Loans are our biggest liabilities that needs to get repaid on time. In fact, right from chalking out a perfect strategy for taking a loan till it is actually approved, is a cumbersome process. And then unemployment, job loss and other misfortunes could seriously pose a hurdle in the repayment of loans when we are tagged as ‘loan defaulters.’ Banks or non-banking Financial Institutions (FIs) start the recovery proceedings of their dues in case of a default.

Know Your Rights As A Loan Defaulter

In case of any misconduct on the part of the lender, the defaulter can exercise legal rights

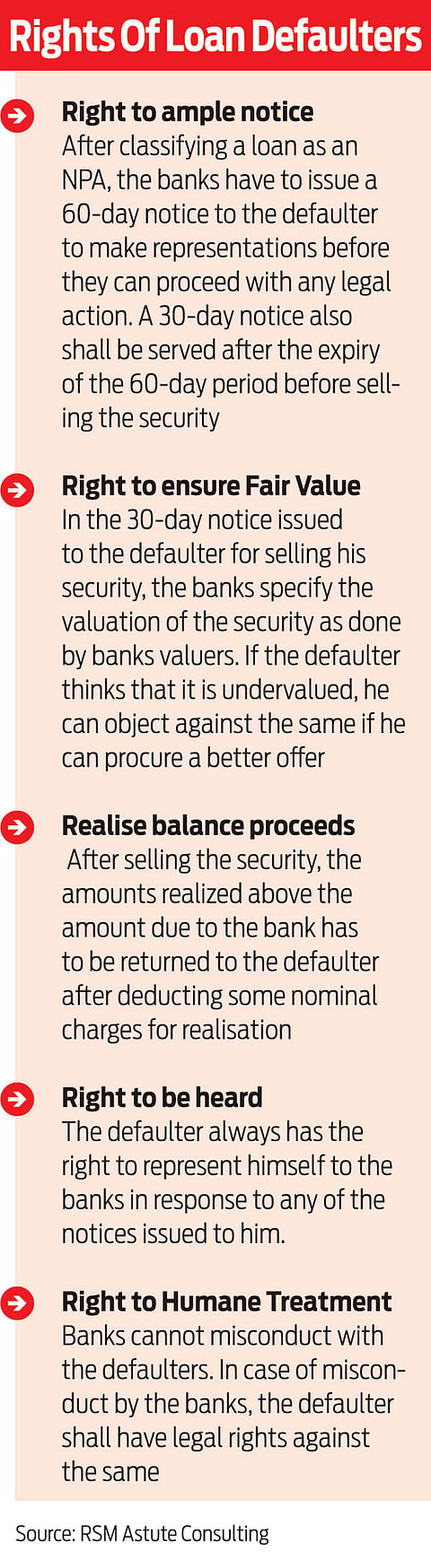

That said, in any action initiated by the banks or non-banking financial institutions, it must be pursued in accordance with the procedure laid down by the law. As per the experts bypassing of the procedure would entitle the borrower or loan defaulter to use the same as a defence. There is a set of rights which a loan defaulter can excercise to seek protection.

“When someone defaults on the loans, prima facie, she starts receiving communications from the lender bank or financial institution. Depending on the terms and conditions of the loan, the lender would list you as a Non-Performing Asset (NPA) after a certain number of defaults and start taking legal action against such defaulters,” explains Suresh Surana, Founder, RSM Astute Consulting.

Once the borrower’s account has been classified as NPA, or repayment has been overdue by 90 days, the banks or FIs may initiate the action under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interests Act, 2002 (SARFAESI). Under this act the security can be sold through public auction or private treaty under SARFAESI. The proceeds are utilised for repayment of loan.

Alternatively, a bank may initiate recovery proceedings before Debt Recovery Tribunal (DRT) under the Recovery of Debt Due to Banks and Financial Institutions Act, 1993 (DRT Act). “There is also a possibility of banks or non-banking FIs transfer the borrower’s accounts to debt collection or recovery agents. Apart from the pressure of clearing defaults there is an added element of harassment, which the borrower is often subject to by such debt collection or recovery agents,” highlights Varghese Thomas, Partner, J. Sagar Associates.

However, experts argue if borrowers can convince the lender that defaults are temporary and repayment would soon become regular, the lender may delay the legal proceedings. Therefore, it is crucial that the loan defaulter has a clear communication with the lender bank or financial institution.

When it comes to default on home loan the bank would issue a 60-day notice to the defaulter. After completion of 60 days, the banks have the right to auction or sell the house.

