Aditya Birla Sun Life Asset Management Company (AMC) has announced the launch of a unique exchange-traded fund (ETF), which will specifically track the ‘Nifty Financial Services total return index (TRI)’.

Aditya Birla Sun Life AMC Launches Nifty Financial Services ETF; Subscription Ends July 27

Aditya Birla Sun Life AMC’s financial services ETF will specifically track Nifty Financial Services total return index. Will provide investors with opportunity to capture growth across financial services sector.

Named as the Aditya Birla Sun Life Nifty Financial Services ETF, it opened for subscription on July 14 and will close on July 27.

According to Aditya Birla Sun Life, this new ETF will help investors capture the growth opportunity across the diversified spectrum of financial services.

Since the ‘Nifty Financial Services Index’ is a well-diversified portfolio that goes well beyond conventional banking stocks to include sectors, such as insurance, wealth management, stock broking, payment platforms, others, this ETF will represent a strong opportunity for growth at a low cost, the AMC said.

A. Balasubramanian, managing director and CEO, Aditya Birla Sun Life AMC, said: “Given the recent volatility, many investors are now resorting to passive products that will provide them with the option to take underlying index exposure in various segments of the market at low costs. This ETF presents a unique investment opportunity in light of the significance of the banking and financial services industries (BFSI) sector.”

Aditya Birla Sun Life AMC said that they came out with the product specifically for investors “who are seeking higher growth assets to ride the cyclical upturn in the financial sector, which holds great significance in the Indian market.

Tracking Error And Expense Ratio

Aditya Birla said that for the retail investor seeking to invest in an ETF, two values assume great significance – tracking error and expense ratio.

Tracking Error: Aditya Birla Sun Life AMC said that the ETF’s investment manager will monitor the tracking error of the scheme and contain it below 2 per cent, unless the market situations become very volatile.

Tracking error concept comes into play when an ETF or fund exactly replicates its underlying index, without any change in weightage of the index constituents.

Expense Ratio: The AMC said that the maximum total expense ratio (TER) of this specific ETF will be 1 per cent of the daily net asset of the fund. That said, an additional 0.3 per cent may be charged for gross net inflows from specified cities to improve the geographical reach of the respective scheme in accordance with Securities Exchange Board of India (Sebi) regulations.

It further said that expenses related to listing of this ETF on the stock exchange will be charged under ‘other expenses’, and it will be included in the TER limit of maximum 1 per cent of daily net asset of the fund.

What Is The Nifty Financial Services Index?

The Nifty Financial Services Index is a 20 stock index as against the 12 stock Bank Nifty. Its stock constituents are different, too.

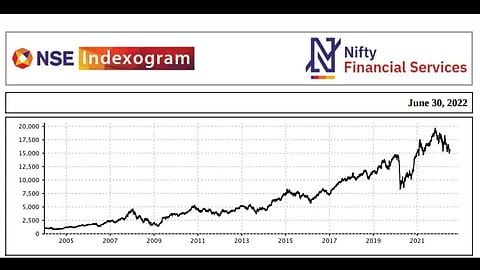

According to data from the National Stock Exchange (NSE), the financial services index generated a return of 10.94 per cent compounded annualised growth rate (CAGR) for a 5-year period as of June 30, 2022. However for a one-year period, this index generated a negative total return of 5.12 per cent.

As for the fundamentals of this index, as on June 30, 2022, the Nifty Financial Services Index had a price to earnings (P/E) ratio of 17.63 and price to book (P/B) ratio of 3.38, while the dividend yield ratio was 0.83, according to data from NSE.