 crore as of June 15, 2022.

The composite liquidity score will be calculated by giving 80 per cent weightage to aggregate trading value, 10 per cent weightage to number of days traded, and 10 per cent weightage to number of trades of G-Secs in the three-month period prior to June 15, 2022.

Source HDFC AMC

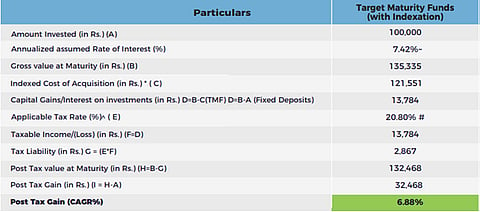

Funds’ Post Tax Yields

Unlike a fixed deposit, target maturity funds get indexation benefits on long-term capital gains tax if one sells these funds after three years. The indicative post-tax yield of HDFC G-Sec 2026 is a 6.88 per cent compound annual growth rate (CAGR).

Table showing the calculation of post-tax yield of HDFC G-Sec 2026 fund assuming the tax rate at 20 per cent and 7.42 per cent CAGR