The Indian ETF market has experienced huge growth over the past decade and signifies a shift in investor preference towards passive funds. Here’s all you need to know about ETFs

Enough To Focus For Investors

The Indian ETF market has experienced huge growth over the past decade and signifies a shift in investor preference towards passive funds. Here’s all you need to know about ETFs

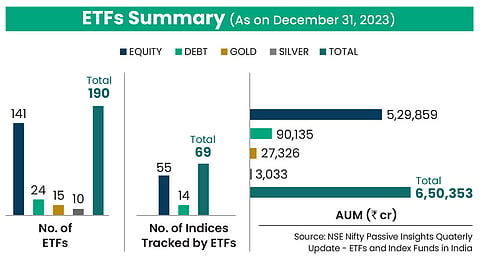

The Indian exchange-traded fund (ETF) market has grown substantially of late, up from 2 per cent assets under management (AUM) of the mutual fund industry in 2012 to 13 per cent in 2023, signifying a shift in investor preference to passive funds.

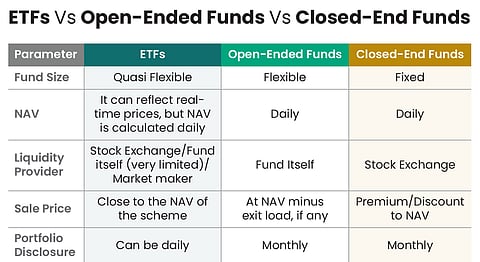

ETFs are a collection of marketable securities that track an underlying index and combine features of mutual funds and stocks. They invest in stocks and/or bonds based on the underlying benchmark index. Though they are similar to index funds, but they are bought and sold at stock exchanges, and not bought or redeemed with mutual funds.

Investors and traders can buy units of ETFs through a dematerialised and trading account with a broker. ETFs are traded on the stock exchange and come with a settlement of T+1 and buy and/or sell throughout the working hours of the day.

Types of ETFs

Equity ETFs: These are available for trading on the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE). Investors can buy or sell them at market price on a real-time basis. The minimum investment quantum is one unit. Investors can buy into multiple companies with one fund, in the same ratio as the underlying index, and get the benefit of diversification.

Debt ETFs: These provide investors with exposure to fixed-income instruments, such as government bonds, corporate bonds and debentures. Investors can buy or sell them in real time at the exchange.

Commodity ETFs: These are passively managed funds tracking an underlying asset, such as gold and silver. Though there are multiple derivative trading contracts available at commodity exchanges, such as for crude oil, jeera, and others, ETFs are limited to gold and silver, as of now.

Liquid ETFs: These ETFs aim to provide money market returns and invest in a basket of call money equivalent, short-term government securities and money-market instruments.

Global ETFs: These provide investors with an opportunity to invest directly in foreign companies. Mutual funds in India offer the product and invest in stocks and/or units abroad. Investors can use such ETFs to diversify their portfolios.

ETFs give investors exposure to a diversified portfolio of assets, thus reducing the risk associated with investing in individual stocks or bonds, which is especially valuable in volatile market conditions.

ETFs are also liquid as they are traded on the stock exchanges. Also note that there are market makers appointed by mutual funds, which is a Securities and Exchange Board of India (Sebi) mandate. Market makers are supposed to step in when there is lack of liquidity. Also, investors can buy or sell at prevailing market prices throughout the trading day.

This enables investors to make informed decisions based on the current composition of the ETF. Investors also have the flexibility to choose funds that align with their goals and risk tolerance.

Relevant Metrics

Tracking Error: This is a measure of the divergence between the performance of an ETF and its underlying index. It is calculated as the annualised standard deviation of the difference in returns between the passive fund and its underlying index. Factors such as fees, trading costs, and imperfect replication can contribute to the deviations. A low tracking error is desirable.

∑ represents summation of each instance of the fund returns considered

Rf is each instance of daily return of the fund portfolio

Ri is each instance of daily return of the benchmark index

n is the number of daily instances considered

Tracking Difference: This is the absolute difference between the returns of an ETF and its underlying index. This tends to be negative due to the ETF’s expense ratio.

Tracking error = Rf –Ri. Here,

Rf is the return of the fund portfolio for the given period

Ri is the return of the benchmark index for the given period

Do note that tracking difference measures the difference in returns between the passive fund and its benchmark index, while tracking error measures the standard deviation of the difference in their returns. Consider both these metrics while evaluating ETFs.

Traded Volume: Volume refers to the number of units bought and sold on any given day or over a given time period. This affects the liquidity of a security because the higher the volume of the ETF, the higher the number of buyers and sellers.

An ETF corpus size, or AUM can also be a determinant of the trading volume, as it indicates a higher number of investors.

Takeaway For Investors

ETFs are an evolving way of investing in securities. By buying one unit of an ETF, you are buying the same stocks in the same proportion as the index. Buying or selling these is the same as buying stocks.

While selecting ETFs, do consider how much you allocate to equity, debt, or gold in your portfolio. Also, within the broad asset allocation, you have to zero-in on the sub-asset categories, such as large-cap, small-cap, long maturity bonds, short maturity bonds, and so on.

Some of the parameters you should keep in mind while selecting ETFs are tracking error, tracking difference and traded volume.

By Joydeep Sen, Corporate Trainer and Author

By Tanay Garg, CA, Pursuing MBA at NMIMS