For the said purpose, the bank will send a valuation report and the borrower will get one month’s time before the house is auctioned. In case of auto loans, the loan agreements provide for repossession of the security without recourse to SARFAESI or court.

The lender can also confiscate any collateral security given by the borrower or even by any third party by adopting almost similar process as above.

“Most auto loans are secured against the vehicle. In case of repeated defaults, the lender can repossess the vehicle after giving proper notice. After repossession, the lender may sell the vehicle to recover the dues,” explains Surana.

Likewise, in the case of personal loans not backed by any security or defaults in credit cards, action is initiated for recovery of the defaulted amount.

“In case of credit cards, the lenders are even entitled to charging high contracted rate of interest. This may include civil action to obtain a decree, which can be enforced through court,” says Mukesh Jain, Corporate Lawyer, Founder - Mukesh Jain & Associates.

When it comes to a student loan, which is a mix of a personal and secured loan, generally, lenders insist upon personal guarantee of the parents and at least one unrelated person. “Loans up to `4 lakh is generally available without any tangible security. However, loans for larger amounts need tangible security,” said Jain.

Experts have pointed out it also depends upon the various kinds of FIs and banks, that take actions on the loan defaulters. So, in case of NBFCs or co-operative banks, the arbitration clause can also be enforced to expedite a money decree or order.

In case of a co-operative bank, the bank can even obtain a recovery certificate under Section 101 of the Maharashtra Co-operative Societies Act. “In the execution of such a decree or order, sometimes even assets that are not secured in favour of the lender can also be attached. Not only that, up to one third of the salary of the borrower also be attached in execution of the decree,” points out Jain.

So, what are those rights that protect a loan defaulter? First and foremost, the borrower is entitled to obtain all relevant information about the loan, incidence of default and details of interest and other charges levied by the lender. Needless to mention, the borrower is entitled to liquidate the loan liability and obtain release of security. However, that does not mean that banks or FIs have a right to misbehave with the defaulters through recovery agents.

In case of any misconduct on the part of the bank or FI, the defaulter has legal rights against the same.

Thomas further explains, “An alternative remedy for a borrower in the event of harassment or coercion by the bank or recovery agents, the borrower may approach the banking ombudsman under the relevant framework of the Reserve Bank of India (RBI). For continued harassment in certain cases the borrower may also file a police complaint or move civil court for an injunction by filing a suit.” Experts said that quite often the borrowers take an insurance policy to cover the amount of the loan so that in any eventuality the proceeds of the insurance policy are adequate to repay the loan.

“In some cases, lenders also encourage them to take such insurance policies, though RBI does not permit any insistence of the lender for taking such policies as a pre-condition to grant the loan. The legal heirs of the borrower (or the borrower in case of a disability policy) shall be entitled to access the said policy for liquidation of the loan,” Jain explains.

In case of sale of security by the lender under SARFAESI or otherwise, the borrower is at liberty to buy the property in an open auction. The borrower shall also be entitled to any surplus from the proceeds of sale of security, remaining after satisfying the debt in default.

“In the event of wrongful invocation of SARFEISI, the mortgagor is entitled to approaching Debt Recovery Tribunal (DRT) for restoring possession of security to the mortgagor. However, such recourse to DRT is expensive and is at best a temporary respite without solving the real issue of default,” Jain adds.

Also, in the eventuality of the security being realised, the borrower is entitled to the excess amounts realised. This is done by One-Time Settlements (OTS). Here the borrower enters into OTS with the banks or non-banking FIs, where the latter agrees to accept an amount less than what was originally due, compromising on their profits.

“Such settlements are reduced to writing in the form of agreements. OTS, once entered into, banks or non-banking FIs cannot initiate recovery proceedings for the defaulted amounts,” says Thomas.

In case of an unsecured personal loan, the borrower or guarantor shall be at liberty to seek reasonable installments from the execution court for discharge of decretal debt for the liability remaining after enforcement of the security.

“During such loans, the borrower or guarantor shall also be entitled to approach the trial court for award of reasonable rate of interest on the ground that the loan was not taken for a business purpose but for personal use,” points out Jain.

The tag of being “Loan Defaulter” never goes in a decent way. Considering the borrower’s credit score gets impacted, it may further affect the borrower’s ability to raise loan in future.

Although steps will be taken to recover the balance liability, if any but with certain rights, the lenders cannot have a complete walkover when a borrower defaults.

himali@outlookindia.